The tide seems to be turning just ahead of the weekend. Swiss Franc is rebounding notably while Dollar is also firmer up. On the other, Euro reverses earlier gain and trades broadly lower. Nevertheless, Yen’s weakness persists and it’s extending recent decline against the greenback. Commodity currencies are steady, however, while Canadian Dollar has no reaction to stronger than expected retail sales.

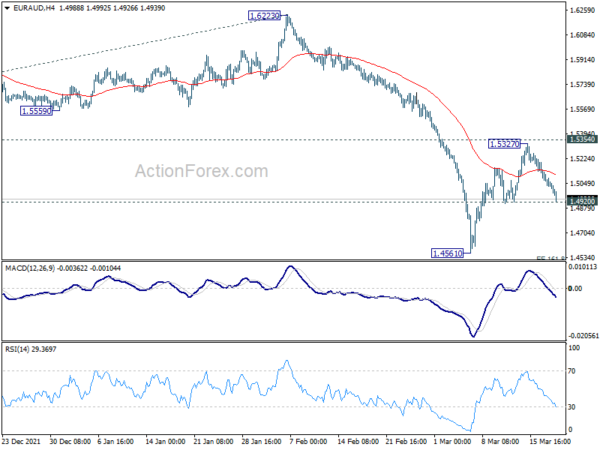

Technically, EUR/USD once again fails to stand above 1.1120 minor resistance and dips. Near term outlook stays bearish downside breakout still in favor. A focus before close is whether EUR/AUD would break through 1.4920 minor support. If happens that would mark the end of the rebound from 1.4561 and should set the stage to resume larger down trend next week.

In Europe, at the time of writing, FTSE is down -0.60%. DAX is down -1.09%. CAC is down -1.11%. Germany 10-year yield is down -0.021 at 0.367. Earlier in Asia, Nikkei rose 0.65%. Hong Kong HSI dropped -0.41%. China Shanghai SSE rose 1.12%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield rose 0.0046 to 0.208.

Canada retail sales rose 3.2% mom in Jan, but to drop -0.5% mom in Feb

Canada retail dales rose 3.2% mom to CAD 58.9B in January, better than expectation of 2.4% mom. The increase was led by higher sales at motor vehicle and parts dealers (+5.3%), as sales at new car dealers (+5.5%) rebounded.

Sales were up in 9 of 11 subsectors, representing 85.5% of retail trade. Core retail sales—which exclude gasoline stations and motor vehicle and parts dealers—increased 2.9%.

In the advance estimate, retail sales dropped -0.5% mom in February.

Fed Bullard explains voting for 50bps hike this week

In a statement, St. Louis Fed President James Bullard explained by he voted for a 50bps rate hike on March 16 FOMC meeting, instead of 25bps. Additional, in the Summary of Economic Projections, he penciled in more rate hikes to 3% this year.

“The combination of strong real economic performance and unexpectedly high inflation means that the Committee’s policy rate is currently far too low to prudently manage the U.S. macroeconomic situation,” he said. “Moreover, U.S. monetary policy has been unwittingly easing further because inflation has risen sharply while the policy rate has remained very low, pushing short-term real interest rates lower. The Committee will have to move quickly to address this situation or risk losing credibility on its inflation target.”

Bullard also compared to what Fed did back in 1994 and 1995, where FOMC “made a similar discrete adjustment to the policy rate to better align it with the macroeconomic circumstances at that time”. And, the results were excellent”.

Eurozone exports rose 18.9% yoy in Jan, imports rose 44.3% yoy

Eurozone goods exports rose 18.9% yoy to EUR 199.5B in January. Imports rose 44.3% yoy to EUR 226.7B. Trade deficit reached EUR -27.2B. Intra Eurozone trade rose 24.2% yoy to EUR 192.3B.

In seasonally adjusted terms, exports rose 3.4% mom to EUR 220.3B. Imports rose 2.3% mom to 228.0B. Trade deficit narrowed from EUR -9.7B to EUR -7.7B. Intra-Eurozone trade dropped from EUR 202.0B to EUR 198.7B.

BoJ stands pat, extremely high uncertainties surrounding impact from Ukraine

BoJ kept monetary policy unchanged as widely expected today. Under the yield curve control frame work, short-term policy interest rate is held at -0.10%. As for long-term interest rate, BoJ will continue to purchases JGBs, without upper limit, to maintain 10-year JGB yield at around 0%. The decision was made by 8-1 vote, with Goushi Kataoka dissented again, preferring to strength monetary easing.

In the accompany statement, BoJ said the “economy has picked up as a trend, although some weakness has been seen in part”. Exports and industrial production “have continued to increase as a trend, despite the remaining effects of supply-side constraints.”

Core inflation is “likely to increase clearly in positive territory for the time being due to a significant rise in energy prices, a pass-through of raw material cost increases, and dissipation of the effects of the reduction in mobile phone charges”.

BoJ also said, “there are extremely high uncertainties over how the situation surrounding Ukraine will affect Japan’s economic activity and prices, mainly through developments in global financial and capital markets, commodity prices, and overseas economies.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 118.30; (P) 118.67; (R1) 118.96; More…

USD/JPY’s rally resumes after brief consolidations and intraday bias is back on the upside. Current up trend should target 100% projection of 109.11 to 116.34 from 114.40 at 121.63 next. On the downside, below 118.35 will turn intraday bias neutral again and bring retreat. But downside should be contained above 116.34 resistance turned support to bring another rally.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Sustained break of 118.65 (2016 high) will pave the way to 125.85 (2015 high) and raise the chance of long term up trend resumption. This will remain the favored case as long as 113.46 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Feb | 0.60% | 0.60% | 0.20% | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jan | -0.70% | -1.00% | 0.40% | |

| 09:00 | EUR | Italy Trade Balance (EUR) Jan | -5.05B | 3.05B | 1.10B | |

| 10:00 | EUR | Eurozone Trade Balance(EUR) Jan | -7.7B | -4.6B | -9.7B | |

| 12:30 | CAD | Retail Sales M/M Jan | 3.20% | 2.40% | -1.80% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | 2.50% | 2.30% | -2.50% | |

| 13:30 | CAD | New Housing Price Index M/M Feb | 1.10% | 0.60% | 0.90% | |

| 15:00 | USD | Existing Home Sales Feb | 6.18M | 6.50M |