Asian markets open with heavy selling today as worries remain that Russia could invade Ukraine “any day now”. New Zealand Dollar is leading Aussie lower on risk aversion. But Canadian Dollar is the stronger one with WTI crude oil staying comfortably at around 94.5. Dollar, and Euro are also slightly stronger. FOMC minutes and comments from Fed officials on the idea of a 50bps March hike would be closely watched. But this should be overwhelmed by news on Russia-Ukraine situations.

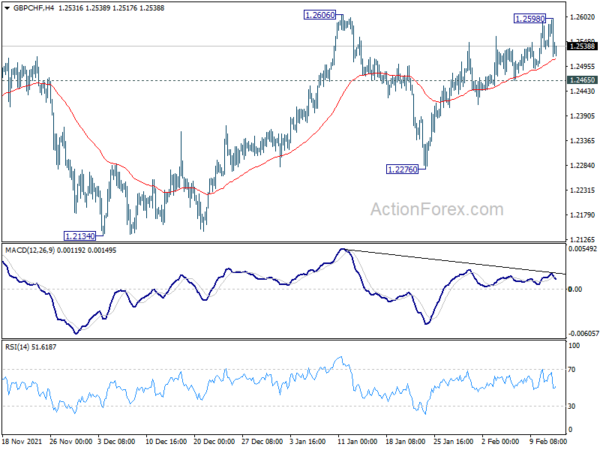

Technically, attention will be on some Swiss Franc pairs to gauge the sentiments in Europe. Break of 1.0439 minor support in EUR/CHF will suggest that rebound form 1.0298 has completed at 1.0610 already and bring deeper fall to retest this low. that would reaffirm medium term bearishness for downtrend resumption later. Also, break of 1.2465 minor support will argue that rebound from 1.2276 has completed at 1.2598, after rejection by 1.2606. Deeper decline would be seen back to 1.2276 support, with prospect of retesting 1.2134 low.

In Asia, at the time of writing, Nikkei is down -2.18%. Hong Kong HSI is down -1.25%. China Shanghai SSE is down -0.63%. Singapore Strait Times is up 0.01%. Japan 10-year JGB yield is down -0.0055 at 0.224.

Fed Daly prefers measured approach after March hike

San Francisco Fed President Mary Daly told CBS on Sunday, “it is obvious that we need to pull some of the accommodation out of the economy”. However, “history tells us with Fed policy that abrupt and aggressive action can actually have a destabilizing effect on the very growth and price stability that we’re trying to achieve,” she warned.

“What I would favor is moving in March and then watching, measuring, being very careful about what we see ahead of us — and then taking the next interest rate increase when it seems the best place to do that. And that could be in the next meeting or it could be a meeting away,” Daly said.

ECB Rehn: Better to look beyond short-term inflation

ECB Governing Council member Olli Rehn said on Saturday, “If we reacted strongly to inflation in the short term, we would probably cause economic growth to stop. It’s better to look beyond short-term inflation and look at what inflation is in 2023, 2024.” He expected inflation to be close to the 2% target in the coming years.

“We will have time to react in the March meeting and in later meetings if it looks like the situation is markedly different than it now appears,” Rehn added.

Another Governing Council member Ignazio Visco said, “the monetary policy stance remains expansionary, though the gradual normalization will continue at a pace consistent with the economic recovery and changes in the outlook for prices.”

“I do not believe that the overall picture underlying this stance has changed significantly,” Visco said. Still, “in the short term, there has been an increase in the risk of consumer prices growing faster than expected and production activity growing more slowly.”

New Zealand BNZ services dropped to 45.9, lowest since Oct

New Zealand BusinssNZ Performance of Services index dropped -3.9 to 45.9 in January. That was the lowest result since October 2021. Looking at some details, activity/sales dropped sharply from 50.7 to 44.1. Employment ticked down from 49.1 to 48.1. New orders/businesses dropped deeply from 52.0 to 41.8. Stocks/inventories dropped from 51.0 to 47.6. Supplier deliveries also tumbled from 49.8 to 43.6.

BNZ Senior Economist Craig Ebert said that “the PSI can jag around quite a lot from month to month – upwards and downwards. However, it’s also worth pointing out that the long-term average of the PSI is 53.6, which is starting to feel some distance away. So much for the new traffic light system releasing the brakes on activity.”

