Overall, the financial markets are very quiet in Asian session today. Commodity currencies are trading mildly firmer in very while Swiss Franc and Yen are softer. But major pairs and crosses are stuck inside Friday’s range. Gold dips mildly after prior rejection by 1950 and it could be heading back to 1900 handle. WTI crude oil is staying in narrow range above 100, giving little reaction to news that EU is considering fresh sanctions, including gas embargo, on Russia for its intensifying war crimes in Ukraine.

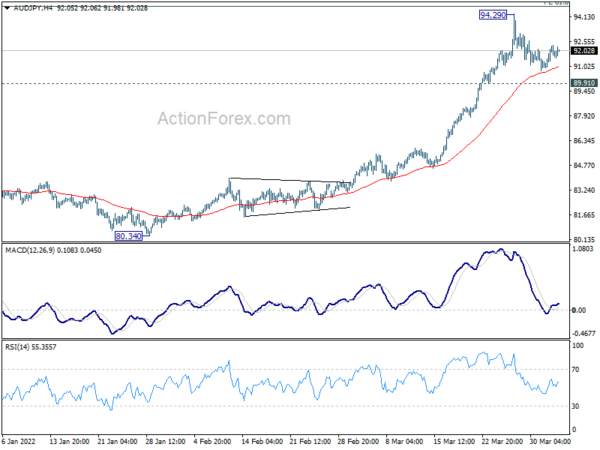

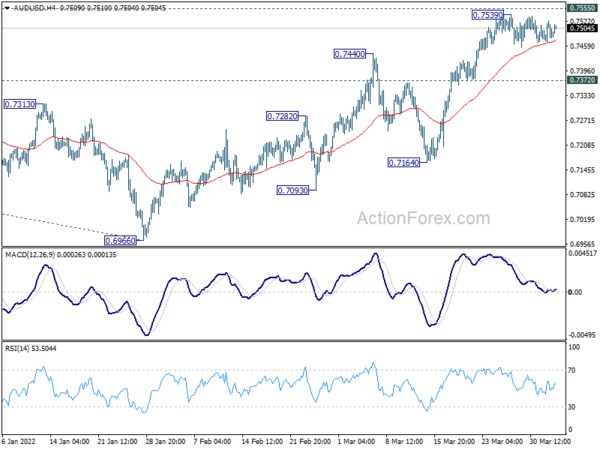

Technically, some attention will be paid to Aussie pairs ahead of tomorrow’s RBA rate decision. AUD/USD consolidating below 0.7539 for now and further rise is expected. Decisive break of 0.7555 resistance would solidify the near term momentum back towards 0.8006 high. AUD/JPY is also holding well above 89.91 minor support as consolidation from 94.29 extends. Further rally is expected through 94.29 at a later stage as larger up trend resumes.

In Asia, at the time of writing, Nikkei is up 0.08%. Hong Kong HSI is up 0.94%. China is on holiday. Singapore Strait Times is up 0.11%. Japan 10-year JGB yield is down -0.0053 at 0.211.

ECB Schnabel: Continuing policy normalization path is appropriate course of action

ECB Executive Board member Isabel Schnabel said in a speech over the weekend, “a considerable part of inflation is likely to prove more persistent, however – to an extent that, without monetary policy adjustment, inflation risks settling above our 2% target over the medium term.”

There are three factors that could make inflations “sticky”. Firstly, strong demand is contributing to rising pipeline pressures. Secondly, supply-side shocks are turning inflationary. Thirdly, wage catch-up is becoming more likely.

She added that continuing the path of policy normalization is “the appropriate course of action.” But, “the speed of normalisation, in turn, will depend on the economic fallout from the war, the severity of the inflation shock and its persistence.”

“We have stressed the importance of optionality and data dependence in our March Governing Council decision: we expect to conclude net asset purchases under our asset purchase programme in the third quarter, as long as the incoming data support the expectation that the medium-term inflation outlook will not weaken. We will hike interest rates some time after, as appropriate in light of incoming data,” Schnabel reiterated.

Fed Daly: The case for 50bps hike has grown

San Francisco Fed President Mary Daly told FT, the case for 50bps rate hike in May has grown. “The case for 50, barring any negative surprise between now and the next meeting, has grown,” she said. “I’m more confident that taking these early adjustments would be appropriate.”

Daly noted the US labor market was “very strong” and “tight to an unsustainable level”.

“If you want a job in the United States, you can get one and you can probably get multiple jobs at this point,” she said. “If you’re an employer looking for workers, it’s hard to both hire them and retain them.”

Fed Williams: Balance sheet reduction can begin as soon in May

New York Fed President John Williams said in a speech that FOMC communicated “two important message” about the likely future course of monetary policy during March meeting, along with the rate hike.

Firstly, it expects that “ongoing increases in the target range will be appropriate” and “the median assessment of the appropriate level of the federal funds rate at the end of next year is expected to be somewhat above the median assessment of its longer-run level”.

Secondly, FOMC expects to “decide at a coming meeting when to begin reducing its holdings of securities”. He added, “I expect that this process of reducing the size of the balance sheet can begin as soon as the May FOMC meeting”.

“These actions should enable us to manage the proverbial soft landing in a way that maintains a sustained strong economy and labor market,” Williams said. “Both are well positioned to withstand tighter monetary policy. In fact, I expect the economy to continue to grow this year and for the unemployment rate to remain close to its current level.”

RBA to stand pat, Fed and ECB to release minutes

RBA will keep interest rate unchanged at 0.10% this week. It’s repeated many times by Governor Philip Lowe that there is room to be patient on rate hikes. Currently the markets are expecting RBA to wait until having Q2 growth and inflation data before acting on rates in August. It’s possible that RBA would act earlier than that, but at least, it will wait for Q1 data. On the central bank front, Fed and ECB will release meeting minutes too.

On the data front, the calendar is relatively light. Eurozone Sentix investor confidence, US ISM services; Canada employment and China Caixin PMI services will catch most attention. Here are some highlights for the week:

- Monday: Germany trade balance; Eurozone Sentix investor confidence; Canada building permits, BoC business outlook survey; US factory orders.

- Tuesday: Australia AiG construction, RBA rate decision; Japan average cash earnings, household spending; France industrial production; Eurozone PMI services final; UK PMI services final; Canada trade balance; US trade balance, ISM services.

- Wednesday: China Caixin PMI services; Germany factory orders; UK PMI construction; Eurozone PPI; Canada Ivey PMI; FOMC minutes.

- Thursday: Australia AiG services, trade balance; Japan leading indicators; Swiss unemployment rate, foreign currency reserves; Germany industrial production; Eurozone retail sales, ECB meeting accounts; US jobless claims.

- Friday: Japan current account, consumer confidence; Canada employment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7474; (P) 0.7499; (R1) 0.7526; More…

Intraday bias in AUD/USD remains neutral for consolidation from 0.7539. Further rally is expected wit h 0.7372 minor support intact. On the upside, decisive break of 0.7555 should confirm that whole corrective decline from 0.8006 has completed at 0.6966. Further rise should then be seen back to retest 0.8005. However, break of 0.7372 will dampen this bullish view and turn bias back to the downside for 0.7164 support instead.

In the bigger picture, correction from 0.8006 could have completed at 0.6966, after drawing support from 0.6991. That is, up trend from 0.5506 (2020 low) might be ready to resume. Firm break of 0.8006 will target 61.8% projection of 0.5506 to 0.8006 from 0.6966 at 0.8511 next. This will remain the favored case as long as 0.7164 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Mar | 7.90% | 7.60% | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Feb | 11.3B | 9.4B | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Apr | -9.7 | -7 | ||

| 12:30 | CAD | Building Permits M/M Feb | 2.30% | -8.80% | ||

| 14:00 | USD | Factory Orders M/M Feb | -0.60% | 1.40% | ||

| 14:30 | CAD | BoC Business Outlook Survey |