Market sentiment stabilized a bit on reports that Russia a suggests to hold another round of peace talks with Ukraine, while Vladimir Putin’s forces continue to shell multiple crowded Ukrainian cities. Stocks are recovery but remain vulnerable to more selloff. In the currency markets, Swiss Franc is paring some gains but remains the strongest one for the week. Euro is staying under tremendous pressure. Canadian Dollar is mixed, awaiting BoC rate hike. In other markets, Gold is dipping mildly after rally stalled at around 1950. WTI crude oil continues to march higher towards 115 handle.

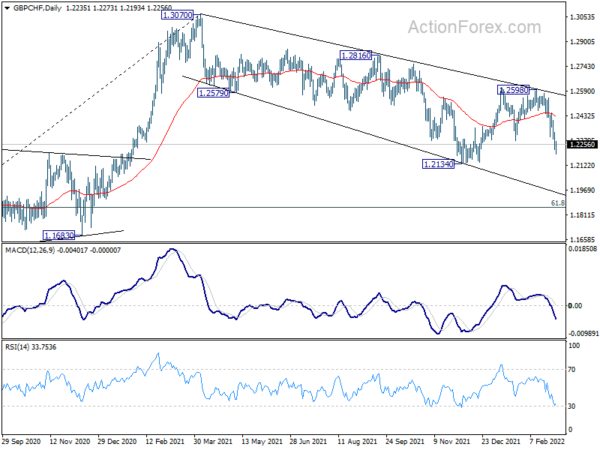

Technically, Sterling is not performing much better than Euro. GBP/CHF’s fall from 1.2598 is accelerating towards 1.2134 support. Break there will resume larger down trend from 1.3070. That, if happens, could be accompanied by a break of 1.3158 low in GBP/USD and 148.94 support in GBP/JPY.

In Europe, at the time of writing, FTSE is up 0.67%. DAX is up 0.11%. CAC is up 0.47%. Germany 10-year yield is up 0.0058 at -0.015. Earlier in Asia, Nikkei dropped -1.68%. Hong Kong HSI dropped -1.84%. China Shanghai SSE dropped -0.13%. Singapore Strait Times dropped -1.04%. Japan 10-year JGB yield dropped -0.0474 to 0.134.

US ADP jobs grew 475k in Feb, hiring remains robust but capped up labor supply

US ADP private employment grew 475k in February, above expectation of 320k. By company size, small businesses lost -96k jobs, medium added 18k while large businesses added 522k. By sector goods-producing jobs rose 57k and service-providing jobs rose 417k.

“Hiring remains robust but capped by reduced labor supply post-pandemic. Last month large companies showed they are well-poised to compete with higher wages and benefit offerings, and posted the strongest reading since the early days of the pandemic recovery,” said Nela Richardson, chief economist, ADP. “Small companies lost ground as they continue to struggle to keep pace with the wages and benefits needed to attract a limited pool of qualified workers.”

ECB de Guindos: Global financial exposure to Russia somewhat limited

European Central Bank (ECB) Vice President Luis de Guindos said, “invasion of Ukraine by Russia will have an impact on the economy in the eurozone, will also have an impact on inflation.”

“Global financial exposure to Russia is somewhat limited,” he said. “Most significant risks are energy shocks.”

De Guindos also said the Eurozone inflation data in February has been a “negative surprise”.

Eurozone CPI rose to new record 5.8% yoy in Feb

Eurozone CPI accelerated from 5.1% yoy to 5.8% yoy in February, well above expectation of 5.3% yoy. That’s also a new record high. Core CPI also rose from 2.3% yoy to 2.7% yoy, above expectation of 2.5% yoy.

Energy is expected to have the highest annual rate in February (31.7%, compared with 28.8% in January), followed by food, alcohol & tobacco (4.1%, compared with 3.5% in January), non-energy industrial goods (3.0%, compared with 2.1% in January) and services (2.5%, compared with 2.3% in January).

