Market sentiment took a big turn overnight with strong rally in US indexes. Nikkei follows in Asia and reclaimed 30k handle, but other Asian markets are soft. Yen dropped notably following return of risk appetite while Dollar also weakened. On the other hand, commodity currencies rebounded notably. Yen is now the worst performing one for the week, followed by Sterling. Swiss Franc is the strongest followed by Canadian. But the picture could change before weekly close.

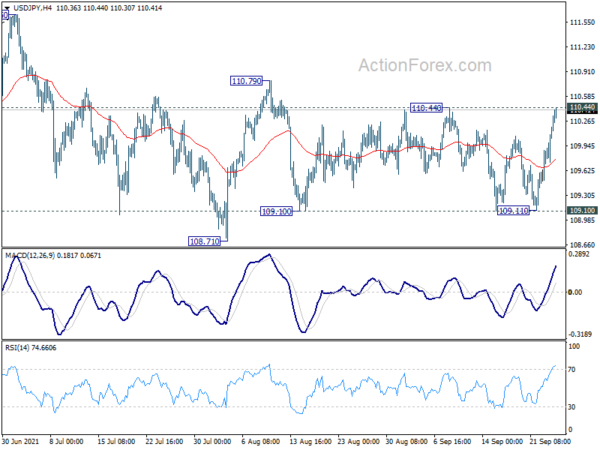

Technically, a focus is now on whether Yen’s selloff would extend further immediately. In particular, break of 110.44 resistance in USD/JPY will be a strong sign of bullish range breakout. Further break of 110.79 resistance would pave the way to retest 111.65 high. Such development, if happens, could be accompanied by break of 130.73 resistance in EUR/JPY, and 152.85 resistance in GBP/JPY.

In Asia, at the time of writing, Nikkei is up 2.01%. Hong Kong HSI is down -0.03%. China Shanghai SSE is down -0.07%. Singapore Strait Times is down -0.12%. Japan 10-year JGB yield is up 0.0142 at 0.050. Overnight, DOW rose 1.48%. S&P 500 rose 1.21%. NASDAQ rose 1.04%. 10-year yield rose 0.074 to 1.410.

Japan PMI manufacturing dropped to 51.2 in Sep, services rose to 47.4

Japan’s PMI Manufacturing dropped from 52.7 to 51.2 in September, below expectation of 52.5. PMI Services rose from 42.9 to 47.4. PMI Composite also rose from 45.5 to 47.7.

Usamah Bhatti, economist at IHS Markit said: “The pace of decline was softer than that seen in August, as the larger services sector saw a considerable easing in the rate of contraction… Input prices across the private sector rose at the fastest pace for 13 years, with businesses attributing the rise to higher raw material, freight and staff costs amid supply shortages.”

Also from Japan, CPI core (all items ex fresh food) rose from -0.2% to 0.0% yoy in August, matched expectations. Headline CPI (all