Russia’s invasion of Ukraine remain the dominant theme in the markets, and Euro and Sterling stay pressured as a result. Swiss Franc is the biggest winner for now on safe haven flow, but Aussie and Yen are also supported. On the other hand, Dollar is dragged down by the steep fall in treasury yield overnight. Canadian Dollar is mixed and BoC rate hike is unlikely to give it much boost. In other markets, WTI crude oil surged again and breached 110 handle. Gold is staying firm above 1900 for now, but still lacks follow through buying. Asian stocks are weak, following the selloff in US overnight.

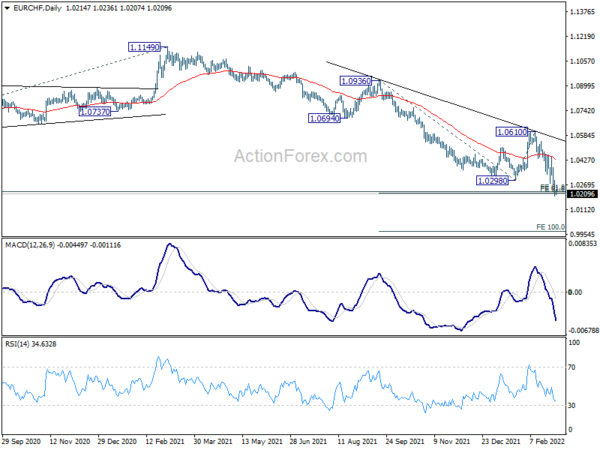

Technically, EUR/CHF is now pressing 61.8% projection of 1.0936 to 1.0298 from 1.0610 at 1.0216. Sustained break of this level could prompt downside acceleration to 100% projection at 0.9972, i.e. below parity. If that happens, the selloff could easily be spread to some other pairs, including EUR/USD, EUR/JPY, EUR/CAD and EUR/AUD.

In Asia, Nikkei closed down -1.68%. Hong Kong HSI is down -1.23%. China Shanghai SSE is down -0.21%. Singapore Strait Times is down -0.58%. Japan 10-year JGB yield is down -0.0431 at 0.138. Overnight, DOW dropped -1.76%. S&P 500 dropped -1.55%. NASDAQ dropped -1.59%. 10-year yield dropped -0.132 to 1.707.

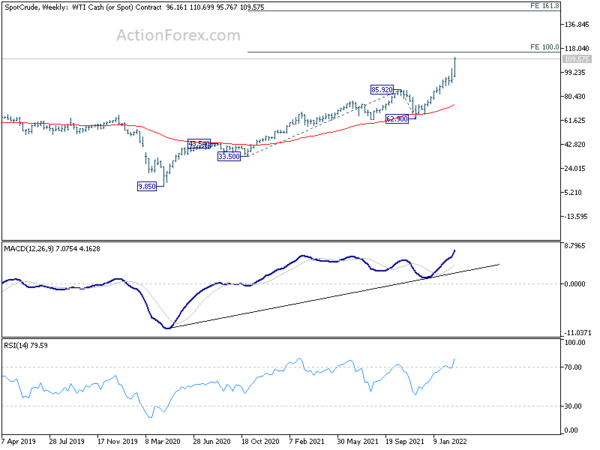

WTI oil breaks 110 on upside acceleration, heading to 147?

Oil price surged to highest level since 2014 on concern of supply disruptions related to Russia invasion of Ukraine. The International Energy Agency’s 31 member countries have just agreed to release 60 million barrels of oil from their strategic reserves. But that’s apparently not enough to calm the markets.

WTI crude oil accelerated sharply to as high as 110.69 so far. Technically, further rise is expected as long as 102.19 resistance turned support holds. Next target is 100% projection of 33.50 to 85.92 from 62.90 at 115.32.

It’s still early to say. But is should be noted that fear driven moves in commodity markets could be extremely powerful. Just remember oil price was negative less than two years ago. So, decisive break of 115.32 could easily prompt more acceleration to 161.8% projection at 147.71, in rather quick manner.

Fed Mester: Russia invasion adding upside risk to inflation, downside risk to growth

Cleveland Fed President Loretta Mester said yesterday that Russia’s invasion of Ukraine could push inflation up higher. “The unfolding event has implications for the economic outlook, adding upside risk to inflation even as it puts downside risks to the growth forecast,” she said.

“The challenge facing Fed policymakers is how to recalibrate monetary policy, reducing the accommodation from the emergency levels needed earlier in the pandemic in order now to get inflation under control and at the same time sustain the expansion and maintain healthy labor markets,” Mester added.

