Risk appetite continued to drive US indices to new records higher overnight. DOW gained 63.01 points, or 0.28% to close at 22331.35. S&P 500 rose 3.64 points or 0.15% to 2503.87. Both were at new records. 10 year yield also gained 0.027 to 2.229. Traders continue to raise their bet on a December Fed hike, with over 57% chance as indicated by fed fund futures. But the Dollar is not getting much support yet. Markets will have their eyes on tomorrow’s FOMC decision on balance sheet normalization, and the post meeting press conference first. Meanwhile, Sterling and Canadian Dollar are both talked down mildly by respective central bank officials. Yen and also stays weak in risk seeking environment. In other markets, Gold is extending recent pull back and is pressing 1310. WTI crude oil continues to struggle around 50.

Sterling retreats mildly as BoE Carney sounded cautious

Sterling retreats mildly and continues to digest recent sharp gain. BoE Governor Mark Carney sounded cautious in his speech at the IMF overnight. He reiterated that interest rates may rise "within months" in reaction to surging prices. But he emphasized that "any prospective increases in Bank Rate would be expected to be at a gradual pace and to a limited extent". Meanwhile, Carney described Brexit as an example of "deglobalization". And "the de-integration effects of Brexit can be expected… to be inflationary." He pointed out that lower immigration to the UK may boost domestic wage growth. Also, new trade barriers would lead to higher prices for goods and services. Meanwhile, the economic impacts of Brexit are subject to "tremendous uncertainty" in terms of scale and timing.

BoC Lane warned protectionists not to "turn back the clock"

Speaking to a business audience, BoC Deputy Governor Timothy Lane warned that rising protectionism is clouding the outlook of the Canadian economy. He pointed out that "the possibility of a material protectionist shift — particularly regarding the outcome of negotiations on possible changes to NAFTA — is a key source of uncertainty for Canada’s economic outlook." He admitted that some workers were "left behind" because of trade and innovations. But policy makers should help workers in the transitions rather than seeking to "turn back the clock". Regarding recent rate hikes and appreciation of exchange rate, Lane said BoC will be "paying close attention to how the economy responds to both higher interest rates and the stronger Canadian dollar." And, going ahead, "each decision is a live decision". What Lane suggested was not to take a hike at every BoC meeting for granted.

RBA talked jobs, Aussie, iron and household debt in minutes

The RBA minutes for the September meeting contained little news. Four main areas of discussions include employment situation, Australian dollar, iron prices and the balance of household debt and low inflation. Policymakers acknowledged the improvement in the employment market, noting higher participation rate and steady unemployment rate. RBA appeared less worrisome about Aussie’s strength. By attributing the appreciation of the Australian dollar to USD’s weakness, it appears less likely that RBA would take actions to curb its strength. RBA expected iron ore prices to fall amidst new supply. As the biggest exporter of iron ores, Australian dollar has been affected by the movement in iron ore prices. More in RBA Minutes: More Confident Over Job Market, Less Action Against Rising Aussie.

On the data front

New Zealand Westpac consumer confidence dropped to 112.4 in Q3. Australia house price index rose 1.9% qoq in Q2. German ZEW economic sentiment is the main feature in European session. Eurozone will also release current account. Later in the day, US will release housing starts and building permits, current account and import price. Canada will release manufacturing shipments.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3435; (P) 1.3526; (R1) 1.3589; More….

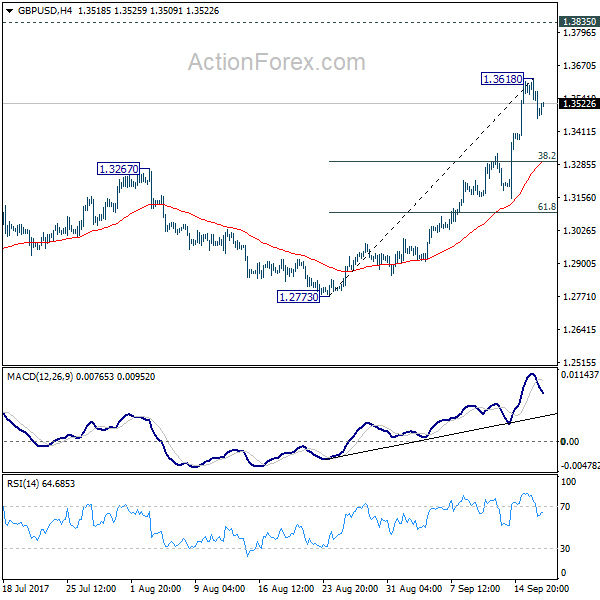

A temporary top is formed at 1.3618 in GBP/USD. Intraday bias is turned neutral for some consolidation first. Downside of retreat should be contained by 38.2% retracement of 1.2773 to 1.3618 at 1.3295 and bring rise resumption. Above 1.3618 will turn bias back to the upside for 1.3835 support turned resistance next. Break there will target 55 month EMA (now at 1.4405).

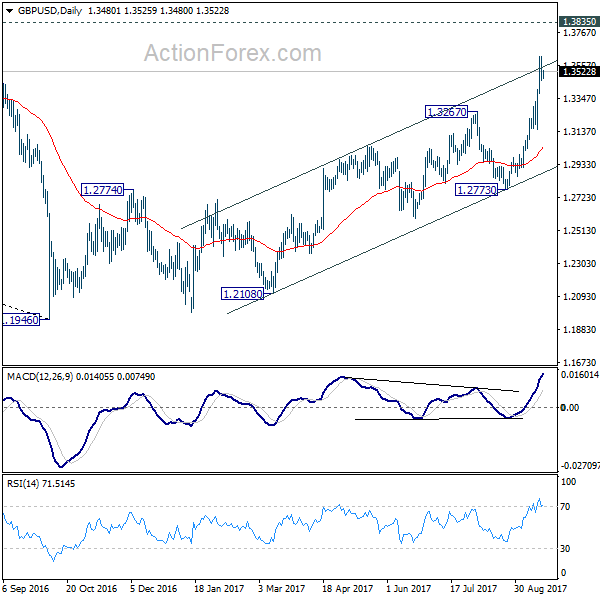

In the bigger picture, the strong break of 1.3444 key resistance now argues that the long term trend in GBP/USD has reversed. That is a key bottom was formed back in 1.1946 on bullish convergence condition in monthly MACD. Current rise from 1.1946 will target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 next. In any case, medium term outlook will now stay bullish as long as 1.2773 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | Westpac Consumer Confidence Q3 | 112.4 | 113.4 | ||

| 1:30 | AUD | House Price Index Q/Q Q2 | 1.90% | 1.30% | 2.20% | |

| 1:30 | AUD | RBA Meeting Minutes Sep | ||||

| 8:00 | EUR | Eurozone Current Account (EUR) Jul | 22.3B | 21.2B | ||

| 9:00 | EUR | German ZEW (Economic Sentiment) Sep | 12 | 10 | ||

| 9:00 | EUR | German ZEW (Current Situation) Sep | 86.3 | 86.7 | ||

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) Sep | 32.4 | 29.3 | ||

| 12:30 | CAD | Manufacturing Shipments M/M Jul | -0.70% | -1.80% | ||

| 12:30 | USD | Current Account Balance (USD) Q2 | -113B | -117B | ||

| 12:30 | USD | Housing Starts Aug | 1.18M | 1.16M | ||

| 12:30 | USD | Building Permits Aug | 1.22M | 1.23M | ||

| 12:30 | USD | Import Price Index M/M Aug | 0.40% | 0.10% |