Selloff in Euro accelerates again today, as Germany benchmark 10-year yield tumbles back below 0.8 handle. Swiss Franc and Sterling are also the weaker ones. Australian Dollar is supported by stronger than expected CPI reading, but looks rather vulnerable into US session. Indeed the greenback is probably ready to power up again, including against commodity currencies and even Yen.

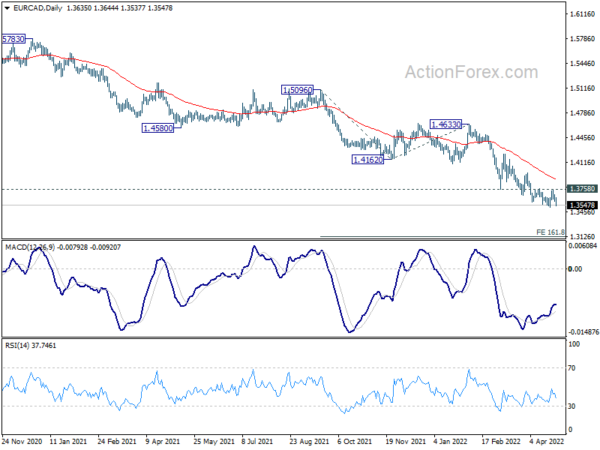

Technically, EUR/CAD will be a focus as it’s heading back to 1.3517 temporary low. Firm break there will resume larger down trend to 161.8% projection of 1.5096 to 1.4162 from 1.4633 at 1.3122. At the same time, break of 1.4687 support in EUR/AUD will also bring retest of 1.4318 low, and solidify Euro’s selloff against commodity currencies.

In Europe, at the time of writing, FTSE is up 0.57%. DAX is up 0.08%. CAC is up 0.26%. Germany 10-year yield is down -0.031 at 0.787. Earlier in Asia, Nikkei dropped -1.17%. Hong Kong HSI rose 0.06%. China Shanghai SSE rose 2.49%. Singapore Strait times dropped -0.04%. Japan 10-year JGB yield rose 0.0026 to 0.250.

US trade deficit widened to USD -125.3B in Mar

US goods exports rose USD 11.4B over the month to USD 169.3B in March. Goods imports rose USD 30.3B to USD 294.6B. Trade deficit came in at USD -125.3B, versus expectation of USD -105.0B.

Wholesale inventories rose2.3% mom to USD 837.7B. Retail inventories rose 2.0% mom to USD 684.3B.

Germany economy ministry cut 2022 GDP growth forecast sharply to 2.2%

Germany’s economy ministry cuts 2022 GDP growth forecast to 2.2%, down from January’s projection of 3.6%. Nevertheless, 2023 GDP growth forecast is upgraded slightly from 2.3% to 2.5%. It expects Russia’s invasion of Ukraine, resulted sanctions and higher energy prices will weigh on output.

Inflation is forecast to be at 6.1% in 2022 and 2.8% in 2023, on rising energy prices and consumer prices.

Germany Gfk consumer sentiment plunged to -26.5, new historic low

Germany Gfk consumer sentiment for May dropped significantly from -15.7 to -26.5, well below expectation of -15.7. That’s the second month of decline, as well as a new historic low.

Looking at some details for April, economic expectations plunged from -8.9 to -16.4. Income expectations dropped from -22.1 to -31.3. Propensity to buy dropped from -2.1 to -10.6.

“The war in Ukraine and rates of high inflation have dealt a severe blow to consumer sentiment. This means that hopes of a recovery from the easing of pandemic-related restrictions have finally been dashed,” explains Rolf Bürkl, GfK consumer expert.

Australia CPI accelerated to 2.1% qoq, 5.1% yoy, highest since 2000

Australia CPI rose 2.1% qoq in Q1, accelerated from Q3’s 1.3% qoq, above expectation of 1.7% qoq. For the 12-month period, CPI accelerated to 5.1% yoy, up from 3.5% yoy, above expectation of 4.6% yoy. RBA trimmed mean CPI also accelerated from 2.6% yoy to 3.7% yoy, above expectation of 3.4% yoy.

Head of Prices Statistics at the ABS, Michelle Marquardt, said “The CPI recorded its largest quarterly and annual rises since the introduction of the goods and services tax (GST) (in 2000)”

“Strong demand combined with material and labour supply disruptions throughout the year resulted in the highest annual inflation for new dwellings since the introduction of the GST. Annual price inflation for automotive fuel was the highest since the 1990 Iraqi invasion of Kuwait.”

