The financial markets are generally staying in tight range in Asian session today as traders await the heavy-weight events later in the week. US equities ended mixed overnight with DJIA closed down -22.5 pts, or -0.1% at 20881.48. S&P 500, on the other hand, gained 0.87 pts, or 0.04%, to close at 2373.47. Treasury yields also rose with 30 year yield gained 0.023 to close at 3.192. Meanwhile, 10 year yield gained 0.026 to close at 2.608. But both are limited below recent resistance at 3.197 and 2.621 respectively. Gold is trying to regain 1200 handle for the moment. WTI crude oil turned sideway after breaching 48 handle briefly. Dollar index is trying to draw support from 55 day EMA and is trading at 101.40 at the time of writing. Forex pairs are all trading inside Monday’s range.

House of Commons Passed Brexit Bill

In UK, Sterling trades lower as this week’s recovery lost steam. The Parliament passed the bill allowing Prime Minister Theresa May to trigger Article 50 for Brexit negotiation. The House of Commons overturned the amendments of the House of Lords, including the guaranteed rights for EU citizens staying in UK, and a vote by the Parliament on the final Brexit agreement. Brexit Secretary David Davis said that "Parliament has today backed the Government in its determination to get on with the job of leaving the EU and negotiating a positive new partnership with its remaining member states." May will address the House of Commons today. Some expect May to wait until the end of the month to trigger Brexit. But there are speculations that May could announce it this week.

Staying in UK, Scottish First Minister Nicola Sturgeon confirmed that she would ask for permission to hold a second independence referendum. PM May warned that the move would set Scotland on a course for "more uncertainly and division" as the majority of Scottish people do not want a second vote. As May noted, "the tunnel vision that SNP has shown today is deeply regrettable… Instead of playing politics with the future of our country, the Scottish government should focus on delivering good government and public services for the people of Scotland. Politics is not a game".

Dutch to Vote on March 15

Elsewhere in Europe, the Netherlands’ general election would be held on March 15. With fractured political environment, no party is expected to gain a majority. And it’s expected that as many as five parties could be needed to form the coalition even though the Liberals are tipped to secure a majority of votes. Nonetheless, firstly, with rising popularity of the far-right candidate Geert Wilders, leader of the Party of Freedom, the market is concerned his victory would intensify anti-EU/euro debates. Secondly, the result of the Dutch election is another indicator of populism in Europe and is seen as a precursor to French elections in April and May.

Fed to revise median "dot plot"

On the other side of the Atlantic, markets are awaiting the FOMC rate decision on Wednesday. The Fed is 99.99% certain to increase the policy rate by 25 bps. The is seen as driven by improvement in the economic outlook with the employment and inflation data showing that the Fed is on the way to achieve its dual mandate. We expect the policy statement to sound more upbeat and point to faster rate hike this year. Fed fund futures are pricing in 64% chance of another hike by June. The point of interests will be on economic projections and in particular the median "dot plot" rate path. Back in December, Fed projected interest rate to hit 1.4% by the end of 2017 and 2.1% by end of 2018. Upward revision in these two figures would fuel rally in Dollar.

On the data front…

China has released just now that industrial production expanded 6.3% yoy in the first two months of the year, up from consensus of 6.1% and December’s 6%. Urban fixed asset investment (FAI) grew 8.9% yoy during the period, beating consensus of 8.3% and 8.1% previously. However, the growth of retail sales moderated to 9.5% yoy, from 10.4% in December. The market had anticipated stronger growth of 10.6%. For the day ahead, US PPI probably eased to 0.1% mom in February, from 0.6% a month ago, while the core reading slowed to 0.2%, from 0.4% previously. In the Eurozone, industrial production probably expanded 1.2% mom in January, after a -1.6% contraction in the prior month. On the sentiment data, the ZEW economic sentiment index for Germany probably added 1.6 points to 12 in March, while the current situation index added 2.2 points to 78 this month.

GBP/USD Daily Outlook

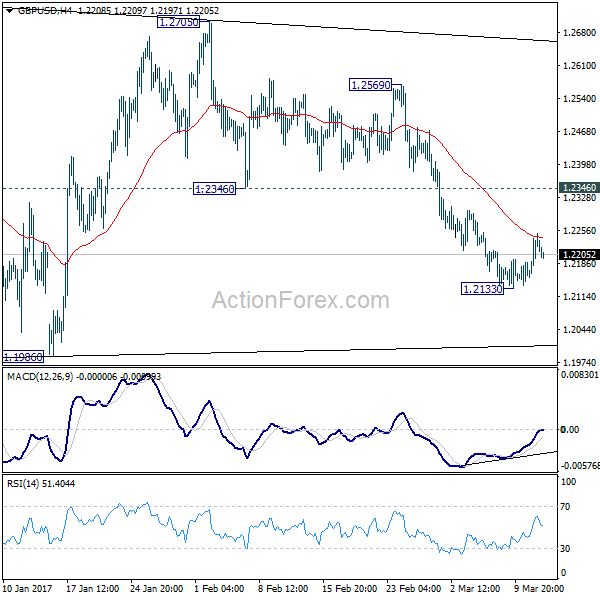

Daily Pivots: (S1) 1.2159; (P) 1.2205; (R1) 1.2263; More…

GBP/USD’s recovery from 1.2133 was limited by 4 hour 55 EMA and weakens mildly today. Intraday bias stays neutral first as the consolidation could extend. Another recovery cannot be ruled out but upside should be limited by 1.2346 support turned resistance and bring fall resumption. As noted before, consolidation pattern from 1.1946 is completed at 1.2705 is resuming larger down trend. On the downside, below 1.2133 will turn bias to the downside for retesting 1.1946/86 support zone. Break of 1.1946 will confirm our bearish view. However, sustained break of 1.2346 will dampen out view and turn focus back to 1.2569 resistance first.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | NAB Business Confidence Feb | 7 | 10 | ||

| 2:00 | CNY | Industrial Production YTD Y/Y Feb | 6.30% | 6.10% | 6.00% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Feb | 8.90% | 8.30% | 8.10% | |

| 2:00 | CNY | Retail Sales YTD Y/Y Feb | 9.50% | 10.60% | 10.40% | |

| 7:00 | EUR | German CPI M/M Feb F | 0.60% | 0.60% | ||

| 7:00 | EUR | German CPI Y/Y Feb F | 2.20% | 2.20% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 1.20% | -1.60% | ||

| 10:00 | EUR | German ZEW (Economic Sentiment) Mar | 12 | 10.4 | ||

| 10:00 | EUR | German ZEW (Current Situation) Mar | 78 | 76.4 | ||

| 10:00 | EUR | Eurozone ZEW (Economic Sentiment) Mar | 19.3 | |||

| 12:30 | USD | PPI M/M Feb | 0.10% | 0.60% | ||

| 12:30 | USD | PPI Y/Y Feb | 1.60% | |||

| 12:30 | USD | PPI Core M/M Feb | 0.20% | 0.40% | ||

| 12:30 | USD | PPI Core Y/Y Feb | 1.20% |