Dollar, Yen and Swiss Franc turned slightly weaker in quiet markets today. Euro is supported by better than expected investor sentiment data, while Sterling also recovers. New Zealand Dollar is also trading higher but Australian and Canadian Dollar are lagging behind. Gold is back above 1800 handle but has yet to break through 1833 key resistance level. WTI oil is range bound at around 82. Bitcoin is now trying to resume up trend for new record.

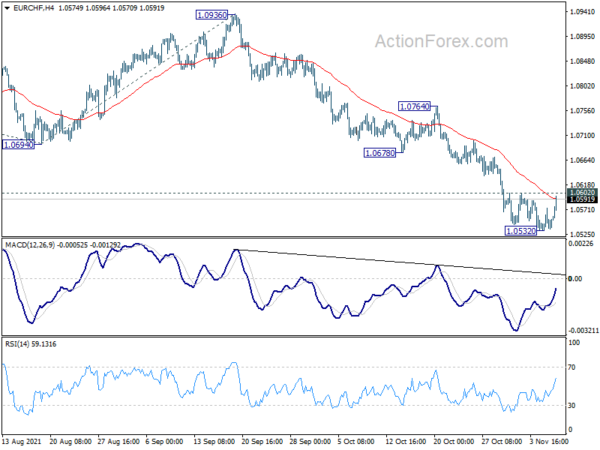

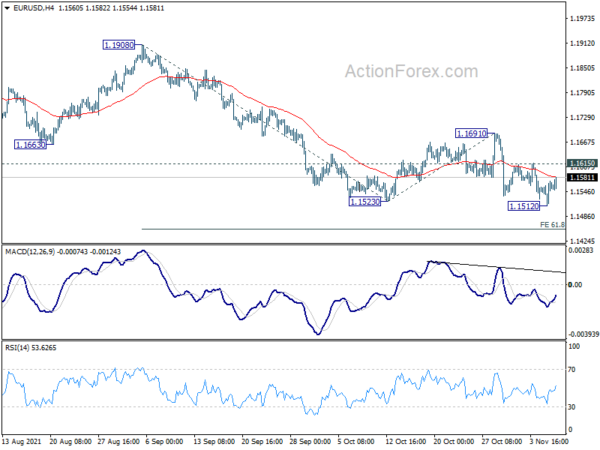

Technically a focus is now on 1.0602 minor resistance in EUR/CHF and break there will indicate short term bottoming, to be followed by stronger rebound. EUR/USD and GBP/USD are also recovering notably. Break of 1.1615and 1.3604 respectively will likely bring stronger rebound in both pairs.

In Europe, at the time of writing, FTSE is down -0.05%. DAX is down -0.18%. CAC is up 0.26%. Germany 10-year yield is up 0.0243 at -0.253. Earlier in Asia, Nikkei dropped -0.35%. Hong Kong HSI dropped -0.43%. China Shanghai SSE rose 0.20%. Singapore Strait Times rose 0.66%. Japan 10-year JGB yield dropped -0.0024 to 0.061.

Eurozone Sentix investor confidence rose to 18.3, mid-cycle slowdown coming to an end

Eurozone Sentix Investor Confidence rose to 18.3 in November, up from 16.9, slightly below expectation of 18.6. That also the first rise since July. However, current situation index dropped from 26.3 to 23.5, lowest since June. Expectations, on the other hand, rose from 8.0 to 13.3.

Sentix said, the economic slowdown is “coming to an end”. Economic expectations suggested that the latest declines were just a “mid-cycle slowdown”. “This thesis seems to be con-firmed by the November data. The threat of an economic turnaround is thus off the table.”

From Swiss, unemployment rate dropped to 2.7% in October, down from 2.8%, matched expectations.

ECB Lane: There’s still a lot of momentum in the system

In an interview with El País, ECB chief economic Philip Lane said “we don’t think the recovery process is over”, and “growth will be pretty strong in 2022”. Tourist season will be “better next year” and bottlenecks “ultimately will be resolved.” Also, other factors include savings accumulated during the pandemic, the Next Generation EU fund, and the high vaccination rates.

The headaches about bottlenecks and higher energy prices are “not going to wipe out the underlying momentum of the recovery”. He added, “it is not only about getting back to where we were before the pandemic – it’s also about catching up to the growth that we should have had in 2020 and 2021. So there is still a lot of momentum in the system.”

“Inflation is unexpectedly high at the moment, but we do think it is going to fall next year,” he said. “we did talk about ‘inflation, inflation, inflation’, but this period of inflation is very unusual and temporary, and not a sign of a chronic situation. The situation we are in now is very different from the 1970s and 1980s.”

BoJ opinions: Important to persistently continue with extremely accommodative monetary policy

In the Summary of Opinions of BoJ’s October 27-28 meeting, it’s noted that because of low inflation, it’s important to persistently continue with extremely accommodative monetary policy even when pent-up demand increases.” Also, BoJ should “persistently continue with the current monetary easing” so that “a rise in corporate profits leads to wage increases and the virtuous cycle from income to spending intensifies.”

To “alleviate the effects of deterioration in the terms of trade”, it’s necessary to improve economic activity and raise inflation expectations so that “firms can smoothly pass on the rise in raw material prices to domestic selling prices.” It’s important to “improve the output gap” so that “the pass-through of price rises will be promoted..

Yen’s depreciation reflected “differences in inflation rates and monetary policy stances among economies.” It’s important to consider the impact of rise in international commodity prices and Yen’s depreciation. But, it is necessary to keep in mind that their effects on each economic entity are uneven depending on industry and size.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1530; (P) 1.1551; (R1) 1.1589; More…

EUR/USD’s recovery from 1.1512 continues today but outlook is unchanged. Intraday bias stays neutral first. Further decline is in favor as long as 1.1615 minor resistance holds. Break of 1.1512 will extend the pattern from 1.2348 to 61.8% projection of 1.1908 to 1.1523 from 1.1691 at 1.1453. Break will pave the way to 100% projection at 1.1306. On the upside, though, above 1.1615 minor resistance will dampen the bearish case and turn bias back to the upside for 1.1691 resistance.

In the bigger picture, price actions from 1.2348 should at least be a correction to rise from 1.0635 (2020 low). As long as 1.1908 resistance holds, deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Nevertheless break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 05:00 | JPY | Leading Economic Index Sep P | 99.7 | 99.9 | 101.3 | |

| 06:45 | CHF | Unemployment Rate Oct | 2.70% | 2.70% | 2.80% | |

| 09:30 | EUR | Eurozone Sentix Investor Confidence Nov | 18.3 | 18.6 | 16.9 |