The markets are generally quiet as FOMC tapering announcement is awaited. Major European indexes tread water while US futures are mixed. Global benchmark yields are trading lower for now. In the currency markets, Canadian and Dollar are both weakening mildly today. Stronger than expected ADP job report gives little support to the greenback. New Zealand Dollar and Sterling are strengthening. Gold continues to engage in range trading.

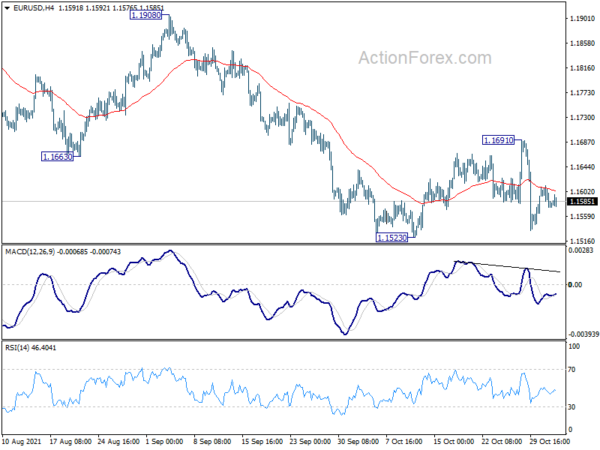

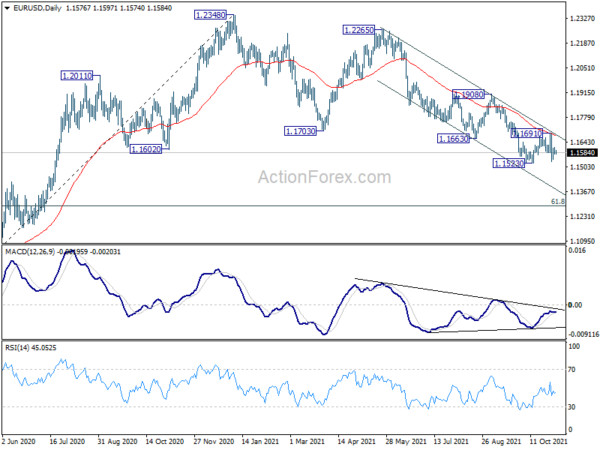

Technically, we’d pay most attention to EUR/USD’s reaction to Fed. For now, a downside breakout through 1.1523 support is favored. But break of 1.1691 resistance will be a sign of near term bullish reversal in the pair. At the same time, we’d also track Yen’s break out from range of 113.24/114.69 to confirm Dollar’s move.

In Europe, at the time of writing, FTSE is down -0.44%. DAX is up 0.01%. CAC is up 0.20%. Germany 10-year yield is down -0.006 at -0.166. Earlier in Asia, Hong Kong HSI dropped -0.30%. China Shanghai dropped -0.20%. Singapore Strait Times dropped -0.39%. Japan was on holiday.

Some previews on Fed:

- FOMC Preview – Tapering to Formally Begin

- FOMC Preview: It’s Time To Taper

- Fed Research Preview: Tapering, Yes, But How Fast?

- October Flashlight for the FOMC Blackout Period

US ADP jobs grew 571k, services led, large companies fueled

US ADP private employment grew 571k in October, above expectation of 400k. By company size, small businesses added 115k, medium businesses added 114, large businesses added 342k. By sector, goods-producing jobs grew 113k, service-providing jobs grew 458k.

“The labor market showed renewed momentum last month, with a jump from the third quarter average of 385,000 monthly jobs added, marking nearly 5 million job gains this year,” said Nela Richardson, chief economist, ADP. “Service sector providers led the increase and the goods sector gains were broad based, reporting the strongest reading of the year. Large companies fueled the stronger recovery in October, marking the second straight month of impressive growth.”

ECB Lagarde: Conditions for rate hike very unlikely to be satisfied next year

In speech, ECB President Christine Lagarde said, “in our forward guidance on interest rates, we have clearly articulated the three conditions that need to be satisfied before rates will start to rise.”

“Despite the current inflation surge, the outlook for inflation over the medium term remains subdued, and thus these three conditions are very unlikely to be satisfied next year,” she added.

She also noted, “market interest rates have risen over the past weeks, mainly as a result of greater market uncertainty about the inflation outlook, spillovers from abroad to policy rate expectations in the euro area, and some questions about the calibration of asset purchases in a post-pandemic world.

Eurozone unemployment rate dropped to 7.4% in Sep, EU down to 6.7%

Eurozone unemployment rate dropped to 7.4% in September, down from August’s 7.5, matched expectations. EU unemployment rate also dropped to 6.7%, down from 6.9%.

Eurostat estimates that 14.324 million men and women in the EU, of whom 12.079 million in the Eurozone, were unemployed in September. Compared with August, the number of unemployed decreased by 306 000 in the EU and by 255 000 in the euro area. Compared with September 2020, unemployment decreased by 2.054 million in the EU and by 1.919 million in the euro area.

