Euro dips notably today in reaction to the results of Germany elections. And, the common currency is trading as the second weakest one so far, just next to New Zealand Dollar. While Angela Merkel won her fourth term as Chancellor, there are big questions and what the coalition government would be. First runner up Social Democrats are very clearly and determined to be a "strong opposition" and the "grand coalition" is ruled out. Meanwhile, the prospect of the Jamaica coalition of CDU, business friendly FDP and Greens is seen by many as having intrinsic instability. The rise of antit-EU AfD might prompt some worries over EU reforms. But AfD has already in disarray as its chair Frauke Petry walked out at a press conference and declared she won’t sit with the party in the Bundestag, showing huge internal dissent.

But after all, technically, EUR/USD is holding above 1.1822/37 support zone. EUR/GBP is trying to defend last week’s low at 0.8773, without giving in. EUR/JPY is well above 131.69 near term support. There is no coalition and a reversal in Euro yet.

More in Merkel Wins Fourth Term But Biggest Challenge Ahead

Ifo Fuest: Significance of AfD’s 13% should not be exaggerated".

Ifo president Clemens Fuest noted that the grand coalition between CDU and SDP, which represents "stability and predictability" is rejected. And this has "advantages and disadvantages". The so called Jamaica coalition between CDU, FDP and Greens has the potential to "make progress in areas of economic policy but also to avoid making certain mistakes. Though, there is a risk that "finding consensus will prove difficult" and that means instability in the government. He also talked down the significance of right wing AfD’s entry into Bundestag. While AfD won 13%, it could only result in the parliament having "more of a nationalist tone". And the "significance should not be exaggerated".

Separately, German Ifo business climate dropped to 115.2 in September, down from 115.7, below expectation of 116.0. Expectation gauge dropped to 107.4, down from 107.8, below expectation of 108.0. Current assessment gauge also dropped to 123.6, down from 124.7, below expectation of 124.7. Ifo noted in the statement that overall, Germany’s economy nevertheless goes into the new legislative period with a strong tailwind." But, the readings suggest that German economic growth is going to accelerate beyond Q1’s 0.7% and Q2’s 0.6.

ECB Draghi: We’re more becoming confident on inflation path

ECB President Mario Draghi said today that policy makers are "becoming more confident that inflation will eventually head to levels in line with our inflation aim". But he maintained that "a very substantial degree of monetary accommodation is still needed for the upward inflation path to materialise." Draghi will testify before a European Parliament committee today and talk about monetary policies and Eurozone economy.

BoE FPC: Brexit agreement must protect GBP 20T of derivative contracts

Bank of England said in a Financial Policy Committee that an agreement is needed as part of the Brexit process to protect the "long term" validity of the GBP 20T of existing derivative contracts. And BoE warned that "impairment to the servicing of these contracts could disrupt market functioning and make it more expensive for firms and households to insure against risks." Meanwhile, "the FPC and Prudential Regulation Committee encourage firms to use any internationally agreed transitional arrangements as they adjust to the new regime, provided the arrangements are broadly similar to those currently being considered."

The fourth round of Brexit negotiation between UK and EU starts in Brussels today. That’s a few days after UK Prime Minister Theresa May called for a two year "implementation period" on Brexit, and during the time, it’s almost like all status quo. UK will continue to have access to the single-market and pay into EU budgets. UK would even accept new EU regulations through to 2021. Such a proposal attracts criticism from May’s own MPs. The criticism mainly center around payment to EU an European Court of Justice jurisdiction.

Japan PMI announces snap election

In Japan, Primes Minister Shinzo Abe finally announced an early election today. Abe mentioned the problems of aging population and tension with North Korea as the biggest problems. And he pledged that "the respond to the problems as leader of the nation, that’s my mission as prime minister". He needed fresh mandate to handle the "national crisis". Abe also announced a JPY 2T stimulus package on education and social spending, for preparing Japan for the future. Abe hasn’t set a date for the election yet. But the Japanese media suggest it will be on October 22.