BoE Saunders prefers to move rates quite quickly towards neutral

BoE MPC member Michael Saunders said yesterday, “the economy is in significant excess demand, and inflation expectations are not as well anchored as I would like.”

“My preference is to move quite quickly towards a more neutral stance in order to prevent the recent trend of higher inflation expectations and rising pay growth from becoming more firmly embedded,” he said.

However, he emphasized that his vote for 50bps hike in February “does not necessarily imply that I would vote for a 50 basis-point hike in the event that further tightening is required.”

” All else equal, the case for policy to move in a larger step probably is greater when Bank Rate is clearly further away from the approximate level that, if maintained, would return inflation to target and keep it there,” he added.

BoE Mann: Embedded inflation becomes a domestic problem

BoE MPC member Catherine Mann said yesterday, “we already have very rapid increase in oil prices… In the U.K., that it becomes embedded by virtue of the institution mechanism of the price cap” on domestic energy bills.

“That embeddedness becomes a domestic inflationary problem that we have to deal with on the monetary policy stage,” she said.

“You only get inflation if businesses raise their prices. That’s where it comes from. It doesn’t come from wage settlements. It comes from businesses’ capacity to raise their prices in a systematic way and sustain demand,” she said.

SNB Zurbruegg: Important to keep rate differential to avoid excessive Franc appreciation

SNB Vice Chairman Fritz Zurbruegg said in a l’agefi interview, “Switzerland has always had lower rates than others since the financial crisis. It is very important for us to keep this differential to avoid an excessive appreciation of the Swiss franc.”

“As soon as the situation requires it, we’ll raise our interest rate,” he said. But, “we’ll keep this ability to intervene in foreign exchange markets if needed to ensure price stability.”

“Experience has shown that having some leeway within the range we associate with price stability has worked well in the past in Switzerland,” he added. “We are a small, open economy with capital flows linked to our safe-haven status. We cannot always achieve a precise target and inflation can fluctuate in the short term because we aim for the medium term.”

Australia GDP grew 3.4% qoq in Q4, no material impact from Omicron

Australia GDP grew 3.4% qoq in Q4, above expectation of 2.9% qoq. Real net national disposable income rose 1.7%. Terms of trade fell -5.1%. GDP in the December quarter 2021 was 3.4% above December 2019 pre-pandemic levels. The emergence of the Omicron variant over the second half of December 2021 did not have a material impact on activity this quarter.

From New Zealand, terms of trade index dropped -1.0% in Q4, below expectation of 0.9%. building permits dropped -9.2% mom in January.

From Japan, capital spending rose 4.3% in Q4, above expectation of 2.9%. Monetary base rose 7.6% yoy in February, below expectation of 8.6% yoy.

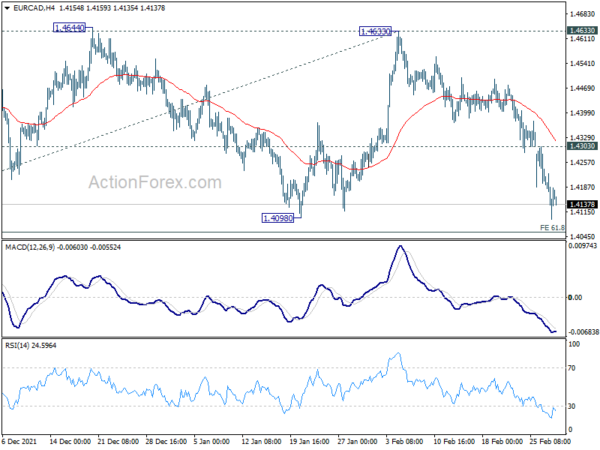

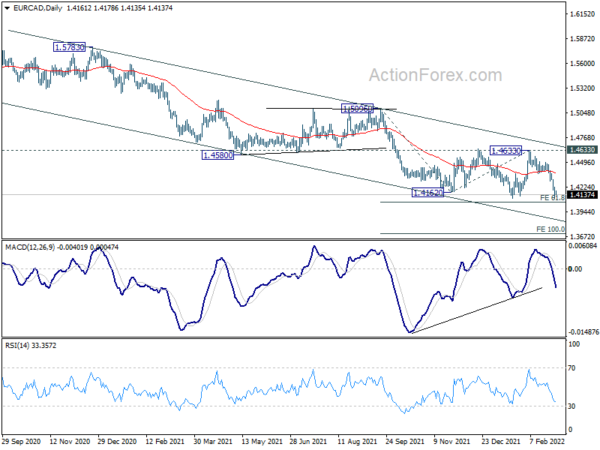

BoC to hike, EUR/CAD breaking to the downside

BoC is widely expected to raise interest rate by 25bps to 0.50% today to kick start the tightening cycle. The central bank might also announce the plan to shrink its balance sheet. Overall tone of the statement should remain hawkish, setting the stages for more rate hikes ahead. Some analysts are expecting the policy rate to hit 1.25% by the end of the year.

Some previews on BoC

- Bank of Canada to start rate hike cycle

- BOC Preview: Will the Bank of Canada be the Next Central Bank to Liftoff?

- Currency Pair of the Week: USD/CAD

- Bank of Canada Rate Hike Expected Despite Geopolitical Turbulence

EUR/CAD’s down trend is trying to resume by breaking through 1.4098 low. But that’s more due to Euro’s broad based selloff than Canadian’s strength. Key level lies in 61.8% projection of 1.5096 to 1.4162 from 1.4633 at 1.4056. Sustained break there could prompt downside acceleration to 100% projection at 1.3699.

Above 1.4303 minor resistance will delay the bearish case and bring some consolidations. But outlook will remain bearish as long as 1.4633 resistance holds.

Looking ahead

Germany unemployment and Eurozone CPI flash will be featured in European session. In addition to BoC rate decision, US will release ADP employment and Fed’s Beige Book report.

GBP/JPY Daily Outlook

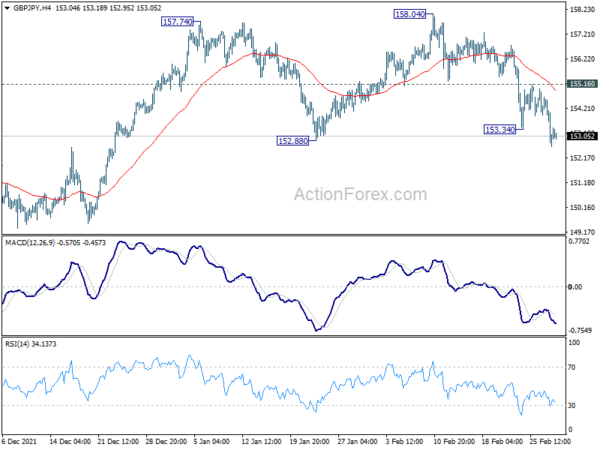

Daily Pivots: (S1) 152.28; (P) 153.48; (R1) 154.31; More…

GBP/JPY’s fall resumes by taking out 153.34 temporary low and intraday bias is back on the downside. Fall from 158.04 is seen as the third leg of the corrective pattern from 158.19. Break of 152.88 will target 148.94 support next. Risk will remain on the downside as long as 155.16 resistance holds, in case of recovery.

In the bigger picture, price actions from 158.19 are seen as developing into a consolidation pattern to up trend from 123.94 (2020 low). Downside should be contained by 38.2% retracement of 123.94 to 158.19 at 145.10 to bring rebound. Firm break of 158.19 will resume the up trend to long term fibonacci level at 167.93. However, sustained break of 145.10 will raise the chance of trend reversal and target 61.8% retracement at 137.02.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Jan | -9.20% | 0.60% | 0.40% | |

| 21:45 | NZD | Terms of Trade Index Q4 | -1.00% | 0.90% | 0.70% | 0.40% |

| 23:50 | JPY | Capital Spending Q4 | 4.30% | 2.90% | 1.20% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | 7.60% | 8.60% | 8.40% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | 1.80% | 1.50% | ||

| 00:30 | AUD | GDP Q/Q Q4 | 3.40% | 2.90% | -1.90% | |

| 08:55 | EUR | Germany Unemployment Change Feb | -23K | -48K | ||

| 08:55 | EUR | Germany Unemployment Rate Feb | 5.10% | 5.10% | ||

| 10:00 | EUR | Eurozone CPI Feb P | 5.30% | 5.10% | ||

| 10:00 | EUR | Eurozone CPI Core Feb P | 2.50% | 2.30% | ||

| 13:15 | USD | ADP Employment Change Feb | 320K | -301K | ||

| 15:00 | CAD | BoC Interest Rate Decision | 0.50% | 0.25% | ||

| 15:30 | USD | Crude Oil Inventories | 2.5M | 4.5M | ||

| 19:00 | USD | Fed’s Beige Book |