Euro rebounds notably today as Germany 10-year yield turns positive. Nevertheless, Australian Dollar is even stronger as markets await RBA rate decision. On the other hand, Dollar and Yen are paring some recent gains. Sterling and Canadian Dollar are mixed.

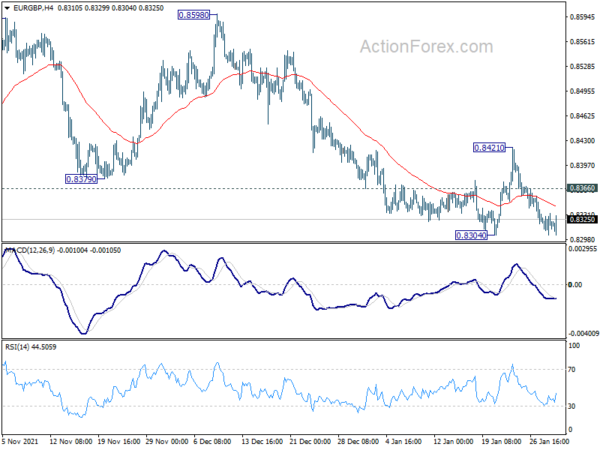

Technically, EUR/GBP appears to be drawing support from 0.8304. Rebound from current level, followed by break of 0.8366 resistance, would bring stronger rise to 0.8421 resistance. That could be a hint on some rise in Euro elsewhere. In particular, while a break of 1.0510 resistance in EUR/CHF is not expected, stronger rise in EUR/GBP could at least pull EUR/CHF closer to this 1.0510 resistance level.

In Europe, at the time of writing, FTSE is up 0.17%. DAX is up 0.61%. CAC is down -0.06%. Germany 10-year yield is up 0.063 at 0.020, turned positive. Earlier in Asia, Nikkei rose 1.07%. Hong Kong HSI rose 1.07%. China Shanghai SSE dropped -0.97%. Singapore Strait Times rose 0.10%. Japan 10-year JGB yield rose 0.0070 to 0.176.

Eurozone GDP grew 0.3% qoq in Q4, EU up 0.4% qoq

Eurozone GDP grew 0.3% qoq in Q4, slightly below expectation of 0.4% qoq. EU GDP grew 0.4% qoq. The 2021 annual growth was at 5.2% based on first estimation for both Eurozone and EU.

Among the EU Member States for which data are available, Spain (+2.0%) recorded the highest increase compared to the previous quarter, followed by Portugal (+1.6%) and Sweden (+1.4%). Declines were recorded in Austria (-2.2%), Germany (-0.7%) and in Latvia (-0.1%). The year on year growth rates were positive for all countries.

From Italy, GDP grew 0.6% qoq in Q4, above expectation of 0.5% qoq. Germany CPI slowed from 5.3% yoy to 4.9% yoy in January, above expectation of 4.3% yoy.

Japan industrial production dropped -1.0% mom in Dec, expected to rebound in Jan and Feb

Japan industrial production dropped -1.0% mom in December, worse than expectation of -0.8% mom. Manufacturers surveyed by the Ministry of Economy, Trade and Industry (METI) expected output to grow 5.2% in January and 2.2% in February.

Retail sales grew 1.4% yoy in December, below expectation of 2.7% yoy. That’s nonetheless the third straight month of increase for sales, lifted by demand for general merchandise and food and beverages. Housing starts rose 4.2% yoy in December, versus expectation of 7.1% yoy. Consumer confidence dropped from 39.1 to 36.7, below expectation of 37.3.

AUD/NZD resumes rally as RBA awaited, some previews

AUD/NZD rises sharply today as markets await RBA rate decision in the upcoming Asian session. Given the surprise drop in unemployment and strong inflation data, RBA is likely to just wrap up the QE program, rather than winding it down to end in May. That would also give the central bank some flexibility to raise interest rate to combat inflation. The question is how RBA would shape market expectation on the timing of the rate hike, or leave it to the Statement on Monetary Policy to be released later in the week. There is prospect of more upside in Aussie in crosses in RBA delivers something more hawkish than expected.

AUD/NZD’s is now extending the whole rise from 1.0278. Next target is 161.8% projection of 1.0278 to 1.0610 from 1.0314 at 1.0851. A bullish scenario is that corrective fall from 1.1042 has completed with three waves at 1.0278 and rise from 0.9992 is ready to resume. The reaction to 1.0944 resistance will reveal if it’s the case. For now, near term outlook will stay bullish as long as 1.0654 support holds, in case of retreat.

Suggested readings on RBA:

- Two Trades to Watch: EUR/USD, AUD/USD

- Aussie Storms Higher, RBA Next

- New Forecasts in RBA SOMP to Be Consistent with Rate Hike in 2022

- RBA to End QE and Bring Forward Rate Hike Guidance: AUDUSD

- RBA Meeting: Managing Rate Hike Expectations

EUR/USD Mid-Day Outlook

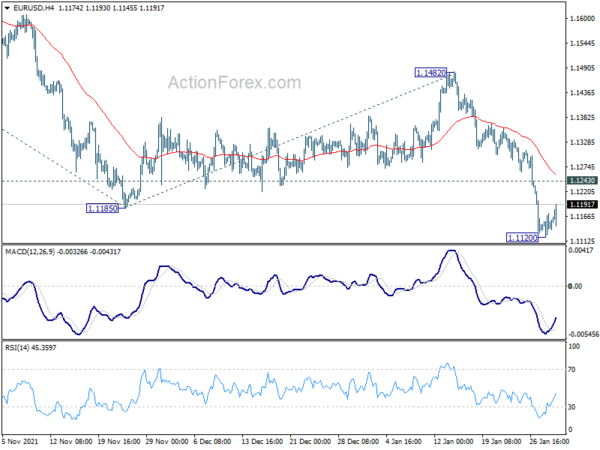

Daily Pivots: (S1) 1.1121; (P) 1.1148; (R1) 1.1173; More…

Intraday bias in EUR/USD is turned neutral with current recovery. Some consolidations could be seen but upside should be limited well below 1.1482 resistance. On the downside, break of 1.1120 will resume larger down trend to 61.8% projection of 1.1908 to 1.1185 from 1.1482 at 1.1035. Break will target 100% projection at 1.0759.

In the bigger picture, the strength of the the decline from 1.2348 (2021 high) suggests that it’s not a corrective move. But still, it could be the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1482 resistance holds. Next target would be 1.0635 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Dec P | -1.00% | -0.80% | 7.00% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | 1.40% | 2.70% | 1.90% | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.80% | 0.70% | 0.90% | 1.00% |

| 05:00 | JPY | Housing Starts Y/Y Dec | 4.20% | 7.10% | 3.70% | |

| 05:00 | JPY | Consumer Confidence Index Jan | 36.7 | 37.3 | 39.1 | |

| 09:00 | EUR | Italy GDP Q/Q Q4 P | 0.60% | 0.50% | 2.60% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | 0.30% | 0.40% | 2.20% | |

| 13:00 | EUR | Germany CPI M/M Jan P | 0.40% | -0.30% | 0.50% | |

| 13:00 | EUR | Germany CPI Y/Y Jan P | 4.90% | 4.30% | 5.30% | |

| 13:30 | CAD | Industrial Product Price M/M Dec | 0.70% | 0.80% | 0.80% | |

| 13:30 | CAD | Raw Material Price Index Dec | -2.90% | 0.60% | -1.00% | |

| 14:45 | USD | Chicago PMI Jan | 62.5 | 63.1 |