Yen is back as the worst performer on improving risk sentiment and rising yields. Dollar is trying to rally in early US session following rise in treasury yields. But strength is mainly seen against European majors and Yen only. Canadian and Australian Dollars are resilient so far. In other markets, Gold is largely staying in familiar range. WT crude oil is extending recovery, back above 113 handle. European and US stock markets are likely extending near term rebound.

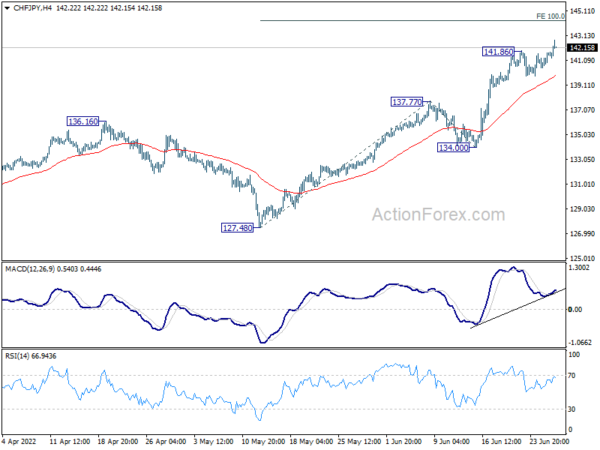

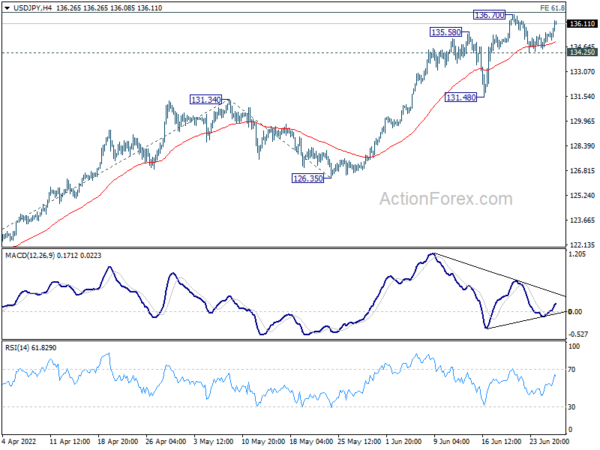

Technically, Yen crosses will come into focus today. CHF/JPY has already resumed recent up trend by breaking through 141.86 resistance. Next target is 100% projection of 127.48 to 137.77 from 134.00 at 144.29. EUR/JPY and USD/JPY could follow by breaking through 144.23 and 136.70 resistance levels respectively.

In Europe, at the time of writing, FTSE is up 1.23%. DAX is up 0.75%. CAC is up 1.16%. Germany 10-year yield is up 0.083 at 1.631. Earlier in Asia, Nikkei rose 0.66%. Hong Kong HSI rose 0.85%. China Shanghai SSE rose 0.89%. Singapore Strait Times rose 0.09%. Japan 10-year JGB yield dropped -0.0039 to 0.234.

US goods trade deficit narrowed to USD 104.3B in May

US goods exports rose USD 2B to USD 176.6B in May. Goods imports dropped USD -0.4B to USD 280.9B. Goods trade deficit narrowed from USD -106.7B to USD -104.3B, still above expectation of USD -101.7B.

Wholesale inventories rose 2.0% to USD 880.6B. Retail inventories rose 1.1% to USD 705.3B.

ECB Lagarde: Policy normalization will continue in a determined and sustained manner

ECB President Christine Lagarde said in a speech, “based on the overall outlook, the process of normalizing our monetary policy will continue in a determined and sustained manner.” However, given the uncertainty, “the pace of interest rate normalization cannot be defined ex ante.” She emphasized that the appropriate policy stance has to incorporate the “principles of gradualism and optionality”.

As for policy moves ahead, Lagarde reiterated that ECB will end net asset purchases on July 1, then hike the three interest rates by 25bps at next meeting on July 21. Also, “a larger increment” would be appropriate at the September meeting, “if the medium-term inflation outlook persists or deteriorates”.

Beyond September, the Governing Council has agreed that a “gradual but sustained” path of further rate increases will be appropriate. “The starting point at each meeting will be an assessment of the evolution of the shocks, their implications for the outlook and the degree of confidence we have in inflation converging to our medium-term target,” she said.

ECB Kazaks: Frontloading rate hike a reasonable choice

ECB Governing Council member Martins Kazaks told BloombergTV today that if the central bank hikes by 25bps in July, then a 50bps hike might be needed in September. He argued that ECB might need to considering a 50bps hike in July instead.

“If we see that the situation has worsened, that inflation is high and we see negative news in terms of inflation expectations, then in my view front-loading the increase would be a reasonable choice,” he said.

Germany Gfk consumer sentiment dropped to new record low, in a downward spiral

Germany Gfk consumer sentiment. for July dropped from -26.2 to -27.4, better than expectation of -27.7. But that’s nonetheless another record low since 1991.

In June, economic expectations dropped from -9.3 to -11.7. Consumers continue to see a significant risk of recession in Germany. Income expectations dropped from -23.7 to -33.5, worst reading in almost 20 years. Propensity to buy dropped from -11.1 to -13.7, worst since 2008.

“The ongoing war in Ukraine and disruptions in supply chains are causing energy and food prices in particular to skyrocket, resulting in a gloomier consumer climate than ever before”, explains Rolf Bürkl, GfK consumer expert. “Above all, the increase in the cost of living, which is almost eight percent at present, is weighing heavily on consumer sentiment and sending it into a downward spiral.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 134.82; (P) 135.18; (R1) 135.85; More…

USD/JPY rebounds notably today but stays below 136.70 resistance. Intraday bias stay neutral first. On the upside, decisive break of break of 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81 will extend larger uptrend. Next target is 100% projection at 143.29. On the downside, below 134.25 will extend the correction from 136.70 with another fall.

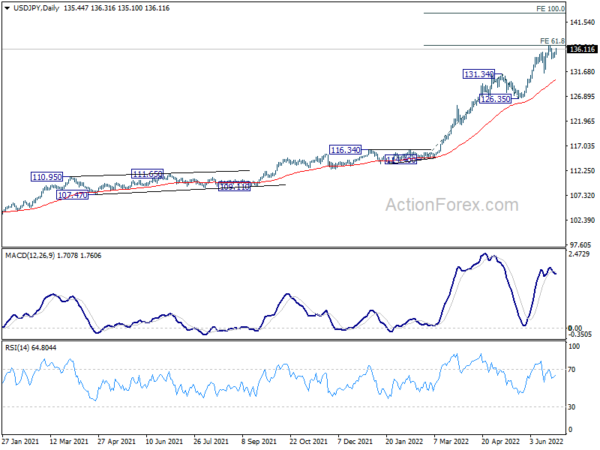

In the bigger picture, current rally is seen as part of the long term up trend from 75.56 (2011 low). Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 126.35 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Gfk Consumer Confidence Jul | -27.4 | -27.7 | -26 | -26.2 |

| 12:30 | USD | Goods Trade Balance (USD) May P | -104.3B | -101.7B | -106.7B | |

| 12:30 | USD | Wholesale Inventories May P | 2.00% | 2.20% | 2.20% | 2.30% |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Apr | 21.20% | 21.00% | 21.20% | |

| 13:00 | USD | Housing Price Index M/M Apr | 1.60% | 1.00% | 1.50% | |

| 14:00 | USD | Consumer Confidence Jun | 100 | 106.4 |