Dollar firms up mildly in early US session as headline CPI was back at multi-decade high, which core CPI remains stubbornly strong. The gain in the greenback is so far limited. Overall markets continue to trade in consolidative mode, with mild weakness seen in commodity currencies while Swiss Franc and Euro are rebounding. Next focus is FOMC minutes, but they are unlikely to unveil anything spectacular, other than that Fed is ready to start tapering by the end of the year.

Technically, as Dollar is trying to recover, we’ll look at 1.3542 minor support in GBP/USD and 0.7287 minor support in AUD/USD. Break of these level could be a sign that Dollar buying is back. If that happens, we’d also have to seen if EUR/USD would reaccelerate down, while USD/JPY reaccelerates up, to confirm.

In Europe, at the time of writing, FTSE is down -0.03%. DAX is up 0.56%. CAC is up 0.28%. Germany 10-year yield is down -0.032 at -0.114. Earlier in Asia, Nikkei dropped -0.32%. China Shanghai SSE rose 0.42%. Singapore Strait Times rose 1.43%. Japan 10-year JGB yield dropped -0.0060 to 0.090.

US CPI ticked up to 5.4% yoy in Sep, CPI core unchanged at 4.0% yoy

US CPI rose 0.4% mom in September, above expectation of 0.3% mom. CPI core rose 0.2% mom, matched expectations. For the 12-month period, CPI ticked up to 5.4% yoy, above expectation of 5.3% yoy. It’s back at the highest level since January 1991. CPI core was unchanged at 4.0% yoy, matched expectations.

Eurozone industrial production dropped -1.6% mom in Aug, EU down -1.5% mom

Eurozone industrial production dropped -1.6% mom in August, matched expectations. Production of capital goods fell by -3.9%, durable consumer goods by -3.4%, intermediate goods by -1.5% and non-durable consumer goods by -0.8%, while production of energy rose by 0.5%.

EU industrial production dropped -1.5% mom. Among Member States for which data are available, the largest monthly decreases were registered in Malta (-6.3%), Germany and Estonia (both -4.1%) and Slovakia (-3.8%). The highest increases were observed in Denmark (+3.5%), Lithuania (+2.9%) and Luxembourg (+2.1%).

NIESR expects UK GDP to grow 1.5% in Q3, 0.8% in Q4

NIESR said supply constraints are growing and likely to persist through in Autumn. It forecasts UK GDP to grow 1.5% in Q3, followed by 0.8% in Q4. That included an estimated 0.4% mom growth in GDP in September.

Rory Macqueen Principal Economist, NIESR: “The reopening of the economy continued to support growth in August, with the popularity of domestic holidays contributing to 23 per cent month-on-month growth for hotels and campsites in particular. The fact that consumer-facing services remain 5 per cent below their peak suggests ample room for future catch-up in future too. Elsewhere a further fall in construction output may have been down in part to a reported increase in input costs: something likely to affect the economy more broadly if shortages lead to more generalised price rises over the autumn. The coming months could see something of a two-speed recovery, with sectors most affected by shortages in decline while others continue to recover.”

UK GDP grew 0.4% mom in Aug, still -0.8% below pre-pandemic level

UK GDP grew 0.4% mom in August, slightly below expectation of 0.5% mom. Services grew 0.3%. Production rose 0.8% mom. Construction contracted by -0.2% mom. In the three months to August, GDP grew 2.9% 3mo3m, mainly due to the performance of services, largely reflects gradual reopening.

Comparing to pre-pandemic levels in February 2020, overall GDP was still down -0.8%. Services was down -0.6%. Production was down -1.3%. Manufacturing was down -2.4%. Construction was down -1.5%.

Also from the UK, goods trade deficit widened to GDP -14.9B in August, versus expectation of GBP -11.9B.

Australia Westpac consumer sentiment dropped to 104.6, still more optimists

Australia Westpac-Melbourne Institute consumer sentiment dropped -1.5% to 104.6 in October, down from September’s 106.2. There continued to be a clear majority of optimists nationally, even at state level – NSW (103.4); Victoria (105.4); Queensland (105.3) and Western Australia (105.4).

Westpac expects RBA to “almost certainly maintain its policy settings” at November 2 meeting. Instead, the next change is likely to be another round of tapering in February. Looking forward, Westpac expects a rate hike in Q2 of 2023, while RBA has repeated said the conditions of hike won’t be met until 2024.

New Zealand ANZ business confidence dropped slightly to -8.6 in Oct

New Zealand ANZ business confidence dropped slightly to -8.6 in October’s preliminary reading, down from September’s -7.2. Own activity outlook rose strongly from 18.2 to 26.2. Export intentions rose from 7.4 to 9.2. Investment intentions rose from 9.2 to 14.3. Employment intentions dropped from 14.1 to 12.1. Cost expectations rose form 84.2 to 84.9. Inflation expectations also ticked up from 3.02% to 3.04%.

