Dollar is back under some selling pressure today as 10-year yield dips back below 4% handle. Broad risk sentiment is also mildly positive. European majors are generally weaker too, together with Canadian. Yen rebounds on falling yields, but it’s outshone by New Zealand Dollar. Kiwi is supported additionally by buying against Aussie, which is also firm after today’s RBA rate hike.

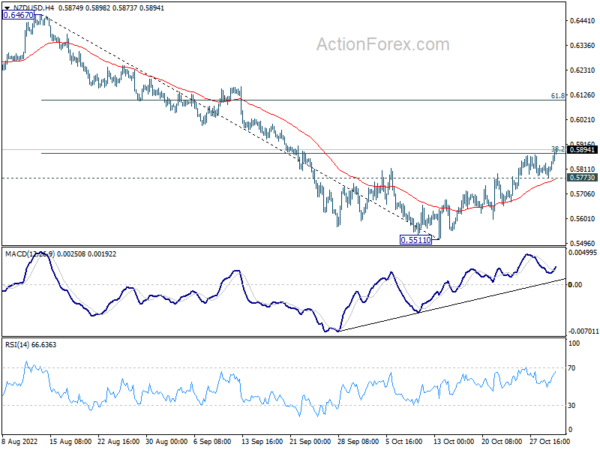

Technically, NZD/USD’s rebound from 0.5511 short term bottom resumed by breaking through 0.5872 temporary top. The break of 38.2% retracement of 0.6467 to 0.5511 at 0.5876 is another near term bullish sign. Further rally is expected as long as 0.5773 minor support holds. Next target is 61.8% retracement at 0.6102. Such development could be an early signal of stronger rebound in AUD/USD too.

In Europe, at the time of writing, FTSE is up 1.48%. DAX is up 1.32%. CAC is up 1.62%. Germany 10-year yield is down -0.105 at 2.039. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI rose 5.23%. China Shanghai SSE rose 2.62%. Singapore Strait Times rose 1.21%. Japan 10-year JGB yield rose 0.0073 to 0.252.

ECB Lagarde: We are not done with tightening yet

ECB President Christine Lagarde said in an interview, “Inflation is still far too high in the euro area as a whole… Higher energy and food prices are still the main drivers of price increases. We are increasingly seeing that these higher energy costs are feeding through to more and more sectors in the economy.”

“We expect to raise interest rates further to make sure that inflation returns to our medium-term target of 2% in a timely manner,” she added.

“Since July we have raised interest rates by 200 basis points – the fastest increase in the history of the euro,” she said. “But we are not done yet. We will decide on future policy steps meeting by meeting, each time assessing how the outlook for the economy and inflation has evolved, also considering how the measures we have taken so far are working.”

She admitted that the “likelihood of a recession has increased and uncertainty remains high.” But ultimately, “persistently high inflation rates are more damaging to society because they make everybody poorer.”

Swiss SECO consumer confidence fell to fresh record low at -47

Swiss SECO Consumer Confidence fell further from -42 to -47 in Q4, below expectation of -43. That’s the record low level since the survey began in 1972.

Looking at some details, expected economic development dropped from -53.5 to -57.2, far below long-term average of -9. Past financial situation dropped from -35.1 to -39.7, a historic low. Expected financial situation dropped sharply from -34.8 to -46.9, also a new low. Major purchases improved slightly from -43.3 to -42.4.

UK PMI manufacturing finalized at 46.2, suffered a further decline

UK PMI Manufacturing was finalized at 46.2 in October, down from September’s 48.4. That’s the lowest level in 29 months, and the reading has been below 50 mark for three consecutive months.

S&P Global noted that output, new orders and new export business all declined. Job cuts were registered for the first time in almost two years. Input cost and selling price inflation eased slightly.

Rob Dobson, Director at S&P Global Market Intelligence, said: “UK manufacturing production suffered a further decline at the start of the fourth quarter, with the sector buffeted by weak demand, high inflation, supply-chain constraints and heightened political and economic uncertainties…. The darkening situation also knocked business optimism down to a two-and-a-half year low… On current form manufacturing is in no position to help prevent the broader UK economy from sliding into recession.”

RBA Lowe: We need to strike the right balance between doing too much and too little

RBA Governor Philip Lowe said in a speech that the earlier large 50bps rate hikes were to “move interest rates quickly away from their pandemic levels to address the rapidly emerging inflation problem.”

As interest rates moved back to “more normal levels”, the board judged that it’s “appropriate to move at a slower pace”, with 25bps hike today, and at last meeting.

“We are conscious that interest rates have been increased by a large amount in a very short period of time and that higher interest rates affect the economy with a lag,” he added. “If we are to stay on that narrow path, we need to strike the right balance between doing too much and too little.”

Lowe also noted that RBA is “not on a pre-set path”. “If we need to step up to larger increases again to secure the return of inflation to target, we will do that,” he added. “Similarly, if the situation requires us to hold steady for a while, we will do that.

RBA hikes 25bps, rates to rise further over the period ahead

RBA raises cash rate target by 25bps to 2.85% as widely expected. It maintains tightening bias and expects to “increase interest rates further over the period ahead”. The size and timing of future rate hikes will be determined by incoming data and the outlook for inflation and labor market.

The central bank expects inflation to “further increase” over the months ahead and peak at around 8% this year. CPI inflation is forecast to be around 4.75% over 2023 and a little above 3% over 2024. GDP growth forecast was “revised down a little” to 3% this year, 1.50% in 2023 and 2024. Unemployment rate is forecast to rise gradually from current 3.5% to a little above 4% in 2024 as economic growth slow.

