Dollar drops broadly today in rather mixed markets. Firmer risk sentiment might be a factor. Yet, Swiss Franc is currently the strongest, followed by Kiwi and then Aussie. Yen is also just steadily mixed. On the other hand, Canadian Dollar is also weak, without much support from stronger than expected GDP data. Euro is also soft in general, except versus the greenback. Nevertheless, development in the stock markets and overall market sentiment would likely guidance the FX markets for now.

Technically, it’s still early to tell if Dollar is reversing. But AUD/USD has made some progress by breaking 0.7089 minor resistance. USD/CHF also breaks 0.9243 minor support. Attention will be on 1.1299 minor resistance in EUR/USD, 1.3523 minor resistance in GBP/USD, and 114.46 minor support in USD/JPY. Break of these level will at least put the greenback under some pressure for the very near term.

In Europe, at the time of writing, FTSE is up 1.05%. DAX is up 1.12%. CAC is up 1.25%. Germany 10-year yield is down -0.0008 at 0.014. Earlier in Asia, Nikkei rose 0.28%. Japan 10-year JGB yield rose 0.0067 to 0.183. Hong Kong, China and Singapore were on holiday.

Canada GDP grew 0.6% mom in Nov, 0.2% above pre-pandemic level

Canada GDP grew 0.6% mom in November, above expectation of 0.4% mom. Increases across almost all sectors contributed to the sixth consecutive monthly expansion. Real GDP was 0.2% above its pre-pandemic level in February 2020. Services-producing industries grew 0.6% mom while goods-producing industries rose 0.5% mom.

Statistic Canada also said advance information shows GDP was essentially flat in December. For Q4, GDP grew 1.6% qoq, 4.9% yoy.

UK PMI manufacturing finalized at 57.3 in Jan, a solid start to 2022

UK PMI Manufacturing was finalized at 57.3 in January, slightly down from December’s 57.9. Markit said production rose at fastest rate in six months. new order growth slowed despite mild uptick in new export businesses. Input cost and output price inflation eased.

Rob Dobson, Director at IHS Markit, said: “UK manufacturing made a solid start to 2022, showing encouraging resilience on the face of the Omicron wave, with growth of output accelerating as companies reported fewer supply delays. Causes for concern remain, however, as new orders growth slowed, exports barely rose, staff absenteeism remained high and manufacturers’ ongoing caution regarding supply chain disruptions led to the beefing up of safety stocks

“There was some positive news on the supply chains front. Although pressure on vendors remains severe, and still sufficient to stymie output growth and cause difficulty in obtaining required inputs, supplier lead times lengthened to the lowest degree since November 2020 to suggest that the current period of abnormal stress has hopefully passed its peak, despite the surge in cases linked to Omicron. This also lessened the upward pressure on prices, with input costs and output charges both rising at less elevated rates in January.”

Eurozone PMI manufacturing finalized at 58.7 in Jan, weathering Omicron better than prior waves

Eurozone PMI Manufacturing was finalized at 58.7 in January, up from December’s 58.0. Markit said there were faster expansion in output and new orders. Employment growth improved to five-month high. Also, supplier performance had the least marked deterioration for a year.

Looking at some member states, Germany PMI manufacturing improved to 59.8, five month high. But Italy dropped to 11-month low at 58.3. France also dropped to 3-month low at 55.5. Overall readings were still strong with Austria at 61.5, the Netherlands at 60.1, Ireland at 59.4, Greece at 57.9 and Spain at 56.2.

Chris Williamson, Chief Business Economist at IHS Markit said: “Eurozone manufacturers appear to be weathering the Omicron storm better than prior COVID-19 waves so far, with firms reporting the largest production and order book improvements for four months in January. Prospects have also brightened, with a further easing in the number of supply chain delays playing a key role in prompting producers to revise up their expectations for growth in the coming year to the highest since last June…

“Escalating tensions surrounding Ukraine, the energy price crisis and prospect of global central bank policy tightening meanwhile create additional headwinds to the outlook, which suggest that – although the global supply crunch may be easing – demand conditions may be less supportive to manufacturers in coming months.”

Eurozone unemployment rate dropped to 7.1% in Dec, EU down to 6.4%

Eurozone unemployment rate dropped from 7.1% to 7.0% in December, better than expectation of 7.1%. EU Unemployment rate dropped from 6.5% to 6.4%.

Eurostat estimates that 13.612m men and women in the EU, of whom 11.481m in the euro area, were unemployed in December. Compared with November, the number of persons unemployed decreased by 210k in the EU and by 185k in the euro area.

From Swiss, retail sales dropped -0.4% yoy in December versus expectation of 5.5% yoy. SECO consumer climate dropped from 4 to -4 in Q1. PMI manufacturing rose from 62.7 to 63.8 in January, below expectation of 63.9.

RBA stops QE purchases, to be patient on interest rate

RBA keeps cash rate target unchanged at 0.10% today. It’s reiterated that RBA “will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range”. And, it is “too early to conclude that it is sustainably within the target band”. Thus, “the Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA also decided to stop the asset purchase program after February 10. The issue of reinvestment of the proceeds of future bond maturities will be considered at the meeting in May.

As for the economy, RBA said Omicron “has not derailed” recovery. Central forecast if for GDP to grow around 4.25% over 2022 and 2% over 2.023. Unemployment rate is projected to fall below 4% later in the year, and to be around 3.75% at the end of 2023. Underlying inflation is is expected to increase further in coming quarters to around 3.25%, and decline to around 2.75% over 2023.

Australia retail sales dropped -4.4% mom in Dec, but turnover remains strong

Australia retail sales dropped -4.4% mom in December, much worse than expectation of -1.9% mom. That’s also the largest monthly decline since April 2020.

