Dollar is back under pressure in today, as the rebound in US stocks carry forward to Asia. Swiss Franc is also paring some gains too while Yen softens slightly. Australian and New Zealand Dollars are firm together while Sterling while Euro is mixed. Return of risk-on sentiment, as well as extended pull back in treasury yields could drag the greenback further lower before the week closes.

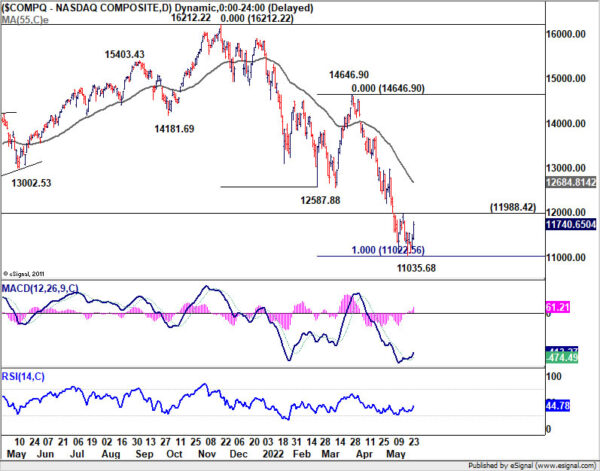

Technically, NASDAQ has been the relatively poor performer recently among major US indexes. As the rebound extends, focus will be on 11988.42 resistance. Firm break there should confirm that a stronger rebound, at least a bear market rally, is underway for 12587.88 support turned resistance ahead in the coming weeks. Such development, if happens, would likely be accompanied by deeper correction in Dollar in general. This will be the focus for today and the early part of next week.

In Asia, at the time of writing, Nikkei is up 0.59%. Hong Kong HSI is up 2.34%. China Shanghai SSE is up 0.08%. Singapore Strait Times is up 0.42%. Japan 10-year JGB yield is down -0.0055 at 0.230. Overnight, DOW rose 1.61%. S&P 500 rose 1.99%. NASDAQ rose 2.68%. 10-year yield rose 0.007 to 2.756.

BoJ Kuroda: Prices won’t rise sustainably without wage hikes

BoJ Governor Haruhiko Kuroda told the parliament today that core inflation (all items excluding fresh food) is “likely to remain around 2% for about 12 months”, unless energy prices drop sharply.

However, he emphasized that “prices won’t rise sustainably, stably unless accompanied by wage hikes.” That’s seen as in indication that recent rise in inflation is not enough to lead to exit of the ultra-loose monetary policy.

Also from Japan, Tokyo CPI core was unchanged at 1.9% yoy in May, below expectation of 2.0% yoy.

Australia retail sales rose 0.9% mom in Apr, driven by higher food prices

Australia retail sales rose 0.9% mom in April, slightly below expectation of 1.0% mom. For the 12-month period, sales rose 9.6% yoy.

New South Wales was the only state or territory to record a fall, down -0.3%. Queensland had the largest rise in retail turnover, up 1.6%. Turnover also rose in Victoria (1.1%), Western Australia (2.2 %), South Australia (1.4%), Tasmania (2.0%), the Australian Capital Territory (0.5%) and the Northern Territory (0.7%).

ABS said: “The strength in retail turnover is being driven by spending across the food industries. High food prices have combined with increased household spending over the April holiday period as more people are travelling, dining out and holding family gatherings.

Looking ahead

Eurozone M3 money supply is the only feature in European session. US will release personal income and spending with PCE inflation, goods trade balance.

GBP/USD Daily Outlook

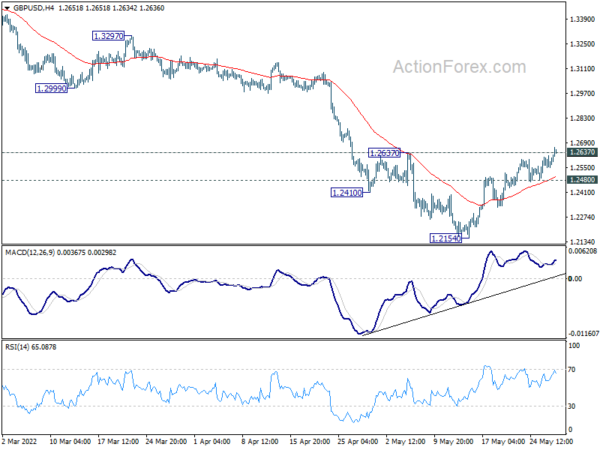

Daily Pivots: (S1) 1.2567; (P) 1.2594; (R1) 1.2636; More..

GBP/USD’s rebound from 1.2154 extended with break of 1.2637 resistance. Intraday bias is now on the upside and further rally would be seen to 55 day EMA (now at 1.2756). Sustained break there will target 1.2999 support turned resistance next. On the downside, though, break of 1.2480 minor support will turn bias back to the downside for retesting 1.2154 low instead.

In the bigger picture, based on current momentum, fall from 1.4248 (2018 high) at least at the same degree as the rise from 1.1409 (2020 low). That is, fall from 1.4248 could be a leg inside the pattern from 1.1409, or resuming the longer term down trend. In either case, deeper decline is expected as long as 1.2999 support turned resistance holds. Next target is 1.1409 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y May | 1.90% | 2.00% | 1.90% | |

| 01:30 | AUD | Retail Sales M/M Apr | 0.90% | 1.00% | 1.60% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 6.30% | 6.30% | ||

| 12:30 | USD | Personal Income M/M Apr | 0.60% | 0.50% | ||

| 12:30 | USD | Personal Spending Apr | 0.70% | 1.10% | ||

| 12:30 | USD | PCE Price Index M/M Apr | 0.80% | 0.90% | ||

| 12:30 | USD | PCE Price Index Y/Y Apr | 6.60% | 6.60% | ||

| 12:30 | USD | Core PCE Price Index M/M Apr | 0.40% | 0.30% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 4.60% | 5.20% | ||

| 12:30 | USD | Goods Trade Balance (USD) Apr P | -114.8B | -127.1B | ||

| 12:30 | USD | Wholesale Inventories Apr P | 2.00% | 2.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May F | 59.1 | 59.1 |