Markets open the week with risk-off sentiment, in particular in Japan. Australian and New Zealand Dollar are trading broadly lower as a result. On the other hand, Dollar is rising broadly. European majors are mixed together with Yen and Canadian.

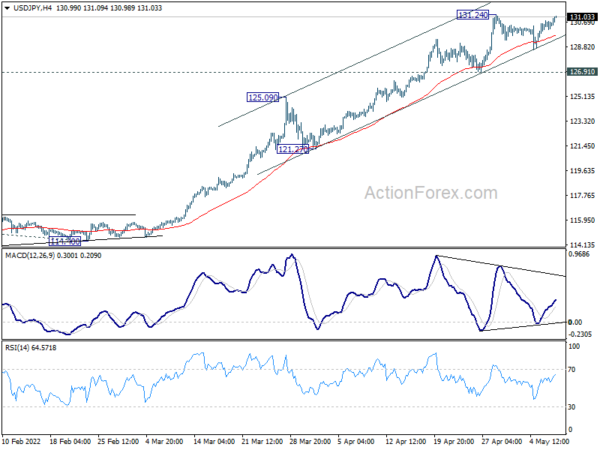

Technically, however, bother EUR/USD and USD/JPY are still bounded in established range even though Dollar is attempting to rise across the board. Attention will stay on 1.0470 support in EUR/USD and 131.24 resistance in USD/JPY. Break of these level will help confirm the underlying momentum in Dollar.

In Asia, at the time of writing, Nikkei is down -2.40%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.17%. Japan 10-year JGB yield is up 0.0053 at 0.251. Hong Kong is on holiday.

ECB Rehn wants first hike in July, rate at zero in Autumn

ECB Governing Council member Olli Rehn said, “We are seeing signs of second-round effects. It’s important that we send a signal that these higher inflation expectations we are currently witnessing will not become entrenched.”

It’s “reasonable that we will rather sooner, in my view in July, start raising rates in line with our normalization of monetary policy. And would expect that when autumn comes, we would be at zero,” he said.

Rehn also noted that the Ukraine war is hampering Eurozone’s economic recovery from the pandemic. “We are seeing some stagflation tendencies,” Rehn said. The Governing Council should ensure that monetary decisions don’t derail economic growth, but at the same time avoid inflation becoming entrenched, Rehn said.

Bitcoin to break through 33k low, ethereum to follow

Bitcoin is extending last week’s decline and it’s now close to making a new low for the year. The move is part of the broad based risk-off selling, which sees Nikkei down over -2.2% in Asia.

Immediate focus is now on 33000 low in bitcoin. Firm break there will resume whole down trend from 68986. In this case, there might be further downside acceleration through 30k handle to 61.8% projection of 68986 to 33000 from 48226 at 25986. Nevertheless, break of 36118 resistance will be a sign of stabilization and bring recovery first.

Ethereum also follows by breaking 2390 support today. The development should confirm that corrective recovery from 2157 has completed with three waves up to 3577. Deeper fall should be seen through 2157 to 38.2% projection of 4863 to 2157 from 3577 at 1904.

US CPI and UK GDP to highlight the week

Expectations on Fed’s tightening path will be remain a major driving force in all financial markets. That would very much depend on inflation development in the US. Thus, this week’s CPI release, and PPI too, would be important food of thoughts for FOMC members. BoE has clearly indicated the risk of stagflation and MPC members will pay close attention to UK GDP data. Elsewhere, Eurozone Sentix and Germany ZEW; Australia NAB business confidence, and BoJ summary of opinions will also be watched.

Here are some highlights for the week:

- Monday: Japan cash earnings, BoJ minutes; China trade balance; France trade balance; Eurozone Sentix investor confidence; Canada building permits.

- Tuesday: Japan household spending; Australia NAB business confidence; Italy industrial production; Germany ZEW economic sentiment.

- Wednesday: Australia Westpac consumer sentiment; China CPI, PPI; Japan leading indicators; Germany CPI final; US CPI.

- Thursday: BoJ summery of opinions, Japan bank lending, current account; New Zealand inflation expectations; UK GDP, productions, trade balance; Swiss PPI; US PPI, jobless claims.

- Friday: Japan M2; Eurozone industrial production; US import prices, U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7043; (P) 0.7090; (R1) 0.7120; More…

AUD/USD’s fall from 0.7660 resumed by breaking through 0.7029 temporary low. Intraday bias is back on the downside. As noted before, such decline is seen as the third third leg of the corrective pattern from 0.8006. Firm break of 0.6955 low will confirm this bearish case and target 0.6756 medium term fibonacci level next. For now, outlook will stay bearish as long as 0.7265 resistance holds, in case of recovery.

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Fall from 0.7660 should be the third leg of this pattern. Break of 0.6966 will target 50% retracement of 0.5506 to 0.8006 at 0.6756. On the upside, break of 0.7660 will revive that case that the correction has already completed at 0.6966.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Mar | 1.20% | 0.90% | 1.20% | |

| 23:50 | JPY | BoJ Monetary Policy Meeting Minutes | ||||

| 02:00 | CNY | Trade Balance (USD) Apr | 51.1B | 51.2B | 47.4B | |

| 02:00 | CNY | Exports (USD) Y/Y Apr | 3.90% | 3.20% | 14.70% | |

| 02:00 | CNY | Imports (USD) Y/Y Apr | -2.00% | -3.00% | -0.10% | |

| 02:00 | CNY | Trade Balance (CNY) Apr | 325.1B | 340B | 301B | |

| 02:00 | CNY | Exports (CNY) Y/Y Apr | 1.90% | 16.40% | 12.90% | |

| 02:00 | CNY | Imports (CNY) Y/Y Apr | -2.00% | -2.90% | -1.70% | |

| 06:45 | EUR | France Trade Balance (EUR) Mar | -11.2B | -10.3B | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence May | -20.8 | -18 | ||

| 12:30 | CAD | Building Permits M/M Mar | 3.40% | 21.00% | ||

| 14:00 | USD | Wholesale Inventories Mar F | 2.30% | 2.30% |