Markets are holding their breath as the highly anticipated FOMC meeting awaited. DJIA’s recovery lost steam and closed down -44.11 pts, or -0.21%, at 20837.37 after breaching 20800 briefly. S&P 500 also lost -8.02 pts, or -0.34%, to close at 2365.45. Both indices are holding above last week’s low at 20777.16 and 2354.54 so far. 10 year yield stayed in tight range below recent resistance at 2.621 and closed down -0.013 at 2.595. Gold continued to engage in range trading around 1200. WTI crude oil dived sharply to as low as 47.09 but recovered to 48.50 for the moment.

Dollar index trading mildly higher to 101.70 at the time of writing, holding above 100.66 near term support. In the currency market, despite some volatility, major pairs and crosses are generally stuck in last week’s range, except GBP/CHF. General weakness is seen in Euro for the week as the common currency pared back post ECB gains. Yen follows as the second weakest as its rebound attempt quickly falters.

Fed to upgrade economic projections

Fed is widely expected to hike federal funds rate by 25bps to 0.75-1.00%. The rate hike itself is well priced in. Thus the focus will be largely on three things, the FOMC statement, new economic projection, and Fed chair Janet Yellen’s press conference. Markets are looking through today’s hike and are eager to get the hints on what Fed would do next. The table below showed FOMC’s median projections back in December.

Federal funds rate are projected to be at 1.4% by the end of 2017, 2.1% by the end of 2018. They equivalent to 3 rate hikes in total for this year and 2-3 hikes next year. Any upward revision to the numbers will imply a faster path. In particular, some analysts are anticipating a meaningful revision to 2018’s projections to reflect a firmer chance of 3 hikes. Meanwhile, the markets will also look closely to the revisions to economic projections, with focuses on the core PCE number for this year and next.

More on FOMC:

- Upcoming Rate Hikes And 2018 Median Dot Plot In Focus

- FOMC Preview – It’s All in the Dots

- Fed Expected to Raise US Interest Rates

- FOMC Preview: Fed to Maintain Signal of Three Hikes this Year

UK employment, US CPI and retail sales featured

Elsewhere, New Zealand current account deficit narrowed to NZD 2.3b in Q4. Australia Westpac consumer confidence rose 0.1% in March. UK employment data will be a main focus in European session. Swiss will release PPI and Eurozone will release employment. US will release Empire state manufacturing, CPI, retail sales and NAHB housing market index.

USD/CAD Daily Outlook

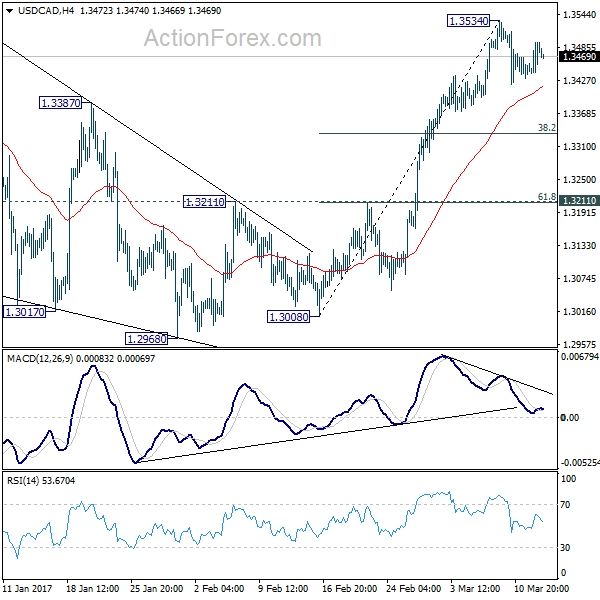

Daily Pivots: (S1) 1.3446; (P) 1.3470; (R1) 1.3503; More…

USD/CAD is still bounded in consolidation below 1.3534 and intraday bias remains neutral for the moment. Another fall cannot be ruled out as the consolidation extends. But downside should be contained by 38.2% retracement of 1.3008 to 1.3534 at 1.3333 and bring another rally. Above 1.3534 will turn bias to the upside for retesting 1.3598 high next.

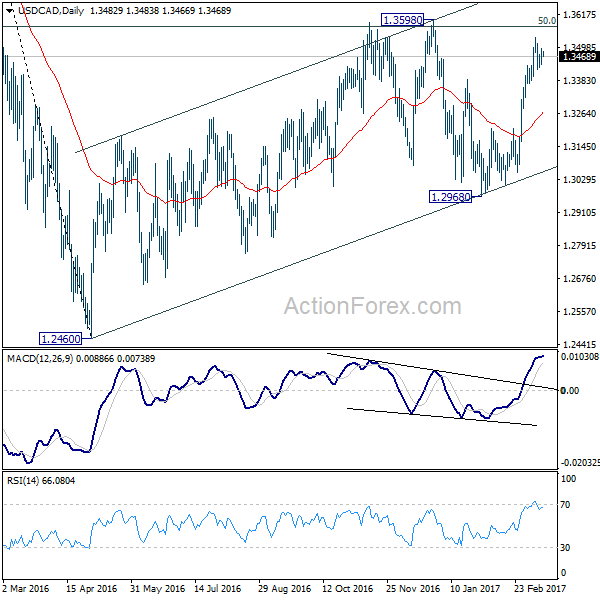

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg, started from 1.2460 is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. Break of 1.2968 wold at least bring at retest of 1.2460 low. However, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account Balance (NZD) Q4 | -2.3B | -2.43B | -4.89B | -5.03B |

| 23:30 | AUD | Westpac Consumer Confidence Mar | 0.10% | 2.30% | ||

| 04:30 | JPY | Industrial Production M/M Jan F | -0.80% | -0.80% | ||

| 08:15 | CHF | Producer & Import Prices M/M Feb | 0.40% | 0.40% | ||

| 08:15 | CHF | Producer & Import Prices Y/Y Feb | 0.80% | |||

| 09:30 | GBP | Jobless Claims Change Feb | 3.2K | -42.4K | ||

| 09:30 | GBP | Claimant Count Rate Feb | 2.10% | |||

| 09:30 | GBP | ILO Unemployment Rate (3M) Jan | 4.80% | 4.80% | ||

| 09:30 | GBP | Average Weekly Earnings 3M/Y Jan | 2.40% | 2.60% | ||

| 10:00 | EUR | Eurozone Employment Q/Q Q4 | 0.20% | 0.20% | ||

| 12:30 | USD | Empire State Manufacturing Index Mar | 15 | 18.7 | ||

| 12:30 | USD | CPI M/M Feb | 0.00% | 0.60% | ||

| 12:30 | USD | CPI Y/Y Feb | 2.60% | 2.50% | ||

| 12:30 | USD | CPI Core M/M Feb | 0.20% | 0.30% | ||

| 12:30 | USD | CPI Core Y/Y Feb | 2.30% | |||

| 12:30 | USD | Advance Retail Sales Feb | -0.10% | 0.40% | ||

| 12:30 | USD | Retail Sales Less Autos Feb | -0.10% | 0.80% | ||

| 14:00 | USD | NAHB Housing Market Index Mar | 65 | |||

| 14:00 | USD | Business Inventories Jan | 0.30% | 0.40% | ||

| 14:30 | USD | Crude Oil Inventories | 8.2M | |||

| 18:00 | USD | FOMC Rate Decision | 1.00% | 0.75% |