Markets continue to tread water today, having basically no reaction to economic data and comments from central bankers. For now, European majors are the slightly stronger ones, as led by Sterling. Commodity currencies are the weaker ones, with the Loonie being the softest. Dollar and Yen are mixed for now. But still, most pair and crosses are stuck inside ranges of yesterday and last week.

Technically, the more interesting developments are find in cryptocurrencies. Bitcoin’s break of 20023 suggests that corrective recovery from 18144 might have completed at 21460 already. Deeper fall is now in favor back to retest 18144 support, and break will target this year’s low at 17575.

In Europe, at the time of writing, FTSE is down -0.02%. DAX is up 0.37%. CAC is up 0.02%. Germany 10-year yield is up 0.001 at 2.345. Earlier in Asia, Nikkei rose 1.25%. Hong Kong HSI dropped -0.23%. China Shanghai SSE dropped -0.43%. Singapore Strait Times rose 0.14%. Japan 10-year JGB yield dropped -0.0063 to 0.252.

ECB de Guindos: We will start QT sooner or later, for sure in 2023

ECB Vice President Luis de Guindos said in an interview, “we will continue raising rates to a level that ensures inflation will come back into line with our definition of price stability”. The level will depend on ” data that we receive, the evolution of inflation, economic conditions, demand, and energy prices.”

He expected inflation to hover around its present level of 10.7% “hover the next few months”. Inflation will then “start to decline in the first half of next year”. Quarterly GDP growth in Q4 will be “negative”, and to continue in Q1. This “technical recession” is not expected to be “very profound”.

On the topic of quantitative tightening, de Guindos said ECB will start it “sooner or later, for sure in 2023”. It must be implemented with “a lot prudence”. He expects to start with a “passive QT by not fully reinvesting the maturing securities in our portfolio.”. The “characteristics and the timing” of QT will be discussed in December. QT may overlap or not with normalization of interest rates.

Eurozone retail sales rose 0.4% mom in Sep, EU up 0.4% mom

Eurozone retail sales rose 0.4% mom in September, better than expectation of 0.0% mom. Volume of retail trade increased by 1.0% for non-food products and by 0.4% for food, drinks and tobacco, while it decreased by -0.6% for automotive fuels.

EU retail sales rose 0.4% mom. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were registered in Austria (+3.9%), Malta (+1.7%) and Poland (+1.4%). The largest decreases were observed in Slovenia (-3.7%), Ireland and Portugal (both -2.0%) and Slovakia (-1.3%).

BoE Pill: We have done some, still more to do

BoE Chief Economist Huw Pill said at a conference that recent market turmoil in the UK led to some “de-anchoring” of inflation expectations. “What we’re most concerned about is whether this self-sustaining inflation will persist,” he said.

He added that officials at BoE have “more to digest” about how the government’s plan will impact the economy. They will look carefully at the budget due November 17.

Regarding interest rates, “we have done some, and I think there is still more to do,” Pill said. “At some point you have to think what level of rate is appropriate.”

SNB Jordan: Determined action is necessary

Chairman Thomas Jordan, said in a conference, “In an environment such as the one we face today, mixed signals on the persistence of inflation might tempt policymakers to postpone further reaction to inflationary pressures until uncertainty about future inflation has receded”.

“Yet uncertainty must not mean indecision. A risk management approach to policy-making sometimes calls for decisive action,” he added

“When faced with large shocks that increase the risk of persistent movements of inflation away from the range, determined action is necessary, irrespective of whether these movements are below or above the range,” Jordan said.

BoJ opinions: Undesirable to make premature changes to monetary policy

In the Summary of Opinions at BoJ’s October 27-28 meeting, it’s noted that it’s wages increase in a “sustainable and stable manner” to achieve the inflation target. Inflation could “deviate upward” form the baseline scenario but it’s still “uncertain” whether the rises in prices will be “sustainable”. It is “undesirable” to “make premature changes” to monetary policy for the “risk of disrupting the formation of a virtuous cycle between prices and wages.”

Nevertheless, on member noted, “it is necessary to examine the impact of high prices on household behavior and wages humbly and without any preconceptions while paying attention to the side effects of monetary easing.

Another member noted, “it is also important to continue to examine how future exit strategies will affect the market and whether market participants will be well prepared for them.”

Australia NAB business confidence dropped to 0, conditions dropped to 22

Australia NAB Business Confidence dropped from 5 to 0 in October. Business Conditions dropped slightly from 23 to 22. Trading conditions dropped from 37 to 31. Profitability conditions rose from 21 to 22. Employment conditions dropped from 17 to 14.

NAB Chief Economist Alan Oster said, “Conditions remained strong in October with demand still very elevated and profitability holding up… Despite the strength in conditions, confidence has been falling for several months as headwinds have weighed on the outlook for the global economy and Australia.”