ANZ said the survey is telling a story of “remarkable resilience”, with most forward-looking activity indicators holding up or improving. Inflation pressures remain “intense” and cost pressures are “extreme”.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.15; (P) 113.47; (R1) 113.93; More…

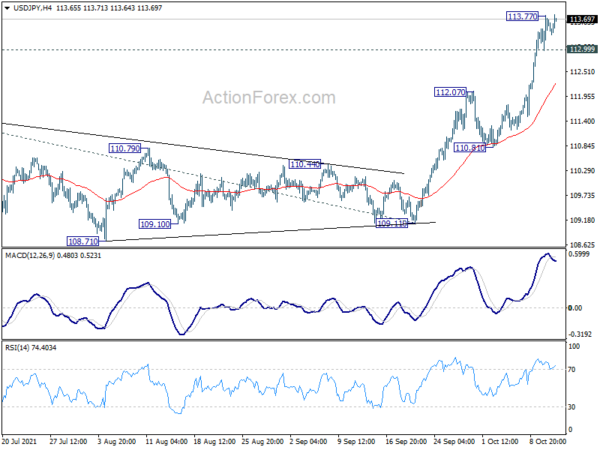

Intraday bias in USD/JPY is back on the upside as it’s trying to resume recent rally after brief retreat. The up trend from 102.58 should target 61.8% projection of 102.58 to 111.65 from 109.11 at 114.71. Firm break there will target 100% projection at 118.18 next. On the downside, break of 112.99 minor support will turn intraday bias neutral and bring consolidations again. But strong support should be seen above 112.07 to bring rise resumption.

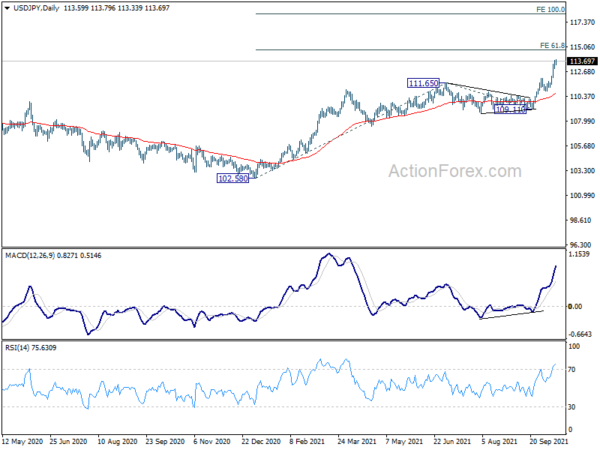

In the bigger picture, corrective decline from 118.65 (2016 high) should have completed at 101.18 already. Rise from the 102.58 is seen as the third leg of the up trend from 101.18. Next target is 114.54 resistance and then 118.65 high. This will now be the preferred case as long as 108.71 support hold, even in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | -1.50% | 2.00% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 4.20% | 4.20% | 4.70% | |

| 23:50 | JPY | Machinery Orders M/M Aug | -2.40% | 1.60% | 0.90% | |

| 03:00 | CNY | Trade Balance (USD) Sep | 66.8B | 47.2B | 58.3B | |

| 03:00 | CNY | Exports (USD) Y/Y Sep | 28.10% | 21.50% | 25.60% | |

| 03:00 | CNY | Imports (USD) Y/Y Sep | 17.60% | 19.20% | 33.10% | |

| 03:00 | CNY | Trade Balance (CNY) Sep | 433B | 323B | 376B | |

| 03:00 | CNY | Exports (CNY) Y/Y Sep | 19.90% | 17.10% | 15.70% | |

| 03:00 | CNY | Imports (CNY) Y/Y Sep | 10.10% | 22.30% | 23.10% | |

| 06:00 | EUR | Germany CPI M/M Sep F | 0.00% | 0.00% | 0.00% | |

| 06:00 | EUR | Germany CPI Y/Y Sep F | 4.10% | 4.10% | 4.10% | |

| 06:00 | GBP | GDP M/M Aug | 0.40% | 0.50% | 0.10% | -0.10% |

| 06:00 | GBP | Industrial Production M/M Aug | 0.80% | 0.40% | 1.20% | 0.30% |

| 06:00 | GBP | Industrial Production Y/Y Aug | 3.70% | 3.00% | 3.80% | 4.40% |

| 06:00 | GBP | Manufacturing Production M/M Aug | 0.50% | 0.00% | 0.00% | -0.60% |

| 06:00 | GBP | Manufacturing Production Y/Y Aug | 4.10% | 6.00% | 6.00% | 6.10% |

| 06:00 | GBP | Goods Trade Balance (GBP) Aug | -14.9B | -11.9B | -12.7B | |

| 09:00 | EUR | Eurozone Industrial Production M/M Aug | -1.60% | -1.60% | 1.50% | -1.40% |

| 12:30 | USD | CPI M/M Sep | 0.40% | 0.30% | 0.30% | |

| 12:30 | USD | CPI Y/Y Sep | 5.40% | 5.30% | 5.30% | |

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Sep | 4.00% | 4.00% | 4.00% | |

| 18:00 | USD | FOMC Minutes |