Yen and Dollar falls broadly today as risk-on sentiment is gaining steam. European majors are making a strong come back too. Sterling is boosted by upbeat job market data. Euro is also lifted after a ECB policymaker threw out the idea of a 50bps rate hike. Commodity currencies are mixed for the moment, slightly on the soft side.

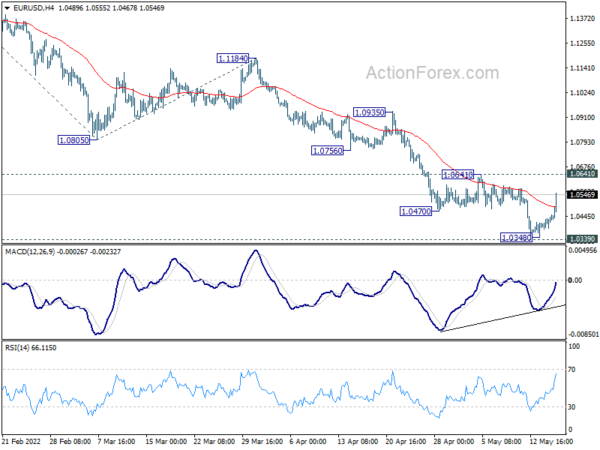

Technically, EUR/USD’s rebound raises the chance of successfully defending 2017 low. Immediate focus is now on 1.0641 resistance. Firm break there will at least confirm short term bottoming and bring stronger rebound. If that happens, focus will also be on 1.2637 resistance in GBP/USD and 0.9871 support in USD/CHF. Break of these levels will also add to the case of extended pull back in Dollar.

In Europe, at the time of writing, FTSE is up 0.79%. DAX is up 1.44%. CAC is up 1.17%. Germany 10-year yield is up 0.101 at 1.040. Earlier in Asia, Nikkei rose 0.42%. Hong Kong HSI rose 3.27%. China Shanghai SSE rose 0.65%. Singapore Strait Times rose 0.34%. Japan 10-year JGB yield rose 0.0010 to 0.245.

US retail sales rose 0.9% mom in Apr, ex-auto sales up 0.6% mom

US retail sales rose 0.9% mom to USD 677.7B in April, below expectation of 1.1% mom. Ex-auto sales rose 0.6% mom, above expectation of 0.3% mom. Ex-gasoline sales rose 1.3% mom. Ex-auto, ex-gasoline sales rose 1.0% mom. Retail trade rose 0.7% mom.

Total sales for the three-period, February through April, were up 10.8% from the same period a year ago.

ECB Knot: 25bps hike realistic, 50bps must not be excluded

ECB Governing Council member Klaas Knot told Dutch TV program College Tour, “the first interest rate hike is now being priced in for the monetary policy meeting of 21 July.” A 25bps hike ” seems realistic to me.”

He also added that if inflation is “broadening further or accumulating… a bigger increase must not be excluded either.”

“In that case a logical next step would amount (to) half a percentage point,” he said.

Released today, Eurozone GDP grew 0.3% qoq in Q1, above expectation of 0.2% qoq. Employment rose 0.5% qoq, matched expectations.

UK payrolled employees rose 131k in Apr, unemployment rate dropped to 3.7% in Mar

In April, UK payrolled employees rose 0.4% mom, or 131k, to 29.5m. Claimant count dropped -56.9k, versus expectation of -42.3k.

Unemployment rate dropped from 3.8% to 3.7%, versus expectation of being unchanged at 3.8%. Employment rate rose to 75.7%. Average earnings including bonus jumped 7% 3moy, versus expectation of 5.4%. Average earnings excluding bonus rose 4.2% 3moy, matched expectations.

RBA considered 15bps, 25bps, 40bps hikes in May

In the minutes of May 3 meeting, RBA revealed that three options on interest rate hikes were considered, including 15bps, 25bps and 40bps.

Raising the cash rate by 15bps was not preferred “given that policy was very stimulatory and that it was highly probable that further rate rises would be required.” And argument for 40bps “could be made given the upside risks to inflation and the current very low level of interest rates”.

But the preferred option of was 25bps, as “a move of this size would help signal that the Board was now returning to normal operating procedures after the extraordinary period of the pandemic”.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0402; (P) 1.0422 (R1) 1.0455; More…

EUR/USD is still limited below 1.0641 resistance and intraday bias stays neutral first. On the upside, firm break of 1.0641 resistance will confirm short term bottoming at 1.0348, ahead of 1.0339 long term support. Intraday bias will be turned back to the upside for 1.0805 support turned resistance. On the downside, however, decisive break of 1.0339 will carry larger bearish implication and target 161.8% projection of 1.1494 to 1.0805 from 1.1184 at 1.0069.

In the bigger picture, break of medium term channel support suggests downside acceleration. Current decline from 1.2348 (2021 high) is probably resuming long term down trend from 1.6039 (2008 high). Decisive break of 1.0339 will confirm this bearish case. Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. This will now remain the favored case as long as 1.0805 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 04:30 | JPY | Tertiary Industry Index M/M Mar | 1.30% | 1.20% | -1.30% | |

| 06:00 | GBP | Claimant Count Change Apr | -56.9K | -42.3K | -46.9K | |

| 06:00 | GBP | ILO Unemployment Rate (3M) Mar | 3.70% | 3.80% | 3.80% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 7.00% | 5.40% | 5.40% | 5.60% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 4.20% | 4.20% | 4.00% | 4.10% |

| 08:00 | EUR | Italy Trade Balance (EUR) Mar | -0.08B | 0.79B | -1.66B | -1.77B |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.30% | 0.20% | 0.20% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 P | 0.50% | 0.50% | 0.50% | |

| 12:30 | USD | Retail Sales M/M Apr | 0.90% | 1.10% | 0.50% | |

| 12:30 | USD | Retail Sales ex Autos M/M Apr | 0.60% | 0.30% | 1.10% | |

| 13:15 | USD | Industrial Production M/M Apr | 0.40% | 0.90% | ||

| 13:15 | USD | Capacity Utilization Apr | 78.60% | 78.30% | ||

| 14:00 | USD | Business Inventories Mar | 1.80% | 1.50% | ||

| 14:00 | USD | NAHB Housing Market Index May | 76 | 77 |