Sterling is the better performer in Asian session today. It’s supported by news that former Prime Minister Boris Johnson withdrew from party leadership contest on Sunday, even with enough support to make the final ballot. The development left business friendly Rishi Sunak, a former Finance Minister, as a favorite to replace outgoing Prime Minister Liz Truss. That would give some political stability, at least until a general election.

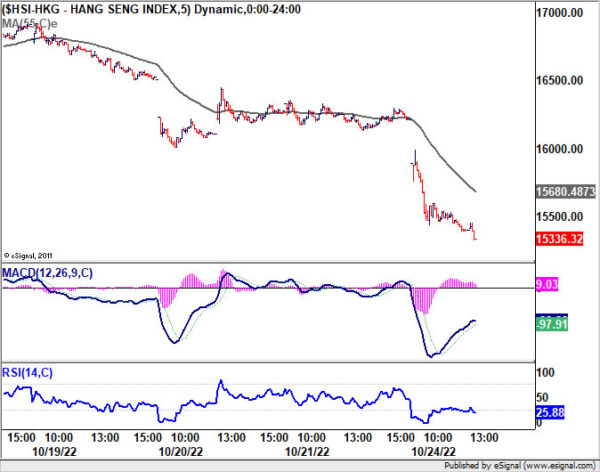

Dollar and Swiss Franc are also firmer on mixed market sentiment. Japan Nikkei followed the strong rebound in the US on Friday. But Hong Kong HSI is down as much as -5%, as reaction to the result of China’s 20th Communist Party Congress, where President Xi Jinping cemented absolute power. China’s Shanghai SSE and Singapore Strait Times are also down. Yen softens as impact of last week’s intervention faded. Commodity currencies are on the soft side while Euro is mixed.

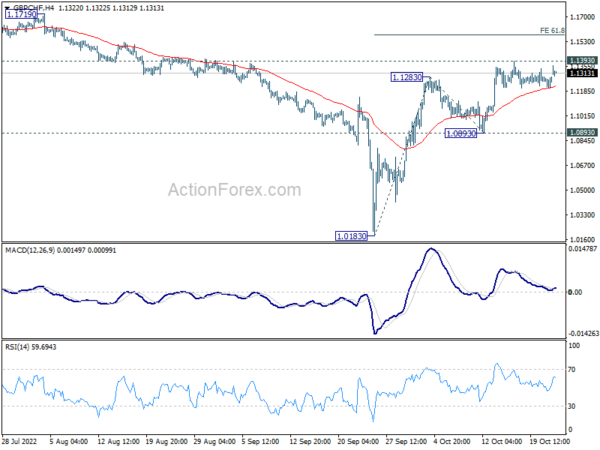

Technically, one focus is on 1.1393 minor resistance in GBP/CHF. Break there will resume the near term rebound from 1.0183 for 61.8% projection of 1.0183 to 1.1283 from 1.0893 at 1.1573. Such development, if accompanied by break of 1.1494 resistance in GBP/USD and 0.8577 support in EUR/GBP, would indicate more persistent rebound in the Pound.

Japan refrains from commenting on currency intervention

Japan Finance Minister Shunichi Suzuki declined to confirm if there was intervention in the currency markets last Friday. But he reiterated, “we cannot tolerate excessive volatility caused by speculative moves, and we are ready to take necessary steps when needed…. we are in a situation where we are confronting speculative moves strictly.”

Masato Kanda, Vice Finance Minister for International Affairs also said, “we won’t comment” on whether Japan will intervene gain. He said, “we will take appropriate steps against excessive volatility 24 hours a day, 365 days a year.”

Chief Cabinet Secretary Hirokazu Matsuno also said, “we refrain from commenting specifically on any currency intervention”.

Japan PMI composite rose to 51.7, but manufacturing struggles

Japan PMI Manufacturing ticked down from 50.8 to 50.7 in October, weakest in 21 months. PMI Manufacturing Output improved slightly from 48.3 to 48.7. PMI Services rose from 52.2 to 53.0. PMI Composite also rose from 51.0 to 51.7.

Laura Denman, Economist at S&P Global Market Intelligence, said: “Latest flash PMI data has pointed to a further improvement in Japan’s private sector economy in October… The manufacturing sector, however, continued to struggle in the face of weak demand conditions and severe cost pressures… With inflationary pressures remaining elevated across the private sector, business confidence dipped to a six-month low.”

RBA Kent: Depreciation in AUD will have very modest uplift in prices

RBA Assistant Governor Christopher Kent said in a speech, “The Board expects to increase interest rates further in the period ahead, given the need to establish a more sustainable balance of demand and supply and in the face of a very tight labour market.” The “size and timing” of rate increases will depend on “incoming data” and “outlook for inflation and the labour market.”

Kent also said the appreciation of the US dollar will “add to the cost of imports for a time” because much the global trade is invoices in it. At the same time, rise in US interest rates will also “contribute to a decline in global inflation pressures”. The depreciation of Australia’s nominal trade-weighted exchange rate over the year to date will contribute only a “very modest uplift in the level of consumer prices over the period ahead”.

Australia PMI composite dropped to 49.6, renewed contraction

Australia PMI Manufacturing dropped from 53.5 to 52.8 in October, a 14-month low. PMI Services dropped from 50.6 to 49.0, a 9-month low. PMI Composite dropped from 50.9 to 49.6, a 9-month low.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence said: “Australia’s private sector saw renewed contraction in October with the service sector primarily showing signs of stress. A fall in demand for services was underpinned by higher interest rates and prices, altogether reflective of the detriments of aggressive monetary policy tightening and capacity constraints upon business activity.”

China posted solid production but weak retail sales data

After a delay amid the 20th Communist Party Congress last week, China released a batch of economic data today.

GDP grew 3.9% yoy in Q3, and beat expectation of 3.3% yoy. In September, industrial grew 6.3% yoy, faster than August’s 4.2% yoy, and beat expectation of 4.9% yoy. Retail sales, however, rose only 2.5% yoy, slowed from August’s 5.4% yoy, and missed expectation of 3.1% yoy. Fixed asset investment rose 5.9% ytd yoy, below expectation of 6.0%.

Also released, in USD term, exports rose 10.7% yoy in September. Imports rose 0.3% yoy. Trade surplus widened from USD 79.4B to USD 84.0B, above expectation of USD 81B.

BoC and ECB to hike, BoJ to stand pat

Three central banks will meet this week. BoC is expected to slow down its tightening pace, and raise the overnight rate by 50bps to 3.75%. But opinions are divided as higher than expected August consumer inflation data increased the chance of another 75bps hike. Nevertheless, the bigger question is whether BoC will signal that tightening cycle is starting to be close to an end.

ECB is widely expected to increase the main refinancing rate by 75bps to 2.00%. President Christine Lagarde should signal that tightening is going to continue until early next year while the pace would be data dependent. A focus will be on the signal of the start of QT discussions, as rate is approaching neutral, if not there after this week’s hike.

BoJ is widely expected to keep monetary policy unchanged. Governor Haruhiko Kuroda will reiterate that current inflation is largely import driven, and local wage growth doesn’t warrant that inflation will stay above target in sustainable way. Nevertheless, like with recent meeting, there are speculations that BoJ might loosen up its 0.25% ceiling for 10-year JGB yield.

On the data front, GDP from the US, Eurozone and Canada will be featured, together with PMIs from Australia, Japan, Eurozone US and US. Germany will release Ifo business climate and GFK consumer sentiment. Australia will release CPI.

Here are some highlights for the week:

- Monday: Australia PMIs; Japan PMI Manufacturing; Eurozone PMIs; UK PMIs; US PMIs.

- Tuesday: Germany Ifo business climate; US house price index, consumer confidence.

- Wednesday: Japan corporate services prices; New Zealand ANZ business confidence; Australia CPI. Swiss Credit Suisse economic expectations; US goods trade balance, new home sales; BoC rate decision.

- Thursday: Australia import prices; Germany Gfk consumer sentiment; ECB rate decision; US GDP, durable goods orders, jobless claims.

- Friday: Australia PPI; BoJ rate decision, Japan Tokyo CPI, unemployment rate; France GDP; Germany CPI, GDP; Swiss KOF economic barometer; Canada GDP; US personal income and spending, employment cost index, pending home sales.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.1134; (P) 1.1225; (R1) 1.1388; More…

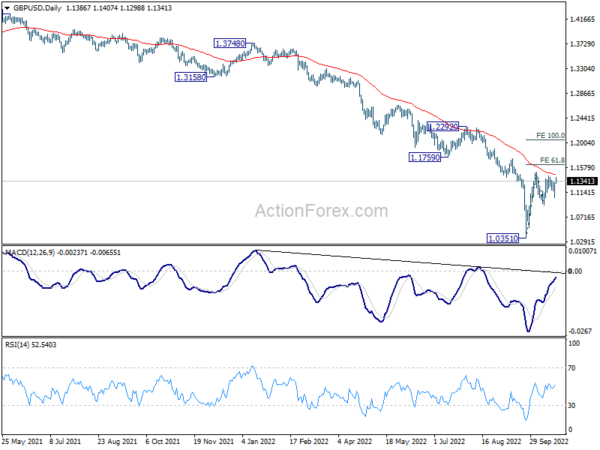

Range trading continues in GBP/USD and intraday bias stays neutral. Further rally is in favor as long as 1.0922 minor support holds. On the upside, break of 1.1494 will resume the rise from 1.0351 to 61.8% projection of 1.0351 to 1.1494 from 1.0922 at 1.1628. On the downside, below 1.0922 will turn bias back to the downside for 1.0351 low instead.

In the bigger picture, fall from 1.4248 (2018 high) is resuming long term down trend from 2.1161 (2007 high). Next target is 100% projection of 2.1161 to 1.3503 from 1.7190 at 0.9532. There is no scope of a medium term rebound as long as 1.1759 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Oct P | 52.8 | 53.5 | ||

| 22:00 | AUD | Services PMI Oct P | 49 | 50.6 | ||

| 00:30 | JPY | Jibun Bank Manufacturing PMI Oct P | 50.7 | 51.3 | 50.8 | |

| 07:15 | EUR | France Manufacturing PMI Oct P | 47 | 47.7 | ||

| 07:15 | EUR | France Services PMI Oct P | 51.5 | 52.9 | ||

| 07:30 | EUR | Germany Manufacturing PMI Oct P | 47.2 | 47.8 | ||

| 07:30 | EUR | Germany Services PMI Oct P | 44.8 | 45 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Oct P | 48 | 48.4 | ||

| 08:00 | EUR | Eurozone Services PMI Oct P | 48.2 | 48.8 | ||

| 08:30 | GBP | Manufacturing PMI Oct P | 48 | 48.4 | ||

| 08:30 | GBP | Services PMI Oct P | 49 | 50 | ||

| 13:45 | USD | Manufacturing PMI Oct P | 51.2 | 52 | ||

| 13:45 | USD | Services PMI Oct P | 49.2 | 49.3 |