Dollar and Yen rise again today as US futures point to sharply lower open. Yesterday’s strong U-turn seems lacking momentum to extend. But selling focus has somewhat turned to European session, with Swiss Franc leading the way lower. Commodity currencies, except Kiwi, are mixed. In other markets, Gold is staying in tight range above 1830. WTI crude oil is in range above 83. Bitcoin is also consolidation around 36k.

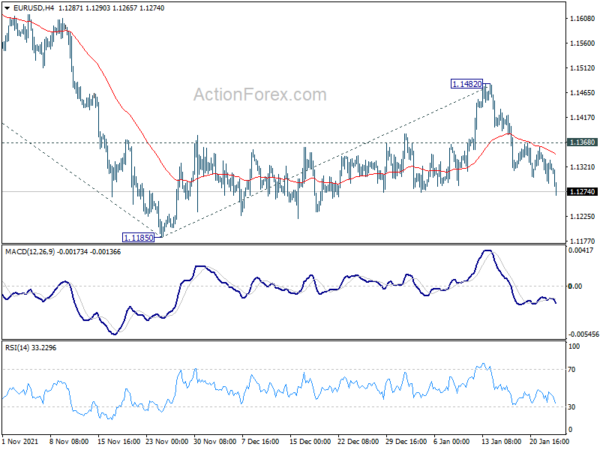

Technically, EUR/USD’s break of 1.1284 support now suggests that larger down trend from 1.2348 is probably ready to resume through 1.1185 low. We’ll now see USD/JPY would break through 115.05 minor resistance to reflect Dollar strength. Or it will break through 113.47 to indicate Yen strength, which could be see in downside acceleration in EUR/JPY in this case.

In Europe, at the time of writing, FTSE is up 0.96%. DAX is up 0.55%. CAC is up 0.89%. Germany 10-year yield is up 0.0218 at -0.084. Earlier in Asia, Nikkei dropped -1.66%. Hong Kong HSI dropped -1.67%. China Shanghai SSE dropped -0.258%. Singapore Strait Times dropped -1.08%. Japan 10-year JGB yield rose 0.0018 to 0.141.

ECB Lane: Let’s think about 2020, 2021, 2022 as part of a pandemic inflation cycle

In an interview with Verslo žinios, ECB Chief Economist Philip Lane said, “in the near term, there are some risks from the Omicron variant. But I think it’s increasingly clear that the impact is only for a few weeks… In that sense, I think there’s less concern about Omicron than we had in December.”

On inflation, Lane suggested to think about 2020, 2021, and 2022 as “part of a pandemic cycle”. “In the first year 2020, inflation was relatively low. In the second half of 2021, inflation turned out to be quite high. And then, as we look into this year, 2022, we think inflation will remain high at the start of this year, but will fall later this year, especially towards the end of the year,” he said.

Lane also said if data suggests that inflation would be too high relative to 2% over the medium term, the response would be “to end net purchasing.” Then, only after ending net purchases “would we look at the criteria for raising the interest rates”.

Germany Ifo business climate rose to 95.7, a glimmer of hope

Germany Ifo Business Climate rose from 94.8 to 95.7 in January, above expectation of 94.7. Current Assessment index dropped from 96.9 to 96.1, matched expectations. Expectations index improved from 92.7 to 95.2, above expectation of 93.0.

By sector, manufacturing rose from 17.4 to 19.9. Services rose from 4.6 to 7.7. Trade rose from -4.1 to -1.3. Construction rose from 7.6 to 8.7.

Ifo said: “While companies’ assessments of the current situation were somewhat less positive, their expectations improved considerably. The German economy is starting the new year with a glimmer of hope.”

Australia CPI surged to 3.5% yoy in Q4, trimmed mean CPI at 7-yr high

Australia CPI rose 1.3% qoq, 3.5% yoy in Q4, well above expectation of 1.0% qoq, 3.2% yoy. RBA trimmed mean CPI rose 1.0% qoq, 2.6% yoy, also above expectation of 0.7% qoq, 2.4% yoy. The 2.6% yoy rise was the highest since June 2014.

