Dollar is trading broadly lower today as markets await FOMC policy decision and press conference. It’s widely expected that Fed would formally announce the schedule of the long-awaited normalization of its USD 4.5T balance sheet. At the June meeting, the Fed revealed the plan to "gradually reduce" its securities holdings by "decreasing its reinvestment of the principal payments" received. More details are awaited as the plan is formalized. Inflation has remained persistently soft despite the upside surprise in the August data. We believe some members would raise concerns that weak price levels might last longer than previously anticipated. There might be downward revisions in the inflation forecast in 2018. Meanwhile, there are some speculations that the Fed might reduce its average Fed funds rates projections. Thus, the so called dot-plot will also be closely watched.

Credit Suisse: BoE hike is a policy mistake

Sterling trades in tight range today as it’s continue to digest recent gains. Retail sales grew strongly by 1.0% mom in August, versus expectation of 0.2% mom. The data adds more case for BoE to finally raise interest rate from 0.25% in November. Indeed, after the hawkish BoE minutes released last week, economists are jumping on the bandwagon of forecasting a BoE hike. Latest comes Credit Suisse. But the investment bank warned that a hike at this point will be a "policy mistake". It pointed out that "the growth threshold required for the BoE to hike looks to have fallen." And, a rate hike in November in the backdrop of weak growth, high-currency-generated inflation but weak wage pressures and uncertainty is likely to be a policy mistake." It further warned that "there is a risk of a non-linear response to the first rate hike in 10 years. A tighter response to an (entirely) externally driven inflation overshoot today runs the risk of a sustained inflation undershoot in the future."

OECD: Nobody is contracting for the first time since 2008

The Organisation for Economic Cooperation and Development released its Interim Economic Outlook today. Global economy is forecast to grow 3.5% in 2017 and 3.7% in 2018. OECD noted that "the upturn has become more synchronised across countries. Investment, employment and trade are expanding." Chief economist Catherine Mann said that "we’ve got some short-term momentum, it’s become broad-based and one way to measure that is to look around the world and see nobody is contracting for the first time since 2008." And she emphasized that "a synchronised upturn is an important signal for businesses to invest."

US growth is forecast to be 2.1% in 2017. OECD warned that shrinking Fed’s huge balance sheet without economic disruption "represent a significant challenge". It emphasized that "To minimize financial market volatility and global spillovers, central banks should opt to reduce their assets gradually and in a predictable way." Eurozone growth is projected to be 2.1% in 2017. UK growth is expected to lag other major economies and be at 1.6% only in 2017, and drop further to 1.0% in 2018, unrevised. OECD warned that "the depreciation of the sterling has modestly improved export prospects but also pushed up inflation, dampening purchasing power and private consumption." China, on the other hand, is expected to grow 6.8% in 2017 and slow to 6.6% in 2018.

New Zealand Election: Change in Government is NZD-Negative in Near-Term

The upcoming New Zealand election would be a tight race between the incumbent National Party and Labor Party. Polls of polls compiled by both RNZ and Stuff indicate that supports for both parties are at around 40%. Moreover, opinion polls have been suggesting that neither of the parties would be able to a government without forming coalition with smaller parties. This is such uncertainty that has increased the volatility of New Zealand dollar of late. This report compares the impacts of various scenarios on the economic growth outlook and the monetary policy, hence the exchange rate. We believe that maintain the status quo – a minority government led by Nationals- would be the most NZD-favorable, while a Labor + Green+ NZ First trio would lead to an immediate, but short-term selloff in the currency. More in New Zealand Election: Change in Government is NZD-Negative in Near-Term.

Elsewhere

Germany PPI rose 0.2% mom, 2.6% yoy in August, above expectation of 0.1% mom, 2.5% yoy. New Zealand current account turned into NZD -0.62b deficit in Q2. Australia Westpac leading indicator dropped -0.1% mom in August. Japan trade surplus widened slightly to JPY 0.37T in August.

