Yen trades generally lower today in otherwise quiet markets. Euro is trading firmer while Sterling is paring some of last week’s sharp gains. Global markets are generally in risk seeking mode. The MSCI Asia Pacific ex Japan index surged to decade high earlier today. European indices follow with some gains, including FTSE. US futures also suggest that stocks are going to extend the record run. If other markets, gold continues with it’s pull back from recent high at 1362.4 and hits as low as 1314.5 so far. It’s possibly heading back to 1300 handle, which is close to 55 day EMA at 1293.4. WTI crude oil weakens mildly as it struggles to find sustainable buying to stay firm above 50 handle.

The economic calendar is rather light today. Canada international securities transactions rose CAD 23.95b in July. Eurozone CPI was finalized at 1.5% yoy in August, core CPI at 1.2% yoy. UK Rightmove house price dropped -1.2% mom in September. There are a lot of high profile events ahead in the week. BoE Governor Market Carney will speak at IMF in Washing today. RBA will release meeting minutes tomorrow. US President Trump will also address the United Nations. Fed is expected to announce the plan to unwind the balance sheet on Wednesday. UK Prime Minister Theresa will deliver a Brexit speech in Italy on Friday. And there will be general elections in New Zealand and Germany in the coming weekend.

ECB Hansson advocates broader recalibration of monetary policy

ECB Governing Council member Ardo Hansson urged not to have "inordinate focus on the asset purchase program". Instead, he advocates a "somewhat broader recalibration" of monetary policy. He noted that the central has "a range of instruments already under implementation" And, ECB could "in addition bring to the table for consideration". He pointed out that "various refinancing operations and the details of forward guidance could be more precise about interest rates". Hansson also played down the concern over Euro’s strength. He noted that the exchange rate is "well within the historical range". Also, the euro area has a "current accounts surplus of some volume".

Sterling awaits BoE Carney speech

Sterling pares back some gains today as markets await BoE Governor Mark Carney’s speech at IMF in Washington. Traders are rather convinced that a November hike is on the table because a known dove Gertjan Vlieghe turned his stance last Friday and said a rate hike is "approaching". The echoed the surprised BoE minutes that showed most members believe there will be a hike in coming months. Markets will look into Carney’s speech today to further verify such expectations. Nonetheless, it should already be priced in well after the strong surge in Sterling last week. Therefore, any Carney triggered gains could be temporary. The Pound may turn into consolidation to digest recent gains, before getting fresh inspirations from incoming data.

Japan PM Abe will decide on parliament dissolution after September 22

In Japan, it’s report over the weekend that Prime Minister Shinzo Abe will dissolve the Lower House on September 28 and call for a snap election on October. Abe responded to the rumor at Haneda airport as he was departing for United Nations Meetings in New York. Abe said that he’ll "refrain from answering each and every question about a dissolution of parliament". And he will "decide when I return to Japan" on September 22. It’s believed that Abe wants to ride on recent resurgence in his approval rating, for handling of the North Korea tensions. In additional, politic analysts noted that the main opposition Democratic Party is in terrible shape, leaving practically no opposition to Abe.

RBA minutes watched in upcoming Asian session

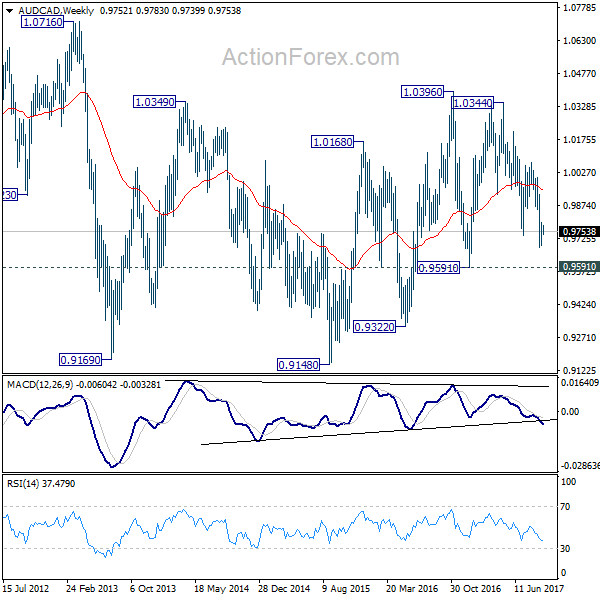

RBA minutes will be a focus in the coming Asian session. The central bank left benchmark interest rate unchanged at 1.50% on September 4 and left the markets with a relatively neutral statement. The minutes would probably just reflect that neutral stance. Nonetheless, attention will still be on any change in tone regarding monetary policies that agrees with the market expectation of a hike as next step in 2018. AUD/CAD has been softer since BoC surprised the markets by two rate hikes this year. Deeper fall is expected in the cross to 09591 key support level in short to medium term. The bearish outlook will remain until RBA becomes more explicitly in its tightening bias.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.79; (P) 110.56; (R1) 111.59; More…

USD/JPY’s rebound from 107.31 continues today and reaches 111.44 so far. Intraday bias remains on the upside for medium term channel resistance (now at 112.91). Sustained break there will argue that whole correction from 118.65 has completed too. In that case, further rise should be seen to 114.49 resistance for confirmation. On the downside, break of 109.54 support is needed to indicate completion of the rebound. Otherwise, outlook will stay cautiously bullish in case of retreat.

In the bigger picture, rise from 98.97 (2016 low) is seen as the second leg of the corrective pattern from 125.85 (2015 high). It’s unclear whether this this second leg has completed at 118.65 or not. But medium term outlook will be mildly bearish as long as 114.49 resistance holds. And, there is prospect of breaking 98.97 ahead. Meanwhile, break of 114.49 will bring retest of 125.85 high. But even in that case, we don’t expect a break there on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Sep | -1.20% | -0.90% | ||

| 09:00 | EUR | Eurozone CPI M/M Aug | 0.30% | 0.30% | -0.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 1.50% | 1.50% | 1.30% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Aug F | 1.20% | 1.20% | 1.20% | |

| 12:30 | CAD | International Securities Transactions (CAD) Jul | 23.95B | 4.46B | -0.92B | |

| 14:00 | USD | NAHB Housing Market Index Sep | 67 | 68 | ||

| 20:00 | USD | Net Long-term TIC Flows Jul | 42.3B | 34.4B |