Dollar rises broadly again today but Asian session is a bit quiet with China and Hong Kong on holiday. Selling mainly concentrates on Aussie and Kiwi, with both breaking through last week’s lows. But Euro and Yen are not too far away. Sterling and Canadian are mixed for now. Three central banks will hike interest rates this week and lots of important economic data are featured. Let’s fasten our seat belts.

Technically, Dollar pairs will be the focuses today. Levels to watch include 1.0470 temporary low in EUR/USD, 0.8579 temporary top in USD/CHF, 131.24 in USD/JPY and 1.2879 in USD/CAD. Firm break of these levels together should confirm resumption of broad based rally in Dollar.

In Asia, at the time of writing, Nikkei is down -0.09%. Japan 10-year JGB yield is up 0.0145 at 0.234. Singapore Strait Times is up 0.65%.

ECB de Guindos: July rate hike is possible but not likely

In an interview published on Sunday, ECB Vice President Luis de Guindos reiterated that ECB decided to end asset purchases in Q3. “In my opinion, there’s no reason why this shouldn’t happen in July,” he said.

As for rate hike, “it could be months, weeks or days” after ending the asset purchases. “July is possible, but that’s not to say it’s likely,” he added.

After the first hike, “we are driven by data, not by markets. Markets can sometimes be wrong. Within the Governing Council we haven’t discussed any predetermined path for rate rises.”

Japan PMI manufacturing finalized at 53.5, war and China weigh on confidence

Japan PMI Manufacturing was finalized at 53.5 in April, down from March’s 54.1. Au Jibun Bank said growth in output levels was unchanged as new orders expansion slowed. Factory gate charges were in record rise amid accelerating input prices. Business optimism dipped to lowest since July 2020.

Usamah Bhatti, Economist at S&P Global, said: “Domestic demand was a key driver of growth… but the reintroduction of lockdown restrictions in China hindered international demand. These measures coupled with the fallout from war in Ukraine continued to disrupt supply chains across the sector.

“Delivery delays and price rises remained a dampener… Sharply rising cost burdens pushed Japanese manufacturers to raise selling prices to the greatest extent in the survey history.

“Though still optimistic, Japanese goods producers were increasingly wary of the continued impact of price and supply pressures, and also the impact of the war and extended lockdowns in China. As a result, confidence dipped to the weakest since July 2020.”

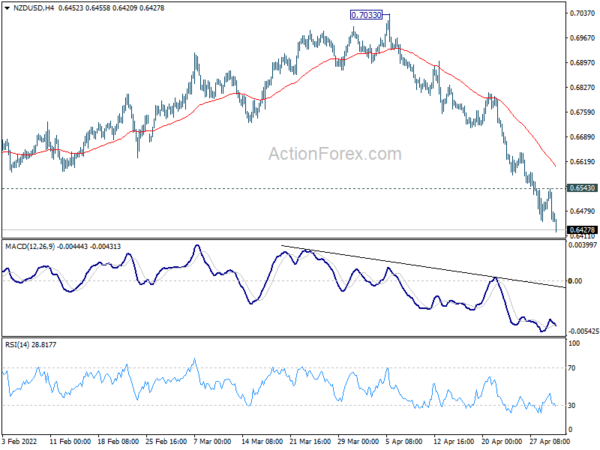

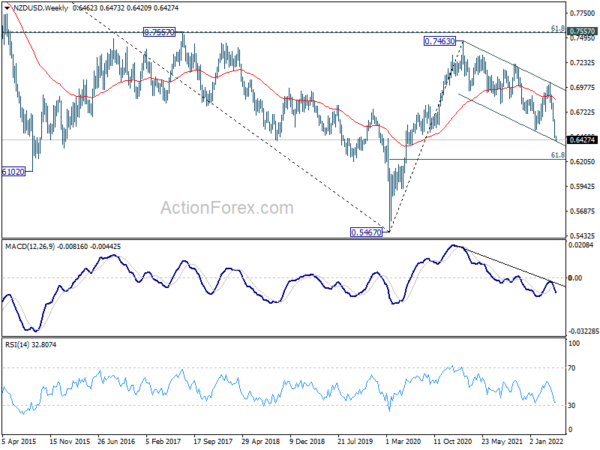

NZD/USD extends down trend, pressing MT channel support

NZD/USD’s decline resumes today and hit as low as 0.6420 so far. The weakness in Kiwi is mainly due to external factors, rather than domestic ones. The economy remains strong while RBNZ is expected to continue with its tightening cycle. But the pace of rate hike would likely be outpaced by Fed’s. Additionally, concerns over China’s slowdown on lockdowns, and general risk-off sentiment are weighing on New Zealand Dollar too.

Immediate focus is now on medium term channel support (now at 0.6430). Sustained break there could prompt further downside acceleration to 61.8% projection of 0.5467 (2020 low) to 0.7463 (2021 high) at 0.6229. Nevertheless, break of 0.6543 minor resistance would be an initial sign of stabilization, and turn bias to the upside for rebound first.