Australia GDP grew 3.4% qoq in Q4, no material impact from Omicron

Australia GDP grew 3.4% qoq in Q4, above expectation of 2.9% qoq. Real net national disposable income rose 1.7%. Terms of trade fell -5.1%. GDP in the December quarter 2021 was 3.4% above December 2019 pre-pandemic levels. The emergence of the Omicron variant over the second half of December 2021 did not have a material impact on activity this quarter.

From New Zealand, terms of trade index dropped -1.0% in Q4, below expectation of 0.9%. building permits dropped -9.2% mom in January.

From Japan, capital spending rose 4.3% in Q4, above expectation of 2.9%. Monetary base rose 7.6% yoy in February, below expectation of 8.6% yoy.

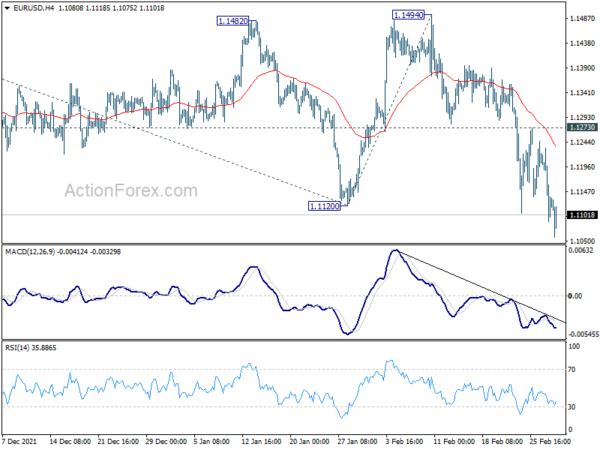

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1065; (P) 1.1149; (R1) 1.1208; More…

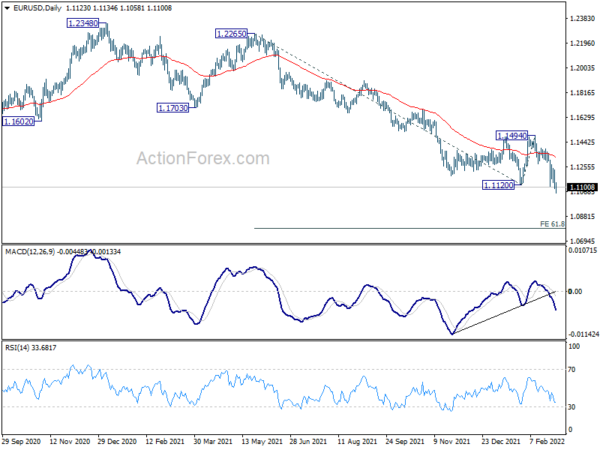

Intraday bias in EUR/USD remains on the downside at this point. Current fall is part of the down trend from 1.2348. Next target is 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786. On the upside, break of 1.1273 resistance is needed to be the first sign of bottoming. Otherwise, outlook stays bearish in case of recovery.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Jan | -9.20% | 0.60% | 0.40% | |

| 21:45 | NZD | Terms of Trade Index Q4 | -1.00% | 0.90% | 0.70% | 0.40% |

| 23:50 | JPY | Capital Spending Q4 | 4.30% | 2.90% | 1.20% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | 7.60% | 8.60% | 8.40% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | 1.80% | 1.50% | ||

| 00:30 | AUD | GDP Q/Q Q4 | 3.40% | 2.90% | -1.90% | |

| 08:55 | EUR | Germany Unemployment Change Feb | -33K | -23K | -48K | |

| 08:55 | EUR | Germany Unemployment Rate Feb | 5.00% | 5.10% | 5.10% | |

| 10:00 | EUR | Eurozone CPI Feb P | 5.80% | 5.30% | 5.10% | |

| 10:00 | EUR | Eurozone CPI Core Feb P | 2.70% | 2.50% | 2.30% | |

| 13:15 | USD | ADP Employment Change Feb | 475K | 320K | -301K | |

| 15:00 | CAD | BoC Interest Rate Decision | 0.50% | 0.25% | ||

| 15:30 | USD | Crude Oil Inventories | 2.5M | 4.5M | ||

| 19:00 | USD | Fed’s Beige Book |