Yen recovers broadly today while Asian equities are trading generally lower as geopolitics is back haunting the markets. Tensions between North Korea and the US escalated again this week after US President Donald Trump’s threat of "total destruction". This was followed by an executive order by Trump to forcefully push through trade embargo with North Korea. Then, North Korea responded by pledging to strike back with with countermeasures, including the use of hydrogen bomb. Dollar is mixed today as the boost from FOMC faded. Aussie and Kiwi are under much pressure. Aussie is still feeling heavy after China rate downgrade. Kiwi is cautious ahead of election in the weekend. On the other hand, Euro is staying firm ahead of Germany election on Sunday. Sterling is mixed a UK Prime Minister Theresa May’s high profile Brexit speech is awaited.

North Korea threatens countermeaure on mentally deranged Trump

North Korea leader Kim Jong-Un issued a rate 500 word statement, striking back at Trump’s speech at the United Nations. Kim called Trump a "mentally deranged U.S. dotard" who is "arousing worldwide concern." And, "after taking office Trump has rendered the world restless through threats and blackmail against all countries in the world." Kim further criticized Trump is "unfit to hold the prerogative of supreme command of a country, and he is surely a rogue and a gangster fond of playing with fire, rather than a politician." Kim warned of the "highest level of hard-line countermeasure in history". And this counter measures is seen by many as a sign of launching a hydrogen bomb in the Pacific Ocean.

Trump to unilaterally force through trade embargo on North Korea

Trump issued a new executive order yesterday targeting North Korea. The Treasury Department is granted authority to penalize any company or person doing business with North Korea. Their access to the US financial system could be cut off and assets could be freezed. The executive order now open the door for the US to unilaterally enforce a trade embargo against North Korea, and force any country in the world to join it. But it remains to be seen whether this would be implemented equally, or just selectively. China is known to have a blind eye of smuggling between itself and North Korea. And Trump has been relatively very quiet on trade between Russia and North Korea. Trump said that "North Korea’s nuclear program is a grave threat to peace and security in our world, and it is unacceptable that others financially support this criminal, rogue regime." Trump also said that the Chinese central bank has requested banks to immediately stop doing business with North Korea too.

WTI steady at around 50 as oil producers meet

WTI Crude oil is steady at around 50 as OPEC and some non-OPEC producers, including Russia and Oman, are meeting today. The market hoped that they would discuss potential extension of the output cut deal. The existing deal aiming at curbing production of 1.2M bpd would end in March 31. Compliance of the current deal would also be assessed. According to Kuwaiti Oil Minister Essam al-Marzouq, the compliance was improving and was above 100%. Meanwhile, a technical committee of OPEC and non-OPEC indicated that the compliance in August was 116% (meaning producers cut output more than required), up from 94% in July.

The producers are, however, divided in whether the deal extension would be discussed. Russian Energy Minister Alexander Novak noted that it is "still too early to talk about concrete timing of extending". However, Algerian Energy Minister Mustapha Guitouni indicated in an interview by a state-run press service that they would discuss the matter, while Iraq’s Oil Minister Jabbar Al-Luaibi had also noted earlier this week that some members were discussing.

S&P downgraded China to A+

Yesterday, S&P’s announced that it has cut China’s sovereign rating, for the first time since 1999, by one notch to A+. The credit rating agency stated that "China’s prolonged period of strong credit growth has increased its economic and financial risks". Although "this credit growth had contributed to strong real gross domestic product growth and higher asset prices, we believe it has also diminished financial stability to some extent". Back in May, another top-tiered rating agency, Moody’s downgraded the country’s sovereign rating to A1 from Aa3 amidst rising default risks. The top 3 agencies now have the same sovereign rating for China, as Fitch’s had put it at that level already in 2013. S&P’s decision has big repercussion on Australian dollar which slumped to a 3-week low against US dollar and a one-month low against New Zealand dollar. As Australia’s biggest trading partner, China has been importing most of Australia’s raw materials, in particular iron ores.

On the data front

Eurozone PMIs are the main focuses in European session. Later in the data, Canadian data will take center stage with CPI and retail sales featured. Also, UK Prime Minister Theresa May will deliver her high profile Brexit speech in Italy.