Australia Westpac consumer sentiment dropped to 78, just slightly above pandemic low

Australia Westpac Consumer Sentiment dropped -6.9% to 78.0 in November. The reading was below the low point of the Global Financial Crisis in 2008, and was just slightly higher than pandemic low at 75.6.

Westpac said that inflation and interest rates are weighing heavily on family finances. Nearly 40% of consumers, a record high, look to cut Christmas spending. Confidence in house prices is heading towards 2018.19 lows.

Regarding RBA policy, Westpac expects it to hike by a further 25bps on December 6. Westpac also expects RBA to hike by an additional 0.75% out to May next year.

Australia AiG services dropped to 47.7, second month of contraction

Australia AiG Performance of Services Index dropped slightly from 48.0 to 47.7 in October, staying in contraction for a second month. Looking at some details, sales dropped -0.5 to 41.3. Employment rose 1.3 to 53.9. New orders rose 4.3 to 54.5. Input prices rose 4.2 to 77.6. Selling prices rose 3.9 to 62.2. Average wages dropped -1.1 to 64.8.

Innes Willox, Chief Executive of Ai Group, said: “Australia’s service sector faces weakening conditions. Chronic labour shortages have dragged on the supply-side of the sector for most of this year. And now the effects of cumulative interest rate rises are weakening demand conditions as well. Conditions particularly deteriorated for retail & hospitality and business & property, which are most exposed to consumer sentiment.”

RBNZ 2-yr inflation expectations rose to 3.62%

In RBNZ’s Survey of Expectations, businesses expect interest rate to rise 65bps to 4.15% a quarter ahead. In a year’s time, they saw interest rates rose further to 4.67%.

Mean one-year ahead GDP growth decreased from prior survey’s 1.49% to 1.27%. One year ahead inflation expectations rose from 4.86% in last quarter to 5.08%. Two year ahead inflation expectations rose sharply from 3.07% to 3.62%.

EUR/USD Mid-Day Outlook

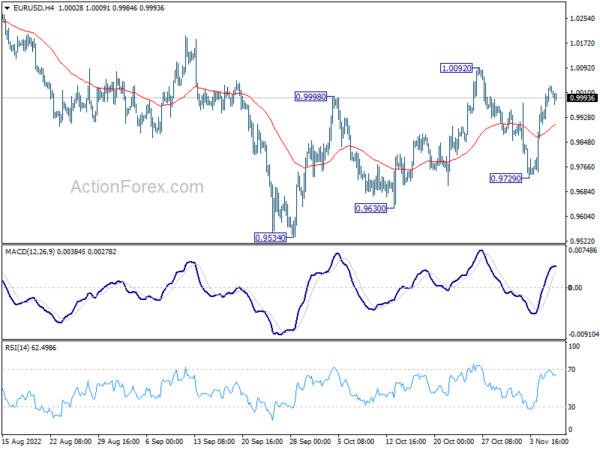

Daily Pivots: (S1) 0.9939; (P) 0.9987; (R1) 1.0068; More…

EUR/USD’s rebound lose momentum ahead of 1.0092 resistance and intraday bias remains neutral. On the upside, firm break of 1.0092 will resume the rebound from 0.9534. Next target is 1.0368 resistance. On the downside, break of 0.9729 will reaffirm the case the corrective rise from 0.9534 has completed at 1.0092. Deeper fall would then be seen to retest 0.9534 low next.

In the bigger picture, medium term outlook stays bearish with trading inside the falling channel. That is larger down trend from 1.2348 (2021 high) is still in progress. Firm break of 0.9534 low will confirm this bearish case. However, break of 1.0092 will add to the case of medium term bottoming, on bullish convergence condition in daily MACD, and bring further rally towards 55 week EMA (now at 1.0583).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Oct | 47.7 | 48 | ||

| 23:30 | AUD | Westpac Consumer Confidence Nov | -6.90% | -0.90% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Sep | 2.10% | 1.60% | 1.70% | |

| 23:30 | JPY | Overall Household Spending Y/Y Sep | 2.30% | 2.70% | 5.10% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Oct | 1.20% | 1.50% | 1.80% | |

| 00:30 | AUD | NAB Business Confidence Oct | 0 | 5 | ||

| 00:30 | AUD | NAB Business Conditions Oct | 22 | 25 | 23 | |

| 02:00 | NZD | RBNZ Inflation Expectations Q/Q Q4 | 3.62% | 3.07% | ||

| 05:00 | JPY | Leading Economic Index Sep P | 97.4 | 101.6 | 101.3 | |

| 07:45 | EUR | France Trade Balance (EUR) Sep | -17.5B | -14.0B | -15.3B | |

| 09:00 | EUR | Italy Retail Sales M/M Sep | 0.50% | -0.10% | -0.40% | |

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | 0.40% | 0.00% | -0.30% | |

| 11:00 | USD | NFIB Business Optimism Index Oct | 91.3 | 91.7 | 92.1 |