Euro surges to highest level since 2015 against Swiss Franc today as boosted by solid improvement in economic sentiments. But the common currency is overwhelmed by Aussie and Kiwi on strong risk appetite. Meanwhile, Sterling also regained ground after the pull back following BoE Governor Mark Carney’s cautious speech yesterday. Dollar is generally softer as markets await FOMC policy decision and press conference tomorrow. In other markets, Gold is gyrating in tight range around 1310 but is vulnerable to another dip to 1300 handle. WTI crude oil is also struggling around 50.

Republicans in last-ditch effort to repeal Obamacare

In US, Senate Republicans are coming back with one last-ditch effort to repeal Obamacare. And they need to act by September 30, using a fast-track procedures. But for the moment, John McCain of Arizona, Rand Paul of Kentucky, Susan Collins of Maine and Lisa Murkowski of Alaska are not offering support yet. Released from US, housing starts dropped to 1.18m annualized rate in August, building permits rose to 1.30m. Import price index rose 0.6% mom. Current account deficit widened to USD -123b in Q2. From Canada, manufacturing shipments dropped -2.6% mom in July.

German ZEW suggests worry of Euro strength has "faded into the background"

German ZEW economic sentiment rose 7 points to 17 in September, well above expectation of 12. While the improvement is notable, it’s staying below historical average of 23.8. Current situation gauge also improved to 87.9, up from 86.7 and beat expectation of 86.3. Eurozone ZEW economic sentiment rose to 31.7, up from 29.3 and beat expectation of 32.4. ZEW president Achim Wambach noted in the statement that ‘the solid growth figures in the second quarter of 2017 in combination with a steep rise in bank lending and increasing investment activities by both the government and private firms are likely reasons for the financial market experts’ significantly more positive outlook compared to that of last month." Also, "the worries about the recent strengthening of the euro have, for now, also faded into the background." Also from Eurozone, Current account surplus widened to EUR 25.1b in July.

ECB may keep QE extension open

Reuters reported, quoting unnamed source, that ECB would likely keep the options of prolonging the asset purchase in 2018 open. There are two camps among ECB policymakers. The hawk are already preferring to wind down the EUR 2.3T program. On the other hand, the doves just prefer to slow down from EUR 60b a month purchase. Meanwhile, the strength of Euro is seen as the "number one problem" for one of the sources. Another source noted that US economic policy is another "main source of uncertainty". Also, ECB President Mario Draghi was very careful in his words and used "recalibration" of the program before. Another source noted that "recalibration is not tapering, it’s open ended".

BoE Kohn warned of impact of monetary stimulus exit

Donald Kohn, a member of the BoE’s Financial Policy Committee, urged global central banks to closely watch the risks of global monetary stimulus exit. Hit said that "macro and micro-prudential policies need to be alert to and anticipate financial stability risks that might arise as rates rise and central bank portfolios stabilize and then decline." He pointed to stress tests" as an "essential tool for spotting risks and building resilience". And that’s particularly as "interest rates rise along the yield curve." "The curve itself may even twist in unexpected ways, revealing vulnerabilities in asset prices and portfolio choices."

BoE Carney talked cautious on rate hikes

Yesterday, BoE Governor Mark Carney sounded cautious in his speech at the IMF. He reiterated that interest rates may rise "within months" in reaction to surging prices. But he emphasized that "any prospective increases in Bank Rate would be expected to be at a gradual pace and to a limited extent". Meanwhile, Carney described Brexit as an example of "deglobalization". And "the de-integration effects of Brexit can be expected… to be inflationary." He pointed out that lower immigration to the UK may boost domestic wage growth. Also, new trade barriers would lead to higher prices for goods and services. Meanwhile, the economic impacts of Brexit are subject to "tremendous uncertainty" in terms of scale and timing.

RBA talked jobs, Aussie, iron and household debt in minutes

The RBA minutes for the September meeting contained little news. Four main areas of discussions include employment situation, Australian dollar, iron prices and the balance of household debt and low inflation. Policymakers acknowledged the improvement in the employment market, noting higher participation rate and steady unemployment rate. RBA appeared less worrisome about Aussie’s strength. By attributing the appreciation of the Australian dollar to USD’s weakness, it appears less likely that RBA would take actions to curb its strength. RBA expected iron ore prices to fall amidst new supply. As the biggest exporter of iron ores, Australian dollar has been affected by the movement in iron ore prices. More in RBA Minutes: More Confident Over Job Market, Less Action Against Rising Aussie.

Also from down under, New Zealand Westpac consumer confidence dropped to 112.4 in Q3. Australia house price index rose 1.9% qoq in Q2.