“Despite this month’s fall, retail turnover remains strong, up 4.8 per cent on December 2020, with strong consumer spending continuing post the Delta Outbreak,” Ben James, Director of Quarterly Economy Wide Statistics, said.

Australia AiG manufacturing dropped to 48.4, modest contraction

Australia AiG Performance of Manufacturing Index dropped sharply by -6.4 pts to 48.4 in January. Production dropped -0.6 to 51.9. Employment dropped -4.6 to 45.4. New orders dropped -8.0 to 51.3. Supplier deliveries dropped -15.6 to 37.8. Exports dropped -9.5 to 45.1. Input prices rose 4.0 to 82.3. Selling prices dropped -3.3 to 64.8. Wages rose 1.1 to 63.5.

Innes Willox, Chief Executive of Ai Group said: “Australia’s manufacturers reported a modest contraction in performance over December and January as businesses reported further disruptions to supply chains and as staff availability emerged as a major constraint on many businesses. Cost pressures were keenly felt with input prices continuing to rise and the selling prices index indicating only a partial recovery of these costs in the market.”

EUR/USD Mid-Day Outlook

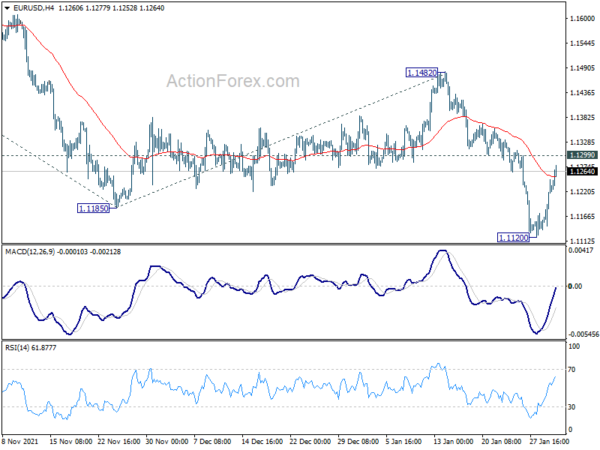

Daily Pivots: (S1) 1.1165; (P) 1.1207; (R1) 1.1274; More…

EUR/USD’s recovery from 1.1120 extends higher today but stays below 1.1299 minor resistance. Intraday bias remains neutral first and further is still in favor. On the downside, break of 1.1120 will resume larger down trend to 61.8% projection of 1.1908 to 1.1185 from 1.1482 at 1.1035. However, break of 1.1299 minor resistance will bring stronger rebound back towards 1.1482 structural resistance.

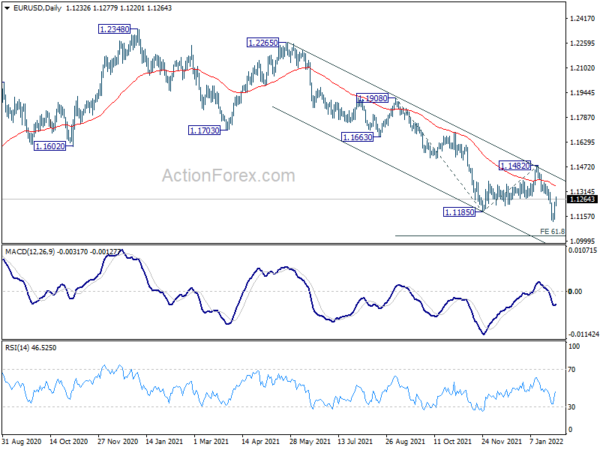

In the bigger picture, the strength of the the decline from 1.2348 (2021 high) suggests that it’s not a corrective move. But still, it could be the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1482 resistance holds. Next target would be 1.0635 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Jan | 48.4 | 54.8 | ||

| 21:45 | NZD | Trade Balance (NZD) Dec | -477M | -700M | -864M | -1060M |

| 23:30 | JPY | Unemployment Rate Dec | 2.70% | 2.80% | 2.80% | |

| 00:30 | AUD | Retail Sales M/M Dec | -4.40% | -1.90% | 7.30% | |

| 00:30 | JPY | Manufacturing PMI Jan F | 55.4 | 54.6 | 54.6 | |

| 03:30 | AUD | RBA Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 07:00 | EUR | Germany Retail Sales M/M Dec | -5.50% | -1.20% | 0.60% | 0.80% |

| 07:30 | CHF | Real Retail Sales Y/Y Dec | -0.40% | 5.50% | 5.80% | 5.30% |

| 08:00 | CHF | SECO Consumer Climate Q1 | -4 | 4 | 4 | |

| 08:30 | CHF | Manufacturing PMI Jan | 63.8 | 63.9 | 62.7 | |

| 08:50 | EUR | France Manufacturing PMI Jan F | 55.5 | 55.5 | 55.5 | |

| 08:55 | EUR | Germany Unemployment Change Jan | -48K | -8K | -23K | |

| 08:55 | EUR | Germany Unemployment Rate Jan | 5.10% | 5.20% | 5.20% | |

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 59.8 | 60.5 | 60.5 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 58.7 | 59 | 59 | |

| 09:30 | GBP | Manufacturing PMI Jan F | 57.3 | 56.9 | 56.9 | |

| 09:30 | GBP | Mortgage Approvals Dec | 71K | 66K | 67K | |

| 09:30 | GBP | M4 Money Supply M/M Dec | 0.10% | 0.80% | 0.70% | |

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 7.00% | 7.10% | 7.20% | 7.10% |

| 13:30 | CAD | GDP M/M Nov | 0.60% | 0.40% | 0.80% | |

| 14:30 | CAD | Manufacturing PMI Jan | 56.5 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 55 | 55 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 57.5 | 58.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 79.5 | 68.2 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 54.2 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.70% | 0.40% |