UK PMI composite finalized at 57.8, cost inflation and prices charged accelerated up

UK PMI Services was finalized at 59.1 in October, up sharply from September’s 55.4. PMI Composite was finalized at 57.8, up from September’s 54.9. Markit said cost inflation accelerated to its strongest in over 25 years. Average prices charged also increased at survey-record pace.

Tim Moore, Economics Director at IHS Markit: “Looser international travel restrictions and greater domestic mobility helped to lift the UK service sector recovery out of its recent malaise in October. Business activity expanded at the fastest pace since July, driven by the first acceleration in new order growth for five months. The latest survey also pointed to the best month for export sales since June 2018.

“Tight labour market conditions persisted in October… Average prices charged increased at a survey-record pace, reflecting across the board pressures on operating expenses… Record rates of input price and output charge inflation appear to have dampened business optimism, which eased to its lowest since January.”

New Zealand unemployment dropped to record low 3.4% in Q3

New Zealand employment rose 2.0% qoq in Q3, much better than expectation of 0.4% qoq. Growth was largely driven by full-time jobs, which increased 2.3% qoq or 50k, while part-time jobs dropped slightly. Unemployment rate dropped sharply from 4.0% to 3.4%, better than expectation of 3.9%. The total employment matched the lowest level on record, reached last time in 2007. Labor force participation rate rose 0.7% to 71.2%.

“The fall in the unemployment rate is in line with reports of difficulty finding workers and high labour turnover, and continued travel restrictions on international arrivals, which put pressure on domestic labour supply,” work and wellbeing statistics senior manager Becky Collett said.

Australia AiG construction rose to 57.6, healthy leap in activity

Australia AiG Performance of Construction rose 4.3 pts to 57.6 in October. Looking at some details, activity rose 15.4 to 65.2. Employment dropped -0.2 to 56.8. New orders dropped -0.2 to 58.7. Supplier deliveries dropped -1.3 to 41.3. Input prices dropped -1.2 to 97.2. Selling prices dropped -0.5 to 78.3. Average wages dropped -1.5 to 75.1.

Ai Group Head of Policy, Peter Burn, said: “The healthy leap in activity levels across the Australian construction sector in October is a taste of what is expected to be a strong rebound for the broader economy over the next few months as New South Wales, Victoria and the ACT, liberated from COVID restrictions, catch up with the rest of the country and as barriers to the movement of people within Australia are removed.”

Also released building permits dropped -4.3% mom in September, versus expectation of -2.0% mom.

China Caixin PMI services rose to 53.8, composite rose to 51.5

China Caixin PMI Services rose to 53.8 in October, up from 53.4, above expectation of 53.6. PMI Composite ticked up to 51.5, from 51.4.

Wang Zhe, Senior Economist at Caixin Insight Group said: “As the number of new Covid-19 cases dropped from late September to the middle of October, related disruption faded and market demand recovered while supply was relatively weak. Manufacturing was significantly weaker than services.

“Supply strains became the paramount factor affecting the economy. Shortages of raw materials and soaring commodity prices, combined with electricity supply problems, created strong constraints for manufacturers. Those factors also had a significant impact on services enterprises.

“Input costs for manufacturers have risen much faster than their output prices for several months. The growth rate of input costs for service providers was also higher than that for prices they charged, putting pressure on downstream enterprises.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1565; (P) 1.1589; (R1) 1.1603; More…

EUR/USD is staying in range of 1.1523/1691 and intraday bias remains neutral. Further decline is expected as long as 1.1691 resistance holds. On the downside, break of 1.1523 will resume the fall from 1.2265, and that from 1.2348 too, for long term fibonacci level at 1.1289 next. However, firm break of 1.1691 will indicate short term bottoming and turn bias back to the upside for stronger rebound, towards 1.1908 resistance.

In the bigger picture, price actions from 1.2348 should at least be a correction to rise from 1.0635 (2020 low). As long as 1.1908 resistance holds, deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Nevertheless break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Oct | 57.6 | 53.3 | ||

| 21:45 | NZD | Employment Change Q3 | 2.00% | 0.40% | 1.00% | |

| 21:45 | NZD | Unemployment Rate Q3 | 3.40% | 3.90% | 4.00% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 0.70% | 0.80% | 0.90% | |

| 00:30 | AUD | Building Permits M/M Sep | -4.30% | -2.00% | 6.80% | 7.60% |

| 01:45 | CNY | Caixin Services PMI Oct | 53.8 | 53.6 | 53.4 | |

| 09:30 | GBP | Services PMI Oct F | 59.1 | 58 | 58 | |

| 10:00 | EUR | Unemployment Rate Sep | 7.40% | 7.40% | 7.50% | |

| 12:15 | USD | ADP Employment Change Oct | 571K | 400K | 568K | 523K |

| 13:45 | USD | Services PMI Oct F | 58.2 | 58.2 | ||

| 14:00 | USD | ISM Services PMI Oct | 62 | 61.9 | ||

| 14:00 | USD | ISM Services Employment Index Oct | 53.3 | 53 | ||

| 14:00 | USD | Factory Orders M/M Sep | -0.10% | 1.20% | ||

| 14:30 | USD | Crude Oil Inventories | 1.9M | 4.3M | ||

| 18:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |