Dollar trades broadly higher overnight together with treasury yields on hawkish comments from Fed officials. The green back remains firm in Asian session today. Though, Aussie remains the strongest one for the week so far, followed by Kiwi. Euro is the worst performing one, followed by Yen and then Swiss Franc.

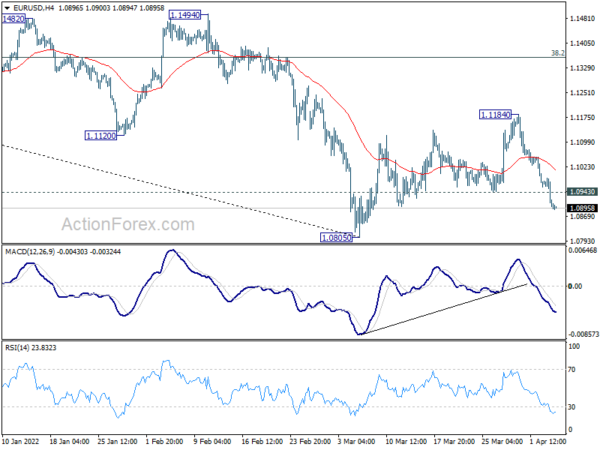

Technically, EUR/USD’s break of 1.0943 support argues that rebound from 1.0805 has completed at 1.1184 as a correction. Larger down trend from 1.2348 might be resuming through 1.0805. At the same time, attention will be on both USD/JPY and EUR/GBP. Break of 125.09 in USD/JPY will affirm the underlying strength in Dollar, as well as benchmark yield too. On the other hand, break of 0.8924 in EUR/GBP will solidify Euro’s weakness, and bring retest of 0.8201 low. But of course, both could happen at the same time.

In Asia, at the time of writing, Nikkei is down -1.63%. Hong Kong HSI is down -1.52%. China Shanghai SSE is down -0.29%. Singapore Strait Times is down -0.49%. Japan 10-year JGB yield is up 0.0217 at 0.233. Overnight, DOW dropped -0.80%. S&P 500 dropped -1.26%. NASDAQ dropped 2.26%. 10-year yield rose 0.144 to 0.2556.

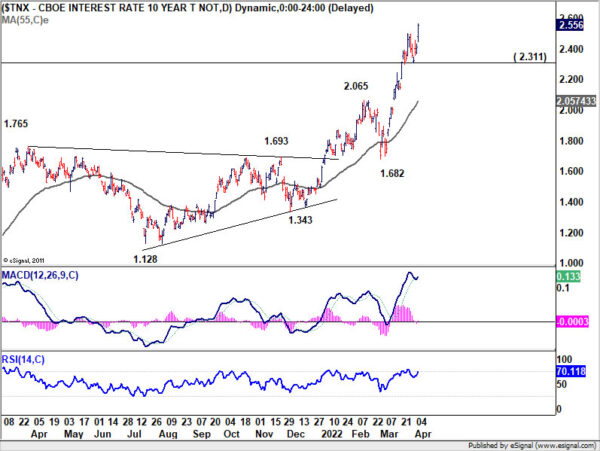

US 10-yr yield breaks 2.5 again as up trend resumes

US 10-year yield resumed recent up trend after hawkish comments from Fed officials, and closed up 0.144 at 2.556. It should be emphasized again that TNX is now facing multi-decade channel resistance, at around 2.6. Rejection by this channel resistance, followed by break of 2.311 support will bring deeper correction, before making the next move.

However, sustained break of the channel resistance will mark the the change of a very long term trend. Further break of 100% projection of 0.398 to 1.765 from 1.343 at 2.710 could trigger rather fierce upside acceleration through 3.248 structural resistance (2018 high).

Brainard: Fed to continue tightening methodically through series of hikes and balance sheet reduction

Fed Governor Lael Brainard said in a speech that FOMC will “continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.”

“Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19,” she added.

“I expect the combined effect of rate increases and balance sheet reduction to bring the stance of policy to a more neutral position later this year, with the full extent of additional tightening over time dependent on how the outlook for inflation and employment evolves,” she said.

Fed George: We might have to go above neutral to bring inflation down

Kansas City Fed President Esther George told Bloomberg that “50 basis points is going to be an option that we will have to consider, along with other things” at the May FOMC meeting.

