Yen continues to be under selling pressure, following the strong rally in US stocks overnight. Yen is additionally weighed down by rally in treasury yields. New Zealand Dollar is leading commodity currencies higher, while Australian and Canadian Dollars are also strong. Euro and Sterling are mixed for the moment, with Sterling having a slight upper hand. Inflation data are the focuses today and could prompt further rally in the Pound as well as Loonie.

Technically, we’d expect the selloff in Yen ahead. In particular, the decline could accelerate if US stock indexes could breakout to new record highs in the coming days. DOW is now close to 35631.19 high and firm break there will resume the medium term up trend from 18213.65. Nevertheless, break of 35023.63 support will indicate rejection by 35631.19 and bring pull back. Yen crosses could also follow in this case too.

In Asia, at the time of writing, Nikkei is up 0.39%. Hong Kong HSI is up 1.31%. China Shanghai SSE is up 0.03%. Singapore Strait Times is up 0.01%. Japan 10-year JGB yield is up 0.0045 at 0.095. Overnight, DOW rose 0.56%. S&P 500 rose 0.74%. NASDAQ rose 0.71%. 10-year yield rose 0.051 to 1.635.

Fed Waller: More Aggressive policy response warranted if inflation continues to run high

Fed Governor Governor Christopher Waller warned in a speech that “the next several months are critical for assessing whether the high inflation numbers we have seen are transitory.” And, “if monthly prints of inflation continue to run high through the remainder of this year, a more aggressive policy response than just tapering may well be warranted in 2022.

He noted, “substantial further progress” towards employment and inflation was already made. He supports ” the FOMC beginning to reduce asset purchases following our meeting in November.” He emphasized that “this action should not tighten financial conditions” since a later 2021 tapering has already been priced in by most market participants. Also, he favored the tapering pace “that would result in the end of asset purchases by the middle of 2022”.

Waller didn’t expect rate hike to occur soon after completing tapering, as “the two policy actions are distinct”. But, if inflation staying “considerably above 2 percent well into 2022”, then he’d “favor liftoff sooner than I now anticipate.”

Australia Westpac leading index turned negative, but rebound expected ahead

Australia Westpac-MI Leading Index dropped from 0.5% to -0.5% in September. That’s the first negative reading since September 2020, which was the followed by strong surge after the economy moved out of lockdown. Westpac expects another strong rebound in the economy ahead as both Sydney and Melbourne are reopening this time too. It also expects the Australia economy to growth by 1.6% in Q4, building towards a 5.6% growth in H2 of 2022.

Westpac expects RBA to maintain current policy setting at the November 2 meeting, followed by tapering in February. The most important aspect of the November meeting will be whether RBA has lifted its inflation forecasts.

Japan exports rose 13% yoy in Sep, imports rose 38.6% yoy

Japan’s exports rose 13.0% yoy to JPY 6481B in September, above expectation of 11.0% yoy. Imports rose 38.6% yoy to JPY 7464B, above expectation of 34.4% yoy. Trade balance reported JPY -623B deficit, versus expectation of JPY -519B.

The weakening in exports could be partly attributed to the -40.3% yoy decline in car shipments, first in seven months. But the situation is expected to improve as supply bottlenecks are solved. Shipment to China grew 10.3% yoy, led by semiconductors and plastic materials. Shipment to the US dropped -3.3% yoy, on cars and airplanes.

In seasonally adjusted terms, exports dropped -3.9% mom to JPY 6750B. Imports rose 0.2% mom to JPY 7375B. Trade deficit came in at JPY -625B.

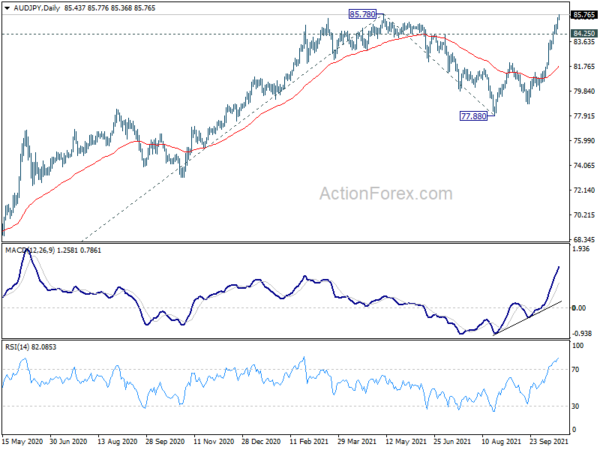

AUD/JPY pressing 85.78 high, ready for up trend resumption

AUD/JPY rises further today, following the strong close in US stocks overnight, as well as rally in treasury yields. It’s now pressing 85.78 high and decisive break there will resume whole up trend from 59.85 (2020 low). Such development would align the outlook with CAD/JPY and NSD/JPY, which complete the upside breakout last week already.