Head of Prices Statistics at the ABS, Michelle Marquardt, said the most significant price rises in the December quarter were new dwellings (+4.2%) and automotive fuel (+6.6%).

Marquardt said: “Annual trimmed mean inflation is the highest since 2014, reflecting the broad-based nature of price increases, particularly for goods.”

Australia NAB business confidence dropped sharply to -12

Australia NAB business confidence dropped sharply from 12 to -12 in December. Business conditions dropped from 11 to 8. Trading conditions was unchanged at 14. Profitability conditions rose from 8 to 10. Employment conditions dropped from 11 to 2.

“Overall, the December survey results are consistent with an economy that’s starting to slow, with some similarities to the data when NSW and Victoria were first entering lockdown,” said NAB Chief Economist Alan Oster. “That probably means conditions will fall in early 2022. However, we don’t expect the Omicron variant to derail the recovery longer-term.”

BoJ Kuroda keeps an eye on inflation risks while maintaining ultra-easy policy

BoJ Governor Haruhiko Kuroda told the parliament today, “the BOJ will continue its ultra-easy policy so improvements in corporate profits and the economy prop up wages and gradually accelerate consumer inflation.”

“We remain vigilant to the risk prices may shoot up before wages begin to rise, or how (rising raw material costs) could hurt smaller firms. We must keep an eye out on these risks, while maintaining our current easy monetary policy,” Kuroda said.

Meanwhile, Prime Minister Fumio Kishida said, “it’s desirable to create an environment in which companies can pass on rising costs and raise wages, so that increasing consumption spurs economic growth and inflation.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1296; (P) 1.1321; (R1) 1.1350; More…

EUR/USD’s break of 1.1284 support how argues that corrective rebound from 1.1185 has completed at 1.1482. Intraday bias is back on the downside for 1.1185 first. Firm break there will resume larger down trend from 1.2348 to 61.8% projection of 1.1908 to 1.1185 from 1.1482 at 1.1035. On the upside, above 1.1368 minor resistance will turn intraday bias back to the upside, and extend the consolidation from 1.1185 with another rise.

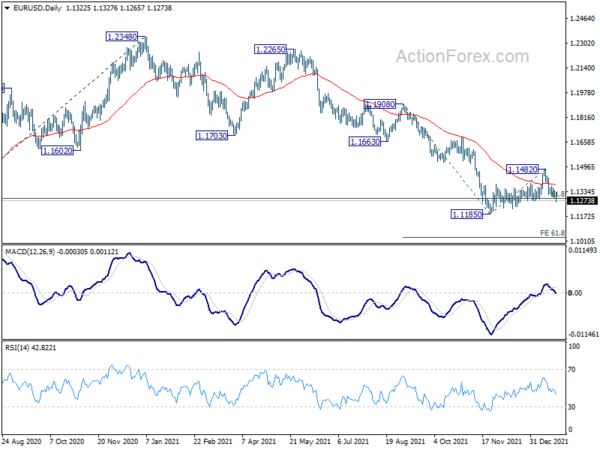

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | NAB Business Confidence Dec | -12 | 12 | ||

| 00:30 | AUD | NAB Business Conditions Dec | 8 | 12 | ||

| 00:30 | AUD | CPI Q/Q Q4 | 1.30% | 1.00% | 0.80% | |

| 00:30 | AUD | CPI Y/Y Q4 | 3.50% | 3.20% | 3.00% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 1.00% | 0.70% | 0.70% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 2.60% | 2.40% | 2.10% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Dec | 16.1B | 14.5B | 16.6B | 14.0B |

| 09:00 | EUR | Germany IFO Business Climate Jan | 95.7 | 94.7 | 94.7 | 94.8 |

| 09:00 | EUR | Germany IFO Current Assessment Jan | 96.1 | 96.1 | 96.9 | |

| 09:00 | EUR | Germany IFO Expectations Jan | 95.2 | 93 | 92.6 | 92.7 |

| 14:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Nov | 17.80% | 18.40% | ||

| 14:00 | USD | Housing Price Index M/M Nov | 1.00% | 1.10% | ||

| 15:00 | USD | Consumer Confidence Jan | 112.3 | 115.8 |