The forex markets are somewhat in hibernation mode this week. Dollar is currently the weakest one, followed Yen. Commodity currencies are generally firm. But Swiss Franc is the strongest, thanks to buying against the weakening Euro and Sterling. But overall, with the exception of a few Yen pairs, major pairs and crosses are staying inside last week’s range. Hopefully, the markets will wake up after today’s US CPI release.

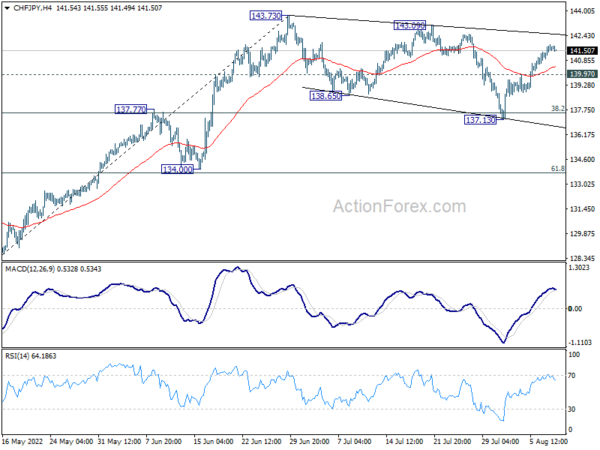

Technically, CHF/JPY is currently the top mover for the week, up 0.86%. While it may be losing some upside momentum, further rally is expected as long as 139.97 support holds. Corrective pattern from 143.73 is tentatively seen as completed with three waves down to 137.13. Retest of 143.73 high should be seen in the near term and firm break there will resume larger up trend.

In Asia, at the time of writing, Nikkei is down -0.71%. Hong Kong HSI is down -2.23%. China Shanghai SSE is down -0.62%. Singapore Strait Times is up 0.38%. Japan 10-year JGB yield is up 0.0244 at 0.191. Overnight, DOW dropped -0.18%. S&P 500 dropped -0.42%. NASDAQ dropped -1.19%. 10-year yield rose 0.032 to 2.797.

Fed Bullard: Too early to claim inflation has peaked

St. Louis Fed President James Bullard said in an MNI interview, “we may see some relief in the headline CPI tomorrow but the reason we tend to track core PCE inflation is exactly because we ignore the energy price movement on the way up but also on the way down.”

“I would like to see improvements across a range of indicators of inflation, not just one measure ticking down a little bit but clear and convincing evidence,” he said, adding that it’s going to be “much harder” to get core factors to turn around.

Bullard still wants to get interest rates to 3.75-4.00% range by the end of the year. “I think the destination is a little bit higher than what I would have thought even a couple months ago because inflation has continued to broaden out and doesn’t look like it’s turning the corner at least based on the evidence we have today… I think it’s too early to make the claim that inflation has peaked.”

S&P 500 pressing key resistance ahead of US CPI

It’s been a very quiet week in the markets so far, and today’s US consumer inflation release should bring trading back to life. Economists are expecting headline CPI to slow from 9.1% yoy to 8.7% yoy in July. But core CPI is expected to rise from 5.9% yoy to 6.1% yoy. While one data point is definitely insufficient to tell the trend, traders are still eager to get hints on whether inflation is still climbing, plateauing, or starting to reverse.

The next move in Dollar would very likely be driven by overall risk sentiment after the CPI release. The greenback tends to weaken in risk-on markets, and strengthen in risk-off markets. For now, as benchmark treasury yield is stuck in consolidation, reactions in stocks are more dollar-moving.

S&P 500 is pressing and important cluster resistance level of 4177.51, as well as 55 week EMA (now at 4182.34). Sustained trading above this 4177/82 zone will add much credence to the case that whole correction from 4818.62 has completed with three waves down to 3636.87. That would set the stage for further rally towards 4818.62 high later in the year, subject to upcoming data release of course. Nevertheless, break of last week low at 4079.891 will tentatively indicate short term topping and bring deeper pull back to 55 day EMA (now at 4012.26) in the near term.

Elsewhere

Japan PPI slowed from 9.4% yoy to 8.6% yoy in July, above expectation of 8.4% yoy. China CPI rose from 2.5% yoy to 2.7% yoy, below expectation of 2.9% yoy. PPI dropped from 6.1% yoy to 4.2% yoy, below expectation of 4.9% yoy.

AUD/USD Daily Report

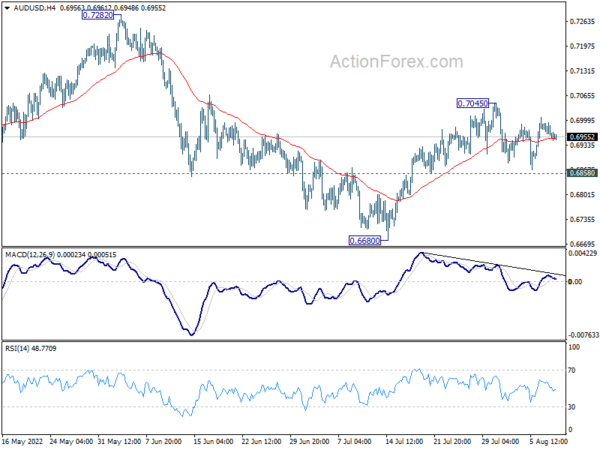

Daily Pivots: (S1) 0.6946; (P) 0.6970; (R1) 0.6987; More…

Range trading continues in AUD/USD and intraday bias remains neutral. On the upside, break of 0.7045 will resume the rebound from 0.6680 to 0.7282 key resistance next. On the downside, however, break of 0.6858 minor support will argue that the rebound is over. Intraday bias will then be back on the downside for retesting 0.6680 low.

In the bigger picture, price actions from 0.8006 (2021 high) is seen more as a corrective pattern to rise from 0.5506 (2020 low). Or it could be a bearish impulsive move. In either case, outlook will remain bearish as long as 0.7282 resistance holds. Next target is 61.8% retracement of 0.5506 to 0.8006 at 0.6461.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jul | 8.60% | 8.40% | 9.20% | 9.40% |

| 01:30 | CNY | CPI Y/Y Jul | 2.70% | 2.90% | 2.50% | |

| 01:30 | CNY | PPI Y/Y Jul | 4.20% | 4.90% | 6.10% | |

| 06:00 | EUR | Germany CPI M/M Jul F | 0.90% | 0.90% | ||

| 06:00 | EUR | Germany CPI Y/Y Jul F | 7.50% | 7.50% | ||

| 12:30 | USD | CPI M/M Jul | 0.20% | 1.30% | ||

| 12:30 | USD | CPI Y/Y Jul | 8.70% | 9.10% | ||

| 12:30 | USD | CPI Core M/M Jul | 0.50% | 0.70% | ||

| 12:30 | USD | CPI Core Y/Y Jul | 6.10% | 5.90% | ||

| 14:00 | USD | Wholesale Inventories Jun F | 1.90% | 1.90% | ||

| 14:30 | USD | Crude Oil Inventories | 0.1M | 4.5M |