Dollar jumps after FOMC kept the target range of federal funds rate at 1.00-1.25% as widely expected. Fed also confirmed that the balance sheet normalization program will be initiated in October. The Dollar positive parts of the announcement are firstly, GDP growth projection for 2017 and 2019 are revised up. Secondly, unemployment rate forecast for 2018 and 2019 are revised down. Federal fund rates projection for 2017 and 2018 are kept unchanged. That indicates Fed is still on course for another rate hike this year and three hikes next year. Nonetheless, core PCE projection for 2017 and 2018 are both revised down.

In the accompanying statement, Fed tried to talk down the impact of hurricanes Harvey, Irma and Maria. It noted that "past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term." Meanwhile, " higher prices for gasoline and some other items in the aftermath of the hurricanes will likely boost inflation temporarily". Still, "inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee’s 2 percent objective over the medium term."

Below is a summary of Fed’s new median projections.

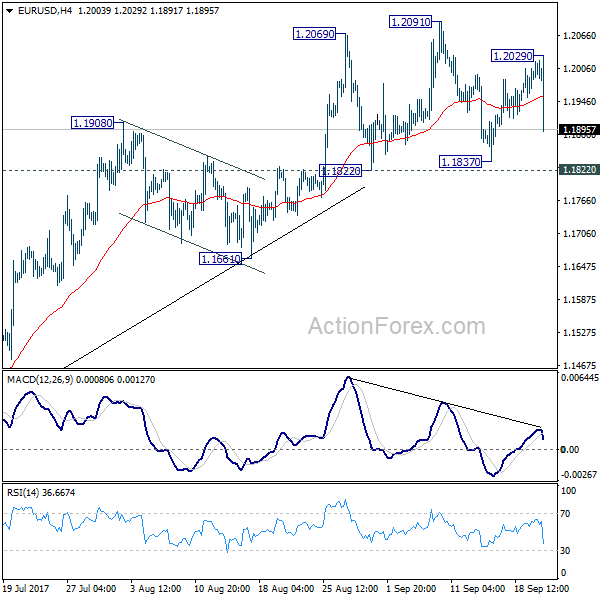

EUR/USD is still holding above 1.1822/37 support zone, for the moment. However, the pair could now be completing and head and shoulder top reversal pattern (ls: 1.2069, h: 1.2091, rs: 1.2029). Break of 1.1822/1837 support zone, together with bearish divergence condition in 4 hour MACD, will indicate near term reversal. That is, EUR/USD could then correct whole medium term rise fro 1.0339 and target 1.1661 support and below.

USD/JPY resumes recent rally and breaks through 111.87 temporary top. Intraday bias is back to the upside, current rise should target medium term channel resistance at 112.87 next.

USD/CHF’s strong rise now put 0.9704 resistance in focus. Break will target 0.9772 key resistance next. And decisive break there will confirm trend reversal.

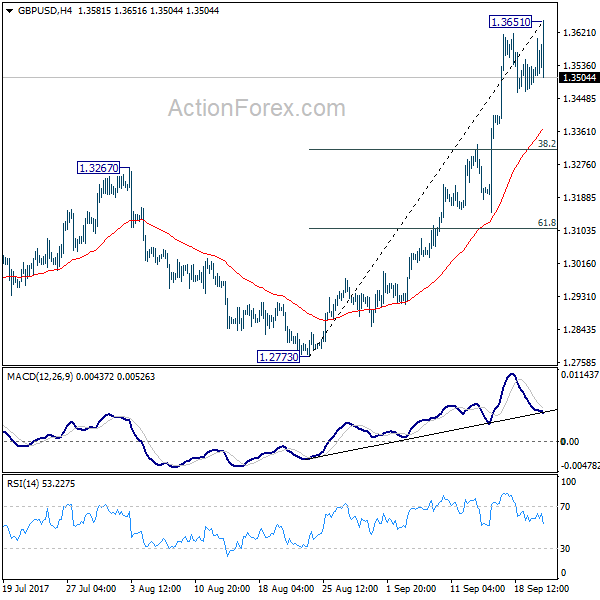

GBP/USD edged higher to 1.3651 earlier today but dips sharply after FOMC. The development suggest that more corrective trading should be seen in near term. And GBP/USD could dip further to 4 hour 55 EMA (now at 1.3369) before staging another rise.