Risk aversion is once again a clear main theme of the day, with European indexes in deep red while US futures point to extended selloff. Safe-haven flows are also pushing benchmark global yields lower, with Germany 10-year yield back at 0.9% while US 10-year yield is back below 2.8%. Swiss Franc is the overwhelming winner but Yen is also catching up. On the other hand, dollar is the worst performing one, followed by Canadian, Sterling and Euro. Aussie and Kiwi are mixed for now.

Technically, USD/JPY’s correction from 131.34 resumed by breaking through 127.51 temporary low. Attention will now be on 1.0641 resistance in EUR/USD and 132.63 support in EUR/JPY. Break of the former will argue that Dollar is setting up itself for deeper broad based correction. On the other hand, Break of the latter will indicate that it’s Yen’s strength that is persisting.

In Europe, at the time of writing, FTSE is down -2.33%. DAX is down -1.74%. CAC is down -1.96%. Germany 10-year yield is down -0.110 at 0.918. Earlier in Asia, Nikkei dropped -1.89%. Hong Kong HSI dropped -2.54%. China Shanghai SSE rose 0.36%. Singapore Strait Times dropped -1.07%. Japan 10-year JGB yield dropped -0.0035 to 0.243.

US initial jobless claims rose to 218k, continuing claims dropped to 1.317m

US initial jobless claims rose 21k to 218k in the week ending May 14, above expectation of 202k. Four-week moving average of initial claims rose 8k to 199.5k.

Continuing claims dropped -25k to 1317k in the week ending May 7, lowest since December 27, 1969 when it was 1304k. Four-week moving average of continuing claims dropped -22.5k to 1362k, lowest since January 24, 1970 when it was 1361k.

ECB accounts: Forward guidance conditions for rate hike crucial for June meeting discussions

In the accounts of April 13-14, ECB said “members widely expressed concern over the high inflation numbers”.

Against this background, “some members viewed it as important to act without undue delay in order to demonstrate the Governing Council’s determination to achieve price stability in the medium term.”

But other members argued that “adjusting the monetary policy stance too aggressively could prove counterproductive, as it would lower growth while inflation remained elevated because monetary policy was unable to address the immediate causes of high inflation”

All in all, “members widely shared the view that the gradual normalisation of the monetary policy stance… should be continued”.

Overall, it was judged that “forward guidance conditions for an upward adjustment of the key ECB interest rates would become crucial for the policy discussion at the Governing Council’s June meeting”

Japan exports rose 12.5% yoy in Apr, imports rose 28.2% yoy

Japan exports rose 12.5% yoy to JPY 8076B in April. Imports rose 28.2% yoy to JPY 8915B, a new record. Trade deficit came in at JPY 839B.

Trade with China shrank notably. China-bound shipments fell -5.9% yoy, the biggest drop since March 2020. Imports from China also fell -5.5% yoy, the most since September 2020. On the other hand, exports to the US jumped 17.8% yoy while imports rose 15.3% yoy.

In seasonally adjusted terms, exports rose 1.0% mom to JPY 7629B. Imports rose 7.9% mom to JPY 9248B. Trade deficit came in at JPY -1619B, larger than expectation of JPY -1520T.

Australia employment rose just 4k in Apr, unemployment at record 3.9%

Australia employment rose just 4k in April, missing expectation of 30k growth. Full time jobs rose 92.4k while part0time jobs dropped -88.4k.

Unemployment rate was unchanged at 3.9%, matched expectations. Participation rate dropped -0.1% to 66.3%. Monthly hours worked rose 23m hours, or 1.3% mom.

Bjorn Jarvis, head of labour statistics at the ABS, said, “3.9 per cent is the lowest the unemployment rate has been in the monthly survey. The last time the unemployment rate was lower than this was in August 1974, when the survey was quarterly.”