“We have to be very deliberate and intentional as we remove this accommodation. I am very focused on thinking about how the balance sheet moves in conjunction with policy-rate increases,” she added.

“I think if you just look at where we are today, you might say we will have to go above neutral to bring inflation down,” George said. “But there is a long time between now and the end of the year to see how the economy unfolds.”

ECB Lane: Inflation may peak by mid then than decline in H2

ECB Chief Economist Philip Lane said in an interview with Antenna TV, there are three concerns about the Russian invasion of Ukraine, from view point of the economy, including energy, trade and uncertainty. “The war is a major negative economic issue, but the reopening of the economy gives some momentum. So this year, for example, we should expect the tourist season to be better than last year,” he said.

Lane expected that inflation might peak by “mid-year” but that depends on the war. “Most likely, with the nature of the energy shock, prices will either level off at these high prices or will start to decline”, he added. “But the momentum of inflation will slow down, so we do think that in the second half to the year, as you say, the inflation rate will come down.”

He also emphasized, “unlike the 1970s, these are a few months of high inflation rates. It is not a decade of high inflation rates, and we do think the inflation will fall later this year. So please remember: this inflation is coming from outside, it is not coming from the European economy. This is why we do think it has this special characteristic.”

China PMI composite dropped to 43.9, downward pressure aggravated by several factors

China Caixin PMI Services dropped sharply from 50.2 to 42.0 in March, much worse than expectation of 49.9. That’s also the worst reading since February 2020. PMI Composite dropped from 50.1 to 43.9, also the worst since February 2020.

Wang Zhe, Senior Economist at Caixin Insight Group said: “At present, China is facing the most severe wave of outbreaks since the beginning of 2020. Uncertainty also increased abroad. The outcome of the war between Russia and Ukraine is uncertain, and the commodity market has convulsed. Several factors have aggravated the downward pressure on China’s economy and underscore the risk of stagflation.”

Looking ahead

Germany factory orders, Eurozone PPI and UK PMI construction will be released in European session. Later in the day, Canada will release Ivey PMI. US will publish FOMC minutes.

USD/JPY Daily Outlook

Daily Pivots: (S1) 122.38; (P) 122.66; (R1) 123.06; More…

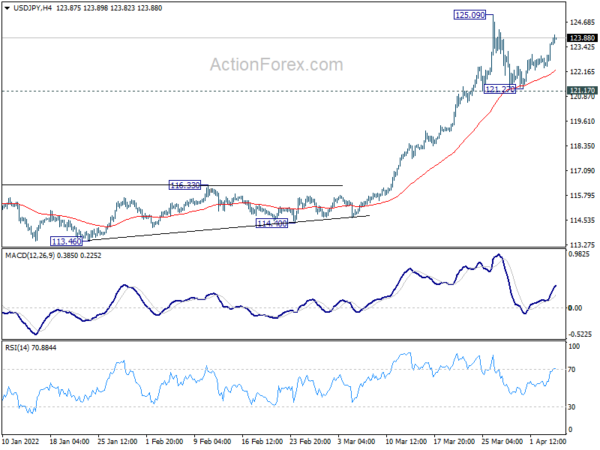

USD/JPY’s rebound from 121.27 continues today but stays below 125.09 high. Intraday bias remains neutral first and more consolidation could still be seen. But outlook remains bullish with 121.17 support intact and further rise is expected. On the upside, break of 125.09 will target 125.85 long term resistance. Firm break pave the way to 130.04 long term projection level. However, break of 121.17 will turn bias back to the downside for deeper pull back.

In the bigger picture, up trend from 98.97 (2016 low) in in progress for retesting 125.85 (2015 high). Sustained break there will confirm long term up trend resumption. Next target will be 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04. This will now remain the favored case as long as 116.34 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Mar | 42.0 | 49.9 | 50.2 | |

| 06:00 | EUR | Germany Factory Orders M/M Feb | -0.20% | 1.80% | ||

| 08:30 | GBP | Construction PMI Mar | 57.3 | 59.1 | ||

| 09:00 | EUR | Eurozone PPI M/M Feb | 1.30% | 5.20% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Feb | 31.60% | 30.60% | ||

| 14:00 | CAD | Ivey PMI Mar | 62.3 | 60.6 | ||

| 14:30 | USD | Crude Oil Inventories | -2.9M | -3.4M | ||

| 18:00 | USD | FOMC Minutes |