China Caixin PMI manufacturing recovered to 49.2, impact of Covid controls lingered

China Caixin PMI Manufacturing rose from 48.1 to 49.2 in October, above expectation of 49.0. Caixin noted that output and new orders fell again as COVID-19 containment measures continued. Selling prices fell for the sixth consecutive month. Business confidence edged up slightly.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the negative impact of Covid controls on the economy lingered. In October, supply, domestic and overseas demand, and employment in the manufacturing sector all contracted, but the rates of contraction slowed from the previous month. Costs rose slightly, and cuts to output prices were still common. Logistics and transportation were still sluggish, and companies’ purchases and inventories rose slightly. Market sentiment improved, but optimism remained limited from a long-term perspective.

Japan PMI manufacturing finalized at 50.7, but business remained optimistic

Japan PMI Manufacturing was finalized at 50.7 in October, slightly down from September’s 50.8. That’s the lowest level in 21 months. S&P Global noted that inflationary pressure remained severer. Business remained optimistic with sentiment at nine-month high.

Laura Denman, Economist at S&P Global Market Intelligence, said: “Sluggish markets and weaker demand conditions, on both a domestic and international level, became a recurring trend throughout the report and were seemingly the driving forces behind the slower sector performance… Meanwhile, inflationary pressures remained severe..

“Japanese manufacturing firms increased their selling prices more aggressively, as signalled by a near-record rate of output cost inflation…. Despite this, firms seem unfazed by the challenges that the sector is currently facing remaining optimistic towards their 12-month outlook on growth in October. In fact, the degree of confidence accelerated from September and reached a nine-month high.”

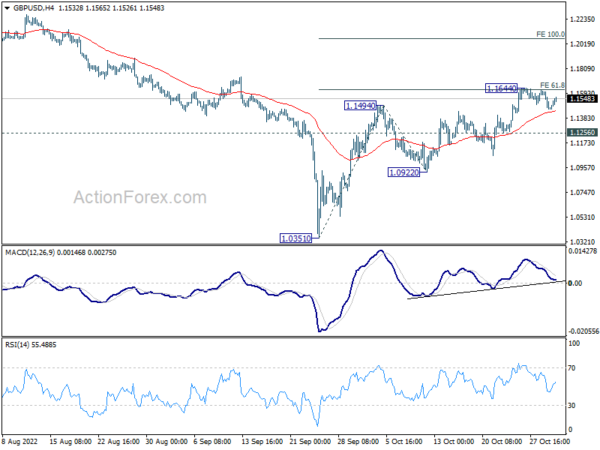

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1414; (P) 1.1514; (R1) 1.1567; More…

Intraday bias in GBP./USD stays neutral and outlook is unchanged. Consolidation from 1.1664 could extend but overall, further rise is expected as long as 1.1256 minor support holds. On the upside, break of 1.1644 will resume rise from 1.0351 to 100% projection of 1.0351 to 1.1494 from 1.0922 at 1.2065. However, break of 1.1256 will turn bias back to the downside for 1.0922 support and below.

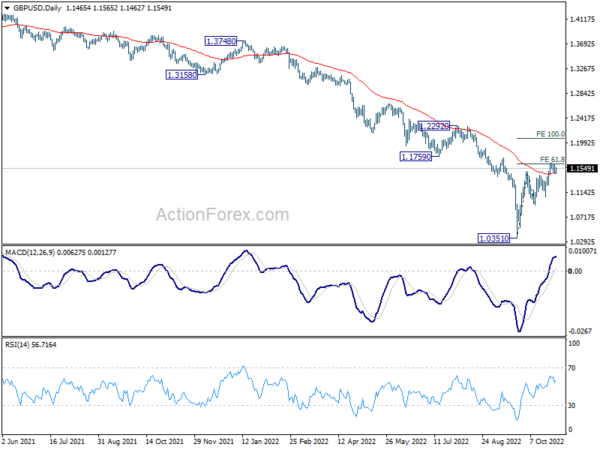

In the bigger picture, fall from 1.4248 (2018 high) is part of the long term down trend from 2.1161 (2007 high). Outlook will stay bearish as long as 1.1759 support turned resistance holds. Parity would be the next target on resumption. Nevertheless, firm break of 1.1759 will confirm medium term bottoming, and open up stronger rise back to 55 week EMA (now at 1.2392).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | 3.80% | -1.60% | ||

| 00:30 | JPY | Manufacturing PMI Oct F | 50.7 | 50.7 | 50.7 | |

| 01:45 | CNY | Caixin Manufacturing PMI Oct | 49.2 | 49 | 48.1 | |

| 03:30 | AUD | RBA Interest Rate Decision | 2.85% | 2.85% | 2.60% | |

| 07:00 | EUR | Germany Import Price Index M/M Sep | -0.90% | 0.60% | 4.30% | |

| 08:00 | CHF | SECO Consumer Climate Q4 | -47 | -43 | -42 | |

| 08:30 | CHF | SVME PMI Oct | 54.9 | 56 | 57.1 | |

| 09:30 | GBP | Manufacturing PMI Oct F | 46.2 | 45.8 | 45.8 | |

| 13:30 | CAD | Manufacturing PMI Oct | 49.2 | 49.8 | ||

| 13:45 | USD | Manufacturing PMI Oct F | 49.9 | 49.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Oct | 50 | 50.9 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Oct | 53 | 51.7 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Oct | 48.7 | |||

| 14:00 | USD | Construction Spending M/M Sep | -0.50% | -0.70% |