Marquardt said: “Annual trimmed mean inflation was the highest since 2009. This reflected the broad-based nature of price rises, as the impacts of supply disruptions, rising shipping costs and other global and domestic inflationary factors flowed through the economy.”

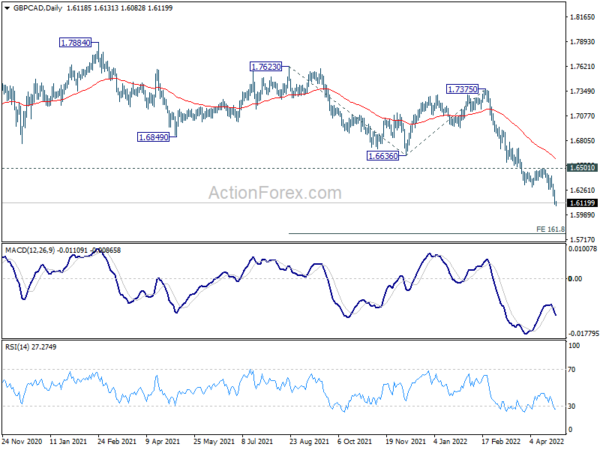

GBP/CAD extending down trend towards 2016 low

GBP/CAD’s down trend continues this week on broad based selloff in Sterling, while Canadian Dollar has been relatively resilient. Current decline should target 161.8% projection of 1.7623 to 1.6636 from 1.7375 at 1.5778. This lies inside key long term support zone between 1.5746 (2016 low) and 1.5875 (2019 low).

The question is whether such 1.5746/5875 support zone would hold. If not, that would firstly mark the resume of the down trend from 2.0971 (2015 high). More importantly, that would also raise the chance of resumption of down trend from 2.5471 (2002 high) through 1.4831 (2010 low).

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0602; (P) 1.0671 (R1) 1.0705; More…

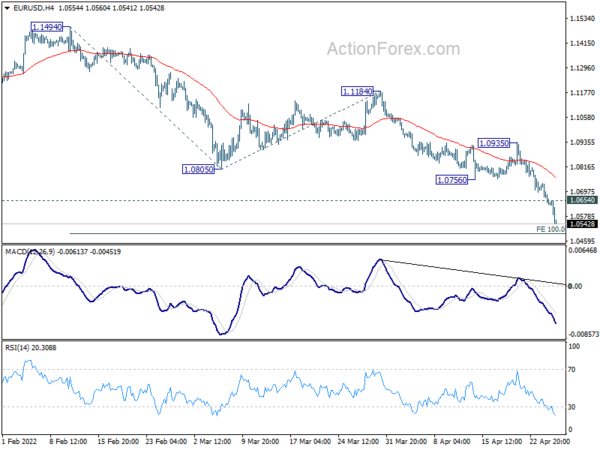

Intraday bias in EUR/USD remains on the downside for 100% projection of 1.1494 to 1.0805 from 1.1184 at 1.0495. Firm break there will pave the way to 161.8% projection at 1.0069. On the upside, above 1.0654 minor resistance will turn bias neutral and bring consolidations. But upside should be limited by 1.0756 support turned resistance to bring fall resumption.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1185 support turned resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1185 will maintain medium term neutral outlook, and extending term range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | CPI Q/Q Q1 | 2.10% | 1.70% | 1.30% | |

| 01:30 | AUD | CPI Y/Y Q1 | 5.10% | 4.60% | 3.50% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q1 | 1.40% | 1.20% | 1.00% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q1 | 3.70% | 3.40% | 2.60% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence May | -26.5 | -15.7 | -15.5 | -15.7 |

| 08:00 | CHF | Credit Suisse Economic Expectations Apr | -51.6 | -27.8 | ||

| 12:30 | USD | Goods Trade Balance (USD) Mar P | -125.3B | -105.0B | -106.6B | |

| 12:30 | USD | Wholesale Inventories Mar P | 2.30% | 2.30% | 2.50% | |

| 14:00 | USD | Pending Home Sales M/M Mar | -1.00% | -4.10% | ||

| 14:30 | USD | Crude Oil Inventories | 0.1M | -8.0M |