In the weekend – New Zealand and Germany elections

The upcoming New Zealand election would be a tight race between the incumbent National Party and Labor Party. Opinion polls suggest that supports for both parties are at around 40%. As such none of them would be able to a form government without entering coalition with smaller parties. This is such uncertainty that has increased the volatility of New Zealand dollar of late. Maintaining the status quo – a minority government led by Nationals- would be the most NZD-favorable while a Labor + Green+ NZ First trio would lead to an immediate, but short-term selloff in the currency. More in New Zealand Election: Change in Government is NZD-Negative in Near-Term

Although Chancellor Angela Merkel’s Christian Democratic Union (CDU) and its sister party, the Christian Socialist Union (CSU), have been comfortably leading in polls. There still are a number of uncertainties in the upcoming German election. While Merkel is on the way to be the Chancellor for a fourth, and the last, term, her party is unlikely to form a government without forming coalition with other party(ies). While the Grand Coalition (CDU/CSU+SPD as the junior partner), just like the one we have had since 2013 and between 2005-2009, is the most favorable to the economy and the financial markets, it cannot be seen as a done deal. Meanwhile, rising supports for the populist Alternative for Germany (AfD) signal that a far-right party would enter the parliament for the first time since WWII. AfD has pledged to promote its anti-EU and anti-immigrants rhetoric in the parliament as it might probably become the biggest opposition party in case of a Grand Coalition. Moreover, the parliament is prone to be more fragmented with six parties in 2017-term, compared with four previously. More in German Election: Not as Boring as You Think

USD/JPY Daily Outlook

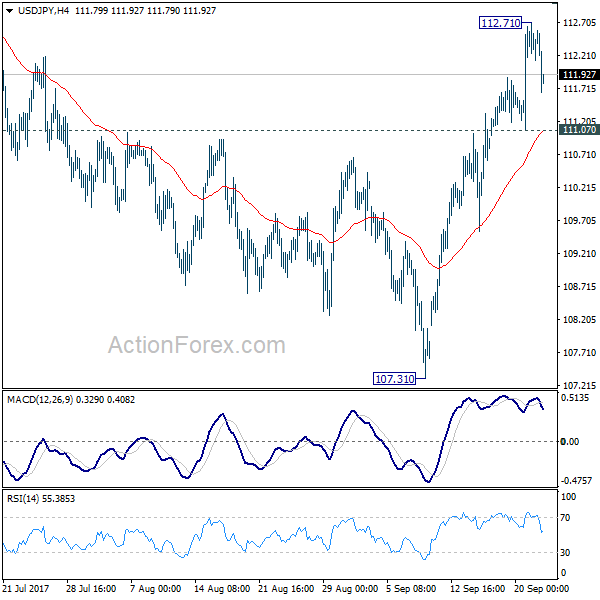

Daily Pivots: (S1) 112.17; (P) 112.44; (R1) 112.75; More…

USD/JPY’s retreat suggests that a temporary top is in place at 112.71. Intraday bias is turned neutral first. Further rally is in favor as long as 111.07 support holds. Sustained break of medium term channel resistance (now at 113.03) will argue that whole correction from 118.65 has completed too. In that case, further rise should be seen to 114.49 resistance for confirmation. However, break of 111.07 minor support will raise the risk of rejection from channel resistance and turn bias back to the downside for 55 day EMA (now at 110.58).

In the bigger picture, rise from 98.97 (2016 low) is seen as the second leg of the corrective pattern from 125.85 (2015 high). It’s unclear whether this this second leg has completed at 118.65 or not. But medium term outlook will be mildly bearish as long as 114.49 resistance holds. And, there is prospect of breaking 98.97 ahead. Meanwhile, break of 114.49 will bring retest of 125.85 high. But even in that case, we don’t expect a break there on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | France Manufacturing PMI Sep P | 55.5 | 55.8 | ||

| 07:00 | EUR | France Services PMI Sep P | 54.8 | 54.9 | ||

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 59 | 59.3 | ||

| 07:30 | EUR | Germany Services PMI Sep P | 53.8 | 53.5 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 57.2 | 57.4 | ||

| 08:00 | EUR | Eurozone Services PMI Sep P | 54.8 | 54.7 | ||

| 10:00 | GBP | CBI Trends Total Orders Sep | 13 | 13 | ||

| 12:30 | CAD | CPI M/M Aug | 0.20% | 0.00% | ||

| 12:30 | CAD | CPI Y/Y Aug | 1.50% | 1.20% | ||

| 12:30 | CAD | CPI Core – Common Y/Y Aug | 1.40% | |||

| 12:30 | CAD | CPI Core – Trim Y/Y Aug | 1.30% | |||

| 12:30 | CAD | CPI Core – Median Y/Y Aug | 1.70% | |||

| 12:30 | CAD | Retail Sales M/M Jul | 0.30% | 0.10% | ||

| 12:30 | CAD | Retail Sales Less Autos M/M Jul | 0.50% | 0.70% | ||

| 13:45 | USD | US Manufacturing PMI Sep P | 53 | 52.8 | ||

| 13:45 | USD | US Services PMI Sep P | 55.9 | 56 |