GBP/USD Mid-Day Outlook

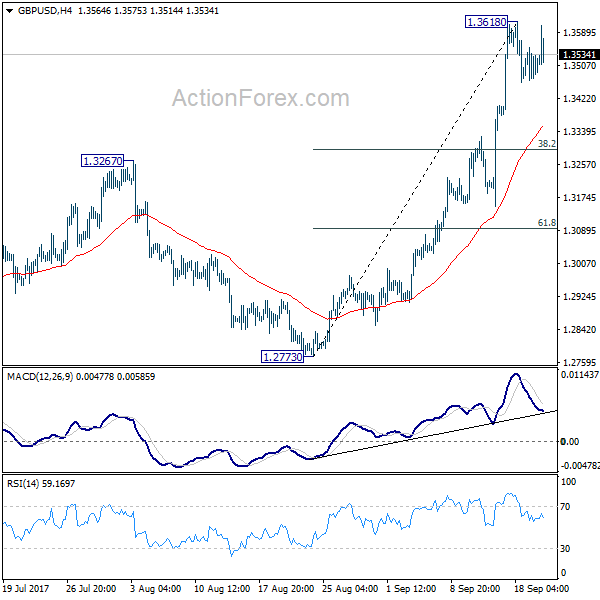

Daily Pivots: (S1) 1.3470; (P) 1.3510; (R1) 1.3553; More….

GBP/USD recovers mildly today but upside is limited below 1.3618 temporary top so far. Intraday bias remains neutral as consolidation could extend with another fall. But downside of retreat should be contained by 38.2% retracement of 1.2773 to 1.3618 at 1.3295 and bring rise resumption. Above 1.3618 will turn bias back to the upside for 1.3835 support turned resistance next. Break there will target 55 month EMA (now at 1.4405).

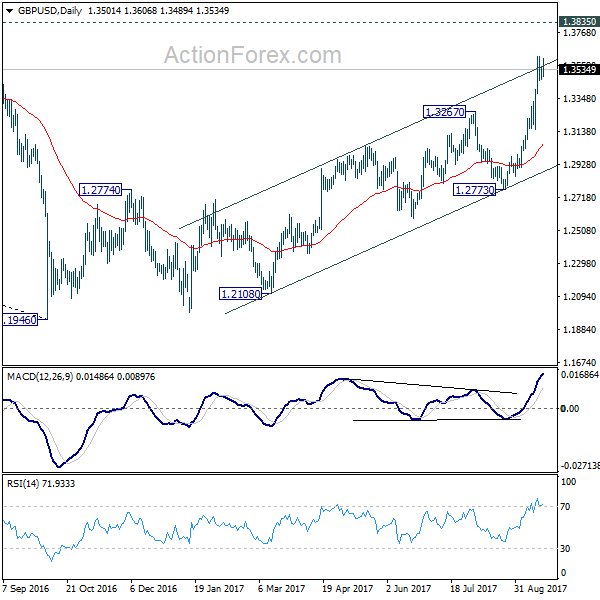

In the bigger picture, the strong break of 1.3444 key resistance now argues that the long term trend in GBP/USD has reversed. That is a key bottom was formed back in 1.1946 on bullish convergence condition in monthly MACD. Current rise from 1.1946 will target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 next. In any case, medium term outlook will now stay bullish as long as 1.2773 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account Balance Q2 | -0.62B | -0.89B | 0.24B | 0.22B |

| 23:50 | JPY | Trade Balance (JPY) Aug | 0.37T | 0.41T | 0.34T | 0.36T |

| 0:30 | AUD | Westpac Leading Index M/M Aug | -0.10% | 0.12% | ||

| 6:00 | EUR | German PPI M/M Aug | 0.20% | 0.10% | 0.20% | |

| 6:00 | EUR | German PPI Y/Y Aug | 2.60% | 2.50% | 2.30% | |

| 8:30 | GBP | Retail Sales M/M Aug | 1.00% | 0.20% | 0.30% | |

| 14:00 | USD | Existing Home Sales Aug | 5.46M | 5.44M | ||

| 14:30 | USD | Crude Oil Inventories | 5.9M | |||

| 18:00 | USD | FOMC Rate Decision | 1.25% | 1.25% | ||

| 18:30 | USD | FOMC Press Conference |