Also from Japan, PMI manufacturing rose to 52.6 in September, up from 52.2, but missed expectation of 53.4. Nonetheless, that’s the 13 straight month of expansionary reading, and the highest level since May. IHS Markit principal economist Annabel Fiddes noted that "firms signalled stronger expansions in both output and new orders amid reports of firmer demand both at home and abroad" And, "the strong end to Q3 bodes well for production in the coming months, with business confidence also perking up slightly since August."

New Zealand General Election: Economics Clouded By Politics

While the final result would be formally announced on October 7 (due to the complex arithmetic of the mixed-member proportion system), the available information confirmed that the centre-right National Party remains the biggest party but would again be shy of being a majority government. Worse still, it would also be challenging for Nationals to form a minority government with consent of smaller parities. While many believe that the most likely result would be a Nationals + NZ First coalition, it is not yet a done deal as it is still possible for NZ First form a coalition government with centre-left Labors and left-wing Greens. With plenty of uncertainties remains and the populist NZ First likely be a kingmaker in this term. More in New Zealand General Election: Economics Clouded By Politics.

New York Fed Dudley: Fed to continue accommodation removal

In US, New York Fed President William Dudley said today that he expects inflation to rise and stabiles around 2% over the medium term. That’s thanks to "firmer import price trend and the fading of effects from a number of temporary, idiosyncratic factors". And therefore, "in response, the Federal Reserve will likely continue to remove monetary policy accommodation gradually." His comments are inline with what he said earlier in the month, and Fed’s own projection of another rate hike by the end of the year.

EUR/USD Mid-Day Outlook

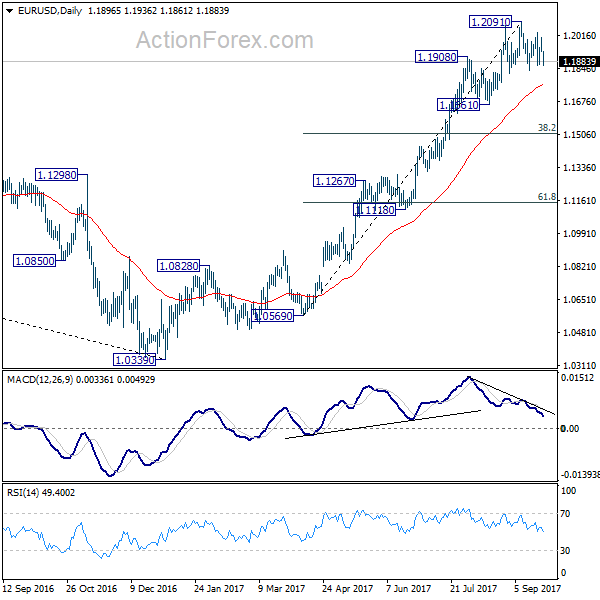

Daily Pivots: (S1) 1.1919; (P) 1.1961 (R1) 1.1990; More…

At this point, EUR/USD is still holding above 1.1822/37, in range below 1.2091. Intraday bias remains neutral for the moment. With 1.1822 support intact, near term outlook remains bullish for further rally. Break of 1.2091 will extend larger rise from 1.0339 and target next key fibonacci level at 1.2516. But considering bearish divergence condition in 4 hour MACD, break of 1.1822 will confirm short term reversal. In the case, intraday bias will be turned back to the downside through 1.1661 support. EUR/USD should then correct whole rise from 1.0569 and target 38.2% retracement of 1.0569 to 1.2091 at 1.1510.

In the bigger picture, rise from medium term bottom at 1.0339 is still in progress for 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside. But after all, break of 1.1661 is needed to indicate medium term topping. Otherwise, outlook will remain bullish in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Sep P | 52.6 | 53.4 | 52.2 | |

| 08:00 | EUR | German IFO – Business Climate Sep | 115.2 | 116 | 115.9 | 115.7 |

| 08:00 | EUR | German IFO – Expectations Sep | 107.4 | 108 | 107.9 | 107.8 |

| 08:00 | EUR | German IFO – Current Assessment Sep | 123.6 | 124.7 | 124.6 | 124.7 |

| 13:00 | CNY | Conference Board Leading Index Aug | 1.10% | 0.90% | 1.00% |