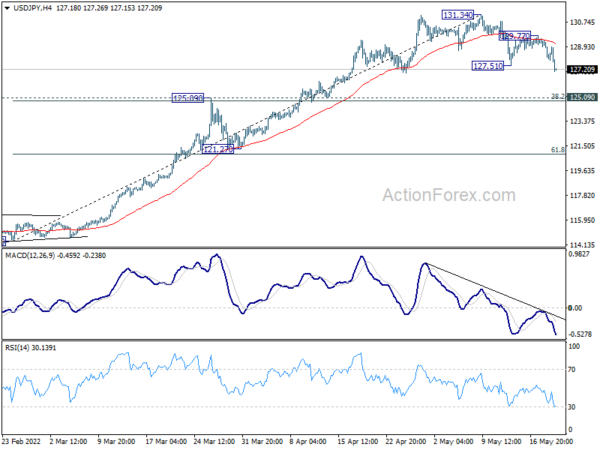

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 127.65; (P) 128.60; (R1) 129.18; More…

USD/JPY’s correction from 131.34 resumed by breaking through 127.51 temporary low. Intraday bias is back on the downside for 125.09 cluster support (38.2% retracement of 114.40 to 131.34 at 124.86). Strong support is expected from there to contain downside to bring rebound. On the upside, break of 129.77 minor resistance will suggest that the correction is finished and bring retest of 131.34.

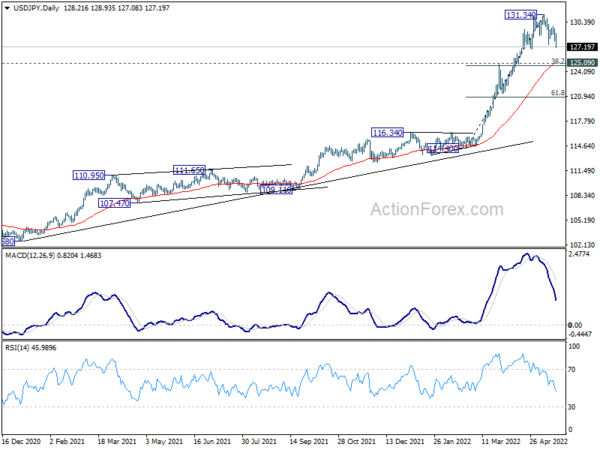

In the bigger picture, current rally is seen as part of the long term up trend form 75.56 (2011 low). Sustained trading above 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04 will pave the way to 100% projection at 149.26, which is close to 147.68 (1998 high). For now, this will remain the favored case as long as 121.27 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q1 | 3.60% | 1.00% | 1.10% | 1.20% |

| 22:45 | NZD | PPI Output Q/Q Q1 | 2.60% | 1.30% | 1.40% | 1.50% |

| 23:50 | JPY | Trade Balance (JPY) Apr | -1.62T | -1.52T | -0.90T | -1.02T |

| 23:50 | JPY | Machinery Orders M/M Mar | 7.10% | 3.70% | -9.80% | |

| 01:30 | AUD | Employment Change Apr | 4.0K | 30.0K | 17.9K | |

| 01:30 | AUD | Unemployment Rate Apr | 3.90% | 3.90% | 4.00% | 3.90% |

| 08:00 | EUR | Eurozone Current Account (EUR) Mar | -1.6B | 20.3B | 20.8B | 15.7B |

| 11:30 | EUR | Eurozone ECB Meeting Accounts | ||||

| 12:30 | CAD | New Housing Price Index M/M Apr | 0.30% | 1.00% | 1.20% | |

| 12:30 | CAD | Raw Material Price Index Apr | -2.00% | 10.30% | 11.80% | |

| 12:30 | CAD | Industrial Product Price M/M Apr | 0.80% | 3.70% | 4.00% | 3.40% |

| 12:30 | USD | Initial Jobless Claims (May 13) | 218K | 202K | 203K | 197K |

| 12:30 | USD | Philadelphia Fed Manufacturing Survey May | 2.6 | 16.2 | 17.6 | |

| 14:00 | USD | Existing Home Sales Apr | 5.63M | 5.77M | ||

| 14:30 | USD | Natural Gas Storage | 90B | 76B |