EUR/CHF Mid-Day Outlook

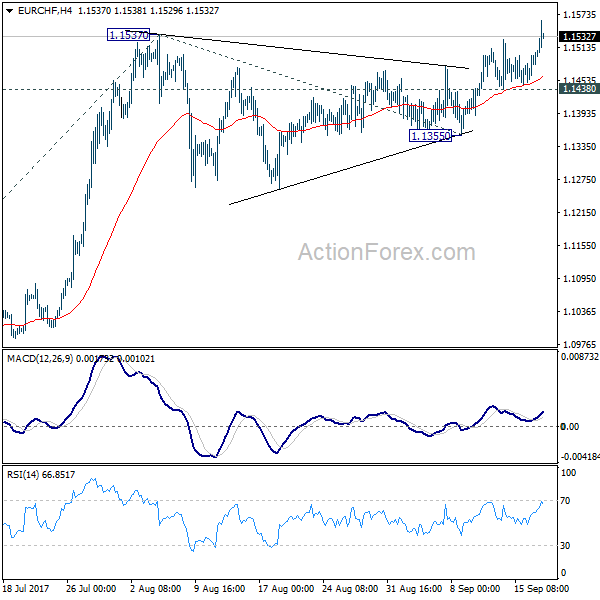

Daily Pivots: (S1) 1.1463; (P) 1.1481; (R1) 1.1516; More… .

EUR/CHF surges to as high as 1.1562 so far today. The break of 1.1537 resistance indicates resumption of medium term rise. Intraday bias is back to the upside for 61.8% projection of 1.0830 to 1.1537 from 1.1355 at 1.1792 next. However, considering weak upside momentum so far, break of 1.1438 will turn focus back to 1.1355 support instead.

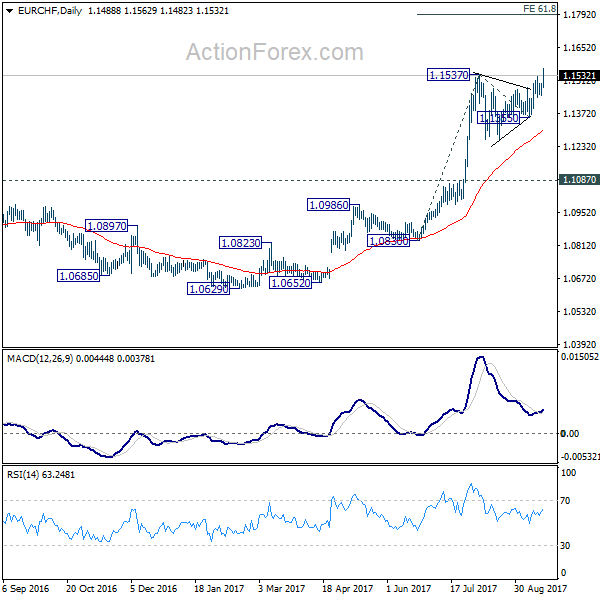

In the bigger picture, long term rise from SNB spike low back in 2015 is still in progress. EUR/CHF should now be heading back to prior SNB imposed floor at 1.2000. For now, this will be the favored case as long as 1.1087 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | Westpac Consumer Confidence Q3 | 112.4 | 113.4 | ||

| 01:30 | AUD | House Price Index Q/Q Q2 | 1.90% | 1.30% | 2.20% | |

| 01:30 | AUD | RBA Meeting Minutes Sep | ||||

| 08:00 | EUR | Eurozone Current Account (EUR) Jul | 25.1B | 22.3B | 21.2B | 22.8B |

| 09:00 | EUR | German ZEW (Economic Sentiment) Sep | 17 | 12 | 10 | |

| 09:00 | EUR | German ZEW (Current Situation) Sep | 87.9 | 86.3 | 86.7 | |

| 09:00 | EUR | Eurozone ZEW (Economic Sentiment) Sep | 31.7 | 32.4 | 29.3 | |

| 12:30 | CAD | Manufacturing Shipments M/M Jul | -2.60% | -0.70% | -1.80% | -1.90% |

| 12:30 | USD | Current Account Balance (USD) Q2 | -123B | -113B | -117B | |

| 12:30 | USD | Housing Starts Aug | 1.18M | 1.18M | 1.16M | 1.19M |

| 12:30 | USD | Building Permits Aug | 1.30M | 1.22M | 1.23M | |

| 12:30 | USD | Import Price Index M/M Aug | 0.60% | 0.40% | 0.10% | -0.10% |