Dollar is rebounding strongly in early US session following much better than expected job and wage growth. The greenback is apparently turning the tide against all major currencies, except Euro. The common currency is still the runaway winner for the week, as boosted by surprised hawkish turn in ECB. In other markets, DOW futures took a deep dive after the release on concern of aggressive Fed tightening. 10-year yield looks set to break through 1.9 handle.

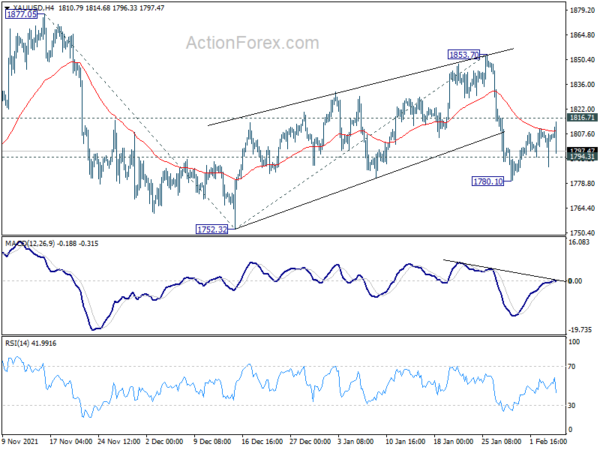

Technically, we’ll pay attention to whether Gold would finally break through 1794.31 with conviction this time, after a false break earlier in the week. If happens, that would help solidify the case for a Dollar comeback. Gold should then dive through 1780.01 to resume the fall from 1853.70 to 1752.32 support next.

In Europe, at the time of writing, FTSE is down -0.10%. DAX is down -1.66%. CAC is down -0.92%. Germany 10-year yield is up 0.0540 at 0.199, pressing 0.2 handle. Earlier in Asia, Nikkei rose 0.73%. Hong Kong HSI rose 3.24%. Singapore Strait Times dropped -0.24%. China was still on holiday. Japan 10-year JGB yield rose 0.212 to 0.201, regained 0.2 handle.

US non-farm payroll grew 467k, wage growth strong too

US non-farm payroll employment grew 467k in January, well above expectation of 150k. Prior month’s figure was also revised sharply up from 199k to 510k. Employment was still down -2.9m or -1.9% from its pre-pandemic level in February 2020.

Unemployment rate, however, ticked up from 3.9% to 4.0%, versus expectation of 3.9%. Participation rate rose from 61.9% to 62.2%. Average hourly earnings posted strong growth of 0.7% mom, above expectation of 0.5% mom.

Canada employment dropped -200k in Jan, unemployment rate jumped to 6.5%

Canada employment dropped -200k in January much worse than expectation of -121k. Part-time jobs dropped -117k while full-time jobs dropped -83k.

Unemployment rate rose by 0.5% to 6.5%, higher than expectation of 6.0%. That’s the first increase since April 2021. Labor force participation rate dropped -0.4% to 65.0%.

Eurozone retail sales dropped -3.0% mom in Dec, EU down -2.8% mom

Eurozone retail sales dropped -3.0% mom in December, much worse than expectation of -0.5%. Retail trade decreased by -5.2% for non-food products and by -0.3% for food, drinks and tobacco, while it increased by 0.1% for automotive fuels.

EU retail sales dropped -2.8% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in the Netherlands (-9.2%), Spain (-5.7%) and Germany (-5.5%). The highest increases were observed in Latvia (+7.2%), Slovenia (+2.1%), Bulgaria and Hungary (both +1.0%).

Also released, Germany factory orders rose 2.8% mom in December, versus expectation of 0.5% mom. France industrial output dropped -0.2% mom in December, below expectation of 0.5% mom.

UK PMI construction rose to 56.3, overall cost inflation eased

UK PMI Construction rose from 54.3 to 56.3 in January, above expectation of 54.3. Markit said the sector gained momentum after subdued end to 2021. Commercial activity helped to offset weaker rise in house building. Cost inflation dipped to 10-month low as supply issues eased.

Tim Moore, Director at IHS Markit said: “UK construction companies started the year on a strong footing as business activity picked up speed and new orders expanded to the greatest extent since last August… Higher energy, transport and raw material bills led to across the board increases in input prices during January, but fewer supply issues helped ease the overall rate of cost inflation to its lowest since March 2021.”

BoJ Kuroda: Hard to see inflation sustainably reach target without wages rise

BoJ Governor Haruhiko Kuroda told the parliament today that inflation remains subdued in Japan because of the delay in recovery from pandemic, the public’s deflationary mindset and firms’ assumption that prices won’t rice much.

“In Japan, nominal wages haven’t risen much. It’s hard to see inflation sustainably reach our 2 per cent target unless wages rise in tandem with prices,” he said.

“It’s important to maintain powerful monetary easing to support the economy, and help generate steady wage and price growth.”

GBP/USD Mid-Day Outlook

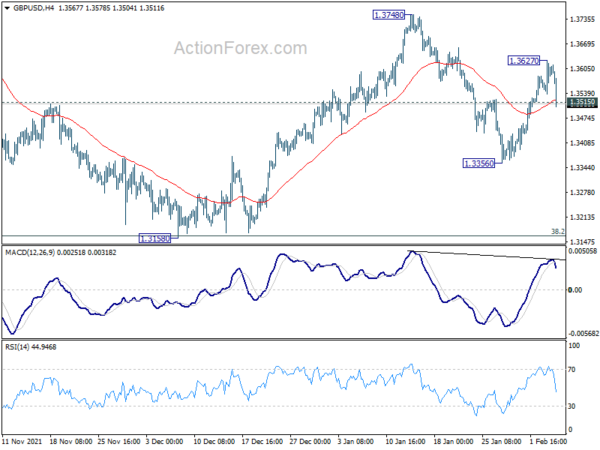

Daily Pivots: (S1) 1.3549; (P) 1.3589; (R1) 1.3639; More…

GBP/USD’s sharp fall and break of 1.3515 minor support suggests that rebound from 1.3356 has completed at 1.3627 already. Intraday bias is back on the downside for 1.3356 support first. Break will resume the decline from 1.3748 to retest 1.3158 low. On the upside, however, above 1.3627 will resume the rebound for 1.3748 resistance instead.

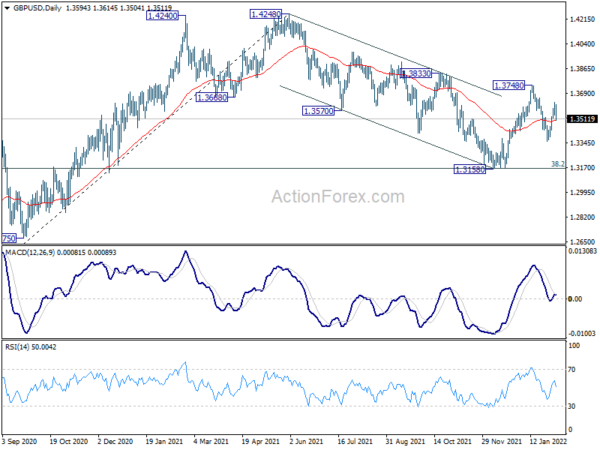

In the bigger picture, as long as 38.2% retracement of 1.1409 to 1.4248 at 1.3164 holds, up trend from 1.1409 (2020 low) is still in progress. On resumption, next target will be 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Nevertheless sustained break of 1.3164 will argue that whole rise from 1.1409 has completed and bring deeper fall to 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Dec | 0.60% | 0.60% | ||

| 00:30 | AUD | RBA Monetary Policy Statement | ||||

| 07:00 | EUR | Germany Factory Orders M/M Dec | 2.80% | 0.50% | 3.70% | |

| 07:45 | EUR | France Industrial Output M/M Dec | -0.20% | 0.50% | -0.40% | |

| 09:30 | GBP | Construction PMI Jan | 56.3 | 54.3 | 54.3 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | -3.00% | -0.50% | 1.00% | |

| 13:30 | USD | Nonfarm Payrolls Jan | 467K | 150K | 199K | 510K |

| 13:30 | USD | Unemployment Rate Jan | 4.00% | 3.90% | 3.90% | |

| 13:30 | USD | Average Hourly Earnings M/M Jan | 0.70% | 0.50% | 0.60% | 0.50% |

| 13:30 | CAD | Net Change in Employment Jan | -200.1K | -121.5K | 54.7K | |

| 13:30 | CAD | Unemployment Rate Jan | 6.50% | 6.00% | 5.90% | |

| 15:00 | CAD | Ivey PMI Jan | 55.1 | 45 |