RBA, Fed and BoE to hike; ISMs and NFP watched too

Three central banks will meet this week, including RBA, Fed and BoE. All are expected to raise interest rates. For both RBA and BoE, the focuses will also be on the new economic projections, which should provide an updated path of monetary policies. As for Fed, a 50bps hike is a done deal. The question is whether Fed would hike even more in June by 75bps as priced in by the markets. Fed Chair Jerome Powell is unlikely to drop many hints on that.

It’s also extremely busy on economic data front. In particular, US will release ISMs and non-farm payroll report. Comments from Fed officials after NFP could be the guidance of the June hike. Other data to watch include employment data from New Zealand and Canada. Here are some highlights for the week:

- Monday: Australia AiG manufacturing; Japan PMI manufacturing final, consumer confidence; Germany retail sales; Swiss SECO consumer climate, PMI manufacturing; Eurozone PMI manufacturing final; US ISM manufacturing, construction spending.

- Tuesday: RBA rate decision; Germany unemployment; UK PMI manufacturing; Eurozone PPI, unemployment rate; US factory orders.

- Wednesday: Australia AiG construction, retail sales; New Zealand employment; Germany trade balance; Eurozone PMI services final, retail sales; UK M4 money supply, mortgage approvals; US ADP employment, trade balance, ISM services, FOMC rate decision; Canada trade balance.

- Thursday: Australia trade balance, building approvals; China Caixin PMI services; Swiss CPI; Germany factor orders; UK PMI services final, BoE rate decision. US jobless claims, non-farm productivity.

- Friday: Australia AiG services; Japan Tokyo CPI, monetary base; Swiss unemployment rate, foreign currency reserves; Germany industrial production; UK PMI construction; Canada employment, Ivey PMI; US non-farm payrolls.

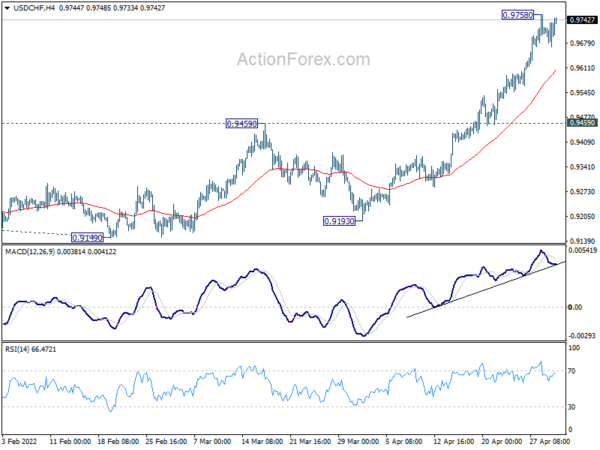

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9692; (P) 0.9714; (R1) 0.9758; More….

Intraday bias in USD/CHF remains neutral for consolidation below 0.9758 temporary top. Deeper retreat could be seen, but downside should be contained well above 0.9459 support to bring another rally. On the upside, break of 0.9758 will resume larger rise to next medium term projection level at 0.9864.

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 100% projection of 0.8756 to 0.9471 from 0.9149 at 0.9864. This will now remain the favored case as long as 0.9459 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Apr | 58.5 | 55.7 | ||

| 00:30 | JPY | Manufacturing PMI Apr F | 53.5 | 53.4 | 53.4 | |

| 05:00 | JPY | Consumer Confidence Index Apr | 33.9 | 32.8 | ||

| 06:00 | EUR | Germany Retail Sales M/M Mar | 0.30% | 0.30% | ||

| 07:00 | CHF | SECO Consumer Climate Q2 | -15 | -4 | ||

| 07:30 | CHF | Manufacturing PMI Apr | 60.2 | 64 | ||

| 07:45 | EUR | Italy Manufacturing PMI Apr | 55.1 | 55.8 | ||

| 07:50 | EUR | France Manufacturing PMI Apr F | 55.4 | 55.4 | ||

| 07:55 | EUR | Germany Manufacturing PMI Apr F | 54.1 | 54.1 | ||

| 08:00 | EUR | Unemployment Mar | 8.40% | 8.50% | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Apr F | 55.3 | 55.3 | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Apr | 108 | 108.5 | ||

| 09:00 | EUR | Eurozone Services Sentiment Apr | 14.2 | 14.4 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Apr | 9.5 | 10.4 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Apr F | -16.9 | -16.9 | ||

| 13:30 | CAD | Manufacturing PMI Apr | 57.9 | 58.9 | ||

| 13:45 | USD | Manufacturing PMI Apr F | 59.7 | 59.7 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 57.5 | 57.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 88.2 | 87.1 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 56.3 | |||

| 14:00 | USD | Construction Spending M/M Mar | 0.80% | 0.50% |