Overall, the forex markets are rather quiet as the week is heading to a close. EUR/USD is still holding above 2017 low but lacks any strength for a recovery. The greenback might still have a last push during the rest of the session. Meanwhile, Gold is a major mover today, and it’s now pressing 1800 handle. As for the week, Yen and Dollar remain the strongest while Kiwi and Aussie are the worst, followed by Euro.

In Europe, at the time of writing, FTSE is up 1.74%. DAX is up 1.26%. CAC is up 1.62%. Germany 10-year yield is up 0.875 at 0.933. Earlier in Asia, Nikkei rose 2.64%. Hong Kong HSI rose 2.68%. China Shanghai SSE rose 0.96%. Singapore Strait Times rose 0.82%. Japan 10-year JGB yield dropped -0.0065 to 0.245.

Gold pressing 1800 as decline continues

Gold’s decline resumes after brief support from 100% projection of 2070.06 to 1889.79 from 1998.23 at 1817.86. It’s now taking on 18k handle and there is no clear sign of bottoming yet. Further fall is expected as long as 1858.57 resistance holds. Next target is 161.8% projection at 1706.55.

Also, the whole fall from 2070.06 is seen as the third leg of the consolidation pattern from 2074.84 (2020 high). It would eventually target 1682.60 support to complete the pattern.

ECB Centeno: Necessary and desirable to normalize monetary policy

ECB Governing Council member Mario Centeno said normalization of monetary policy was “necessary and desirable”. But such normalization must be done gradually. He urged not to “over-react” to inflation rising across Europe or risk penalizing economic growth.

“Although inflation remains high in 2022, there are no structural reasons why it should not converge towards the medium-term objective as imbalances are gradually resolved and uncertainty dissipated,” Centeno said. “There are currently no structuring signs of de-anchoring inflation,” even though the balance of risks around inflation is skewed upward” after Russia’s invasion of Ukraine.

Second-order effects of wage pressures was “an additional risk which needs close and continued monitoring”, he added.

Eurozone industrial production dropped -1.8% mom in Mar, EU down -1.2% mom

Eurozone industrial production dropped -1.8% mom in March, slightly worse than expectation of -1.7% mom. Production of capital goods fell by -2.7%, non-durable consumer goods by -2.3%, intermediate goods by -2.0% and energy by -1.7%, while production of durable consumer goods rose by 0.8%.

EU industrial production dropped -1.2% mom. Among Member States for which data are available, the largest monthly decreases were registered in Slovakia (-5.3%), Germany (-5.0%) and Luxembourg (-3.9%). The highest increases were observed in Lithuania (+11.3%), Estonia (+5.1%), Bulgaria and Greece (both +5.0%).

BoJ Kuroda: Important to underpin economic activity with powerful monetary easing

BoJ Governor Haruhiko Kuroda told the parliament, “it’s important for currency rates to move stably reflecting economic and financial fundamentals… The recent sharp, short-term fluctuations in the yen are undesirable, as it heightens uncertainty and makes it harder for companies to set business plans.”

“The economy is in the midst of a recovery and now faces headwinds from rising commodity prices,” Kuroda said. “It’s therefore important to underpin economic activity with powerful monetary easing.”

Separately, Kuroda also said in a speech, “the coronavirus pandemic is a major risk that could further hurt Japan’s economy.” As such, “it’s appropriate to maintain … the dovish bias of our guidance for the time being.”

“For inflation to heighten as a trend, Japan must see a shift from inflation caused by energy prices, to one that is driven by increasing corporate profits and wage growth,” he said.

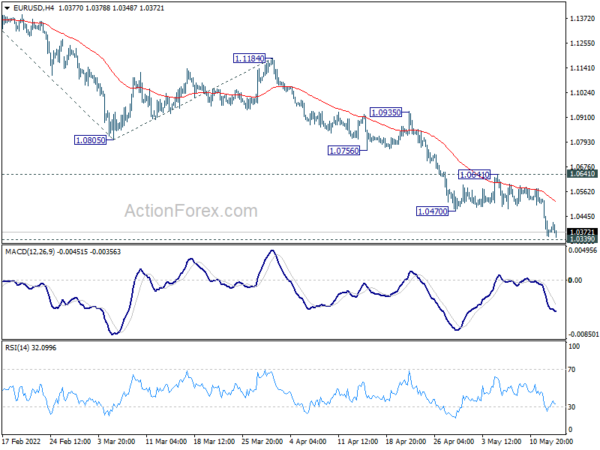

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0313; (P) 1.0421 (R1) 1.0488; More…

Intraday bias in EUR/USD stays on the downside at this point. Decisive break of 1.0339 long term support will carry larger bearish implication and target 161.8% projection of 1.1494 to 1.0805 from 1.1184 at 1.0069. On the upside, break of 1.0641 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, break of medium term channel support suggests downside acceleration. Current decline from 1.2348 (2021 high) is probably resuming long term down trend from 1.6039 (2008 high). Retest of 1.0339 (2017 low) low should be seen next. Decisive break there will confirm this bearish case. This will now remain the favored case as long as 1.0805 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Apr | 51.2 | 53.8 | 53.7 | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 3.60% | 3.60% | 3.50% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | -1.80% | -1.70% | 0.70% | |

| 12:30 | USD | Import Price Index M/M Apr | 0.00% | 0.60% | 2.60% | 2.90% |

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 63.6 | 65.2 |