The up trend would then extend to 61.8% projection of 59.85 to 85.78 from 77.88 at 93.90 in the medium term. This bullish case will now be favored as long as 84.25 minor support holds.

Looking ahead

Inflation data will be the major focuses today. UK will release CPI, PI and PPI. Germany will release PPI. Eurozone will release CPI final. Canada will also release CPI. US will release Fed’s Beige Book report.

USD/JPY Daily Outlook

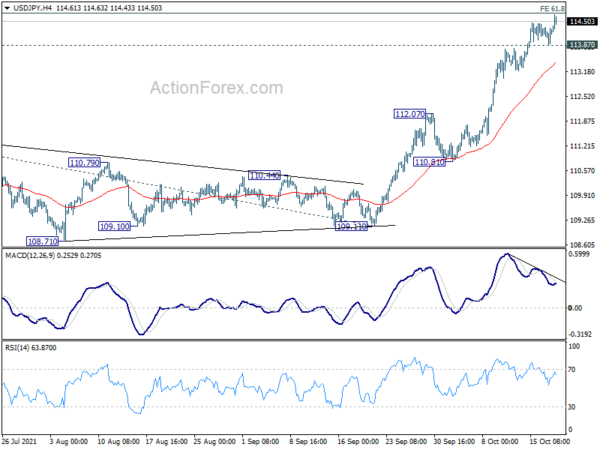

Daily Pivots: (S1) 114.05; (P) 114.23; (R1) 114.56; More…

USD/JPY’s rally continued and hit as high as 114.69 so far. Intraday bias stays on the upside at this point. Firm break of 61.8% projection of 102.58 to 111.65 from 109.11 at 114.71 will pave the way to 100% projection at 118.18 next. However considering bearish divergence condition in 4 hour MACD, break of 113.87 minor support should indicate short term topping, and turn bias to the downside for deeper pull back, to 4 hour 55 EMA (now at 113.42) and below.

In the bigger picture, corrective decline from 118.65 (2016 high) should have completed at 101.18 already. Rise from the 102.58 is seen as the third leg of the up trend from 101.18. Next target is 114.54 resistance and then 118.65 high. This will now be the preferred case as long as 109.11 support hold, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Sep | 0.00% | -0.30% | ||

| 23:50 | JPY | Trade Balance (JPY) Sep | -0.62T | -0.53T | -0.27T | -0.34T |

| 06:00 | EUR | Germany PPI M/M Sep | 1.00% | 1.50% | ||

| 06:00 | EUR | Germany PPI Y/Y Sep | 12.70% | 12.00% | ||

| 06:00 | GBP | CPI M/M Sep | 0.40% | 0.70% | ||

| 06:00 | GBP | CPI Y/Y Sep | 3.20% | 3.20% | ||

| 06:00 | GBP | Core CPI Y/Y Sep | 3.10% | 3.10% | ||

| 06:00 | GBP | RPI M/M Sep | 0.20% | 0.60% | ||

| 06:00 | GBP | RPI Y/Y Sep | 4.70% | 4.80% | ||

| 06:00 | GBP | PPI Input M/M Sep | 0.80% | 0.40% | ||

| 06:00 | GBP | PPI Input Y/Y Sep | 11.60% | 11.00% | ||

| 06:00 | GBP | PPI Output M/M Sep | 0.90% | 0.70% | ||

| 06:00 | GBP | PPI Output Y/Y Sep | 6.80% | 5.90% | ||

| 06:00 | GBP | PPI Core Output M/M Sep | 0.90% | 1.00% | ||

| 06:00 | GBP | PPI Core Output Y/Y Sep | 5.80% | 5.30% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Aug | 24.3B | 21.6B | ||

| 09:00 | EUR | Eurozone CPI Y/Y Sep F | 3.40% | 3.40% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep F | 1.90% | 1.90% | ||

| 12:30 | CAD | CPI M/M Sep | 0.10% | 0.20% | ||

| 12:30 | CAD | CPI Y/Y Sep | 4.30% | 4.10% | ||

| 12:30 | CAD | CPI Common Y/Y Sep | 1.90% | 1.80% | ||

| 12:30 | CAD | CPI Median Y/Y Sep | 2.60% | 2.60% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Sep | 3.30% | 3.30% | ||

| 14:30 | USD | Crude Oil Inventories | 2.1M | 6.1M | ||

| 18:00 | USD | Fed’s Beige Book |