Dollar is trying to recover against other major currencies today as recent selloff looks exhausted. Initial jobless claims rose to 259k in the week ended January 21, above expectation of 245k. That’s the highest level in a month due to holiday volatility. Initial claims have, nonetheless, stayed below 300k handle for the 99 straight weeks and counting, the longest streak since 1970. Continuing claims rose 41k to 2.1m in the week ended January 14. Also from US, trade deficit narrowed slightly to USD -65.0b in December. Wholesale inventories rose 1.0% in December.

In UK, the government published the bill for Brexit today and set 3 days for debates in parliament starting February 8. The so called European Union (Notification of Withdrawal) Bill is a short one without any detail. Prime minister Theresa May said yesterday a white paper will be published and pass through the Parliament before triggering Article 50 by end of March. Brexit Secretary David Davis said that the process will be "as expeditious as we can be".

Sterling retreats mildly today but remains the strongest major currency for the week. UK GDP grew 0.6% qoq in Q4, unchanged from prior quarter and beat expectation of 0.5% qoq. On annual basis, GDP grew 2.2% yoy, above expectation of 2.1% yoy. Index of services rose 1.0% 3mo3m in November, above expectation of 0.9% 3mo3m. BBA mortgage approvals rose to 43k in December. CBI reported sales dropped to -8 in January. Also from Europe, German Gfk consumer sentiment rose to 10.2 in February. Swiss trade surplus narrowed to CHF 2.72b in December.

Elsewhere, New Zealand CPI rose 0.4% qoq, 1.3% yoy in Q4. Japan corporate service price rose 0.4% yoy in December.

EUR/USD Mid-Day Outlook

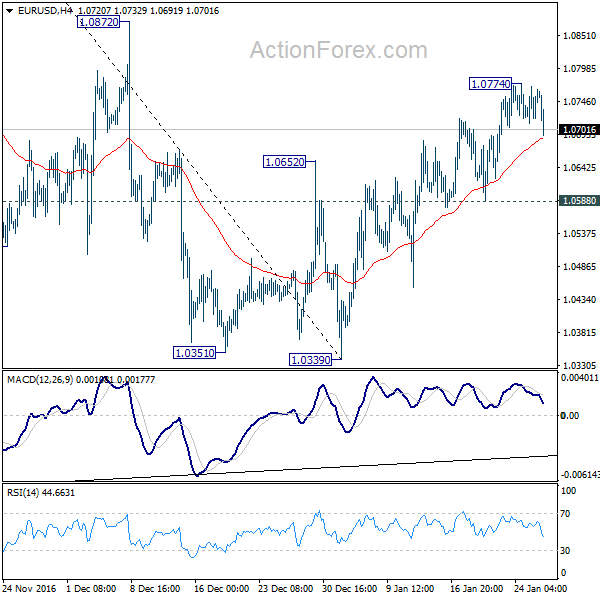

Daily Pivots: (S1) 1.0716; (P) 1.0742 (R1) 1.0774; More…..

A temporary top is in place at 1.0744. Intraday bias in EUR/USD is turned neutral first. Above 1.0774 will extend the rise from 1.0339. But such rise is seen as a corrective move and should be limited by 1.0872 resistance. On the downside, below 1.0588 minor support will argue that it’s completed and turn bias back to the downside for 1.0339 support.

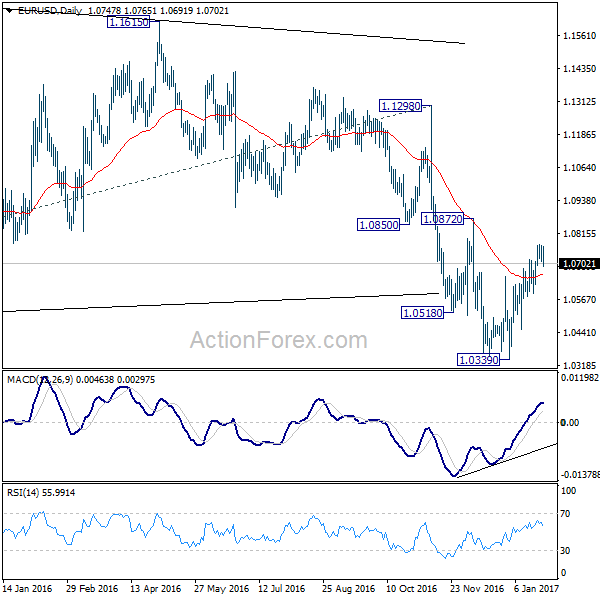

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q4 | 0.40% | 0.30% | 0.30% | |

| 21:45 | NZD | CPI Y/Y Q4 | 1.30% | 1.20% | 0.40% | |

| 23:50 | JPY | Corporate Service Price Y/Y Dec | 0.40% | 0.40% | 0.30% | |

| 7:00 | CHF | Trade Balance (CHF) Dec | 2.72B | 2.81B | 3.64B | 3.50B |

| 7:00 | EUR | German GfK Consumer Confidence Feb | 10.2 | 10 | 9.9 | |

| 9:30 | GBP | BBA Mortgage Approvals Dec | 41000 | 40659 | ||

| 9:30 | GBP | GDP Q/Q Q4 A | 0.50% | 0.60% | ||

| 9:30 | GBP | GDP Y/Y Q4 A | 2.10% | 2.20% | ||

| 9:30 | GBP | Index of Services 3M/3M Nov | 0.90% | 1.00% | ||

| 11:00 | GBP | CBI Retailing Reported Sales Jan | 27 | 35 | ||

| 13:30 | USD | Advance Goods Trade Balance Dec | -64.5B | -66.6B | ||

| 13:30 | USD | Wholesale Inventories Dec P | 0.10% | 1.00% | ||

| 13:30 | USD | Initial Jobless Claims (JAN 21) | 245k | 234k | ||

| 15:00 | USD | New Home Sales Dec | 585k | 592k | ||

| 15:00 | USD | Leading Indicators Dec | 0.50% | 0.00% | ||

| 15:30 | USD | Natural Gas Storage | -243B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box