A week with FOMC minutes and inflation data from UK, Canada and Japan

FOMC minutes are a major focus of the week. Currently, markets are heading towards fully pricing in a 50bps rate hike in March. The minutes might reveal any discussion for a more aggressive tightening cycle. Of course, comments from Fed officials on this topic will be closely watched too. US PPI and retail sales will also catch some attention.

A wave of data will be release from the UK, including employment CPI and PPI, retail sales. CPI data will be the focus. Eurozone GDP and Germany ZEW economic sentiment; Canada CPI and retail sales; Japan GDP and CPI; RBA minutes and Australia employment and New Zealand PPI will also be watched.

Here are some highlights for the week:

- Monday: Swiss PPI.

- Tuesday: Japan GDP, industrial production final; RBA minutes; UK employment; Germany ZEW economic sentiment; Eurozone GDP, employment change, trade balance; US PPI, Empire state manufacturing; Canada housing starts.

- Wednesday: China CPI, PPI; Japan tertiary industry activity index; UK CPI, PPI; Eurozone industrial production; Canada CPI, manufacturing sales, whole sales sales; US retail sales, import prices, industrial production, business inventories, NAHB housing market index, FOMC minutes.

- Thursday: Japan trade balance, machine orders; Australia employment; Swiss trade balance; ECB monthly bulletin; Canada foreign securities purchases; US Philly Fed survey, jobless claims, housing starts and building permits.

- Friday: New Zealand PPI, Japan CPI; UK retail sales; Eurozone current account; Canada retail sales, new housing price index; US existing home sales.

GBP/JPY Daily Outlook

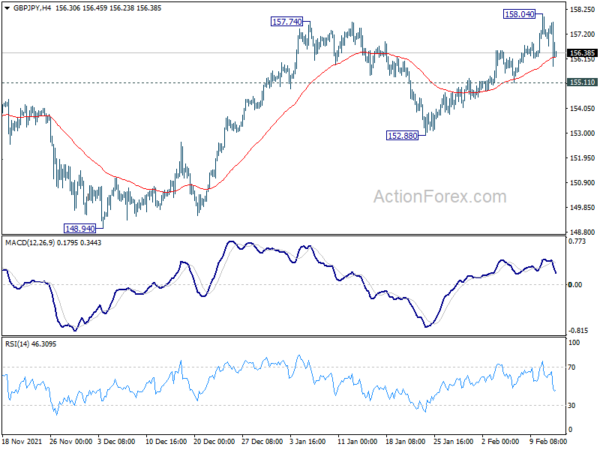

Daily Pivots: (S1) 155.71; (P) 156.71; (R1) 157.55; More…

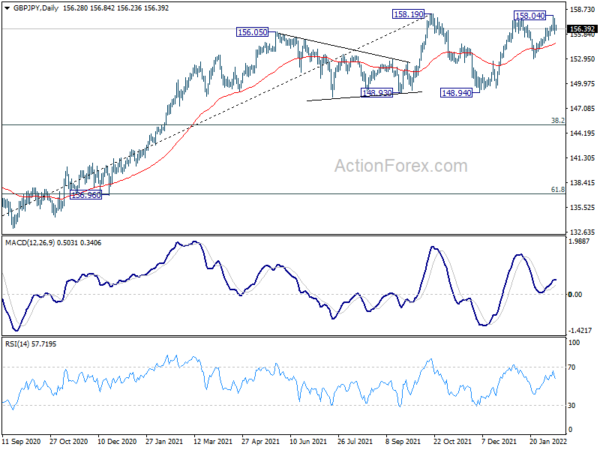

Intraday bias in GBP/JPY remains neutral for the moment. On the downside, break of 155.11 resistance should confirm rejection by 158.19 resistance. Intraday bias will be turned to the downside for 152.88 support, to extend the corrective pattern from 158.19 with another falling leg. However, on the upside, sustained break of 158.19 will resume larger up trend.

In the bigger picture, price actions from 158.19 are seen as developing into a consolidation pattern to up trend from 123.94 (2020 low). Downside should be contained by 123.94 to 158.19 at 145.10 to bring rebound. Firm break of 158.19 will resume the up trend to long term fibonacci level at 167.93. However, sustained break of 145.10 will raise the chance of trend reversal and target 61.8% retracement at 137.02.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:30 | CHF | Producer and Import Prices M/M Jan | 0.10% | -0.10% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Jan | 5.60% | 5.10% |