Markets are relatively steady in Asian today, as traders are awaiting main events of BoC and Fed policy decisions. Asian stocks are treading water after weaker close in US overnight. Dollar remains the strongest one for the week, followed by Yen and then Canadian. Swiss Franc is currently the weakest, followed by New Zealand Dollar and then Euro. Aussie and Sterling are mixed.

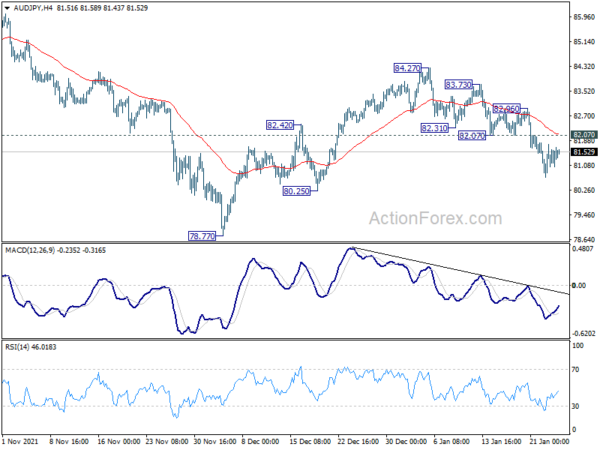

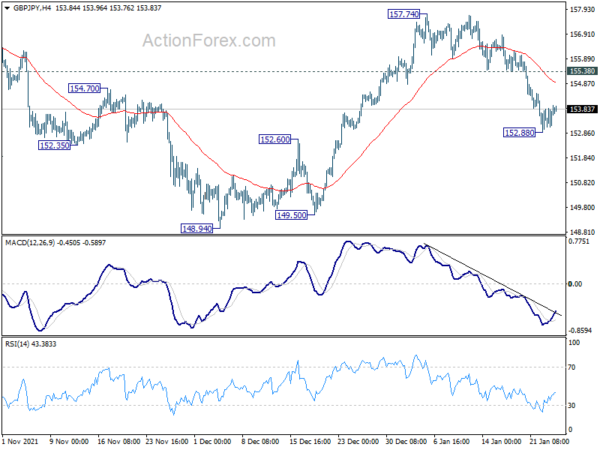

Technically, the decline in Yen crosses are losing some downside momentum but there is no clear sign of bottoming yet. We’ll keep an eye on 130.07 minor resistance in EUR/JPY, 155.38 minor resistance in GBP/JPY and 82.07 minor resistance in AUD/JPY. As long as these levels hold, further decline would remain in favor in Yen crosses in general.

In Asia, at the time of writing, Nikkei is down -0.15%. Hong Kong HSI is up 0.16%. China Shanghai SSE is up 0.14%. Singapore Strait Times is up 0.85%. Japan 10-year JGB yield is down -0.0019 at 0.139. Overnight, DOW dropped -0.19%. S&P 500 dropped -1.22%. NASDAQ dropped -2.28%. 10-year yield rose 0.048 to 1.783.

IMF downgrade global growth forecasts on Omicron, inflation, China

IMF said the global economy enters 2022 in a “weaker position” as the spread of Omicron led to reimposed mobility restrictions. Rising energy prices and supply disruptions have resulted in higher and more broad-based inflation than anticipated, notably in the United States and many emerging market and developing economies. Also, the ongoing retrenchment of China’s real estate sector and slower-than-expected recovery of private consumption also have limited growth prospects.

New GDP growth forecasts:

- Global: 2022 at 4.4% (downgraded by -0.5%); 2023 at 3.8% (upgraded by 0.2%).

- US: 2022 at 4.0% (downgraded by -1.2%; 2023 at 2.6% (upgraded by 0.4%).

- Eurozone: 2022 at 3.9% (downgraded by -0.4%); 2023 at 2.5% (upgraded by 0.5%).

- Japan: 2022 at 3.3% (upgraded by 0.1%); 2023 at 1.8% (upgraded by 0.4%).

- UK: 2022 at 4.7% (downgraded by -0.3%); 2023 at 2.3% (upgraded by 0.4%).

- Canada: 2022 at 4.1% (downgraded by -0.8%); 2023 at 2.8% (upgraded by 0.2%).

- China: 2022 at 4.8% (downgraded by -0.8%); 2023 at 5.2% (downgraded by -0.1%).

BoJ: Economy to grow well above potential in 2022

In the Summary of Opinions at the January 17-18 meeting, BoJ said, “a pick-up in Japan’s economy has become evident” and the economy is “likely to continue recovering moderately”. In fiscal 2022, it’s “highly likely to grow at a pace that is well above its potential growth rate”.

Though, attentions should be paid to risk of COVID-19 spread in China and that could have a “negative impact on Japan’s economy through downward pressure on external demand and amplification of supply-side constraints.”

CPI is expected to “exceed 1 percent” and may “momentarily rise to a level close to 2 percent” from April 2022 onward. It will then be “important to analyze what lies behind this inflation and whether it turns out to be sustainable.”

A member noted “the key factor in assessing the underlying trend in the CPI is developments in wages. In order for the CPI to increase as a trend, it is necessary that services prices rise along with wage increases.

Also from Japan, corporate service price index rose 1.1% yoy in December, matched expectations.

Previews on BoC and a look at CAD/JPY

The opinions on whether BoC will raise interest today are divided. Some expected the tightening cycle to start imminently, with a total of 150bps rate hike this year to 1.75%. Yet, there are conservative opinions that BoJ would wait until April to act and deliver only 75bps hikes this year.

It should be noted that BoC has mentioned before that the condition for rate hikes would be met in the “middle quarters” of 2022. But some argued that the central bank is already behind the curve on controlling inflation. With the publishing of monetary policy report and economic projections, January and April meeting are the more appropriate choice then March. But could BoC keep its hand off until April. It’s a close call.

Some previews on BoC:

- BoC Policy Meeting: It’s Time for a Rate Hike

- Currency Pair of the Week: USD/CAD

- Bank of Canada Preview: Is the BOC Ready to Hike Rates?

- Bank of Canada to Make Highly-Anticipated Rate Decision

- Canada: Rate Hikes Close, But Not Quite Yet

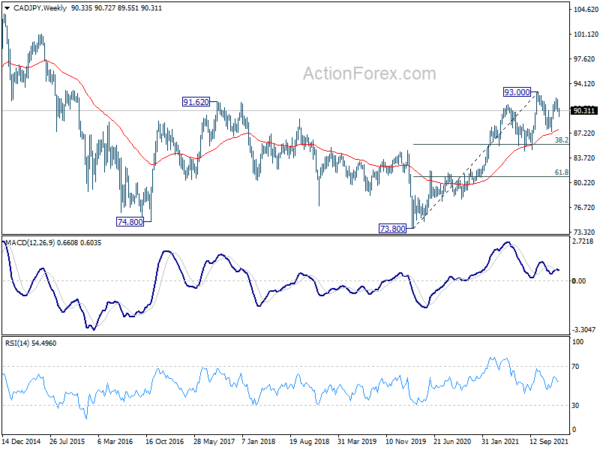

Canadian Dollar’s next move will depends on all factors including BoC, Fed and overall risk sentiment. Technically speaking, CAD/JPY is now seen as in the third leg of a consolidation pattern from 93.00. Deeper fall is in favor back to 87.42, or further to 100% projection of 93.00 to 87.42 from 92.16 at 86.58. We’re not expecting a break of 38.2% retracement of 73.80 to 93.00 at 85.66. On the upside, a firm break of 93.00 high is not expected for now give the overall mixed sentiment.

So the range should be set between 85.66 and 93.00. A strong breakout on either side would imply a rather dramatic underlying development.

Fed to be a non-event, NASDAQ looks into 14k handle

Fed will more likely stick to script today and the FOMC meeting could be a non-event. It’s clearly communicated that net asset purchases will end in March. Markets are expecting a 25bps hike in March too. Chair Jerome Powell is unlikely to say something that deviate from such expectations and rock the boat.

The baseline remains that there will be only three hikes, and no change would be revealed until March economic projections. Powell would also remain non-committal on the timing of balance run-off. So, these two questions would remain unanswered.

Some previews on Fed:

- FOMC Meeting Preview: Is There Still a “Fed Put”?

- Fed meeting: Will Asset Purchases End Early?

- January Flashlight for the FOMC Blackout Period

- Fed: End of Money Printing Brrrrr – (At Least) Four 25bp Rate Hikes this Year and QT in September

Markets will probably look more into other developments like tensions surrounding Ukraine for guidance. NASDAQ’s u-turn on Monday was impressive but there was no follow through buying. For now, there is no clearly sign that the steep fall from 16212.22 is ending. The question is whether there would be slightly lengthier interim consolidations first, or the decline would resume right away.

A close above 14k, which is close to 38.2% retracement 15319.03 to 13094.65 at 13944.36, will suggest the recovery is going to last longer, and possibly further to 61.8% retracement at 14469. However, a close below 13414.14 minor support will raise the chance that free fall is coming back.

On the data front

US will release goods trade balance and new home sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 152.96; (P) 153.73; (R1) 154.54; More…

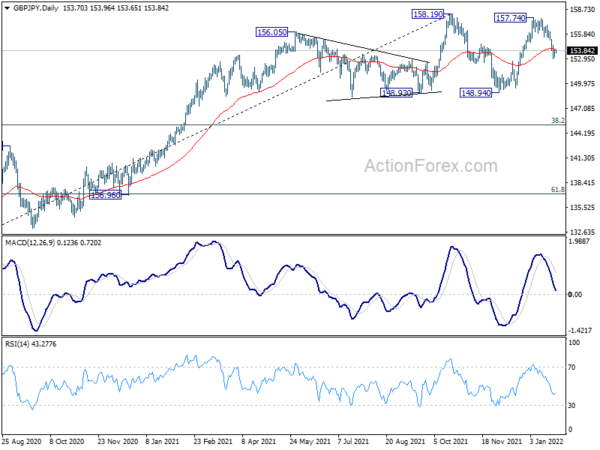

In temporary low is formed at 152.88 as GBP/JPY lost downside momentum. Intraday bias is turned neutral first. Outlook is unchanged that fall from 157.74 is seen as the third leg of the consolidative pattern from 158.19. Deeper decline is expected as long as 155.38 minor resistance holds. Below 152.88 will target 148.94 support next. On the upside, above 155.38 minor resistance will flip bias back to the upside for 157.74/158.19 resistance zone instead.

In the bigger picture, price actions from 158.19 are currently seen as developing into a consolidation pattern to up trend from 123.94 (2020 low). Downside should be contained by 123.94 to 158.19 at 145.10 to bring rebound. Firm break of 158.19 will resume the up trend to long term fibonacci level at 167.93. However, sustained break of 145.10 will raise the chance of trend reversal and target 61.8% retracement at 137.02.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 1.10% | 1.10% | 1.10% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 13:30 | USD | Wholesale Inventories Dec P | 1.30% | 1.40% | ||

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -96.1B | -98.0B | ||

| 15:00 | USD | New Home Sales Dec | 766K | 744K | ||

| 15:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 15:30 | USD | Crude Oil Inventories | 1.0M | 0.5M | ||

| 19:00 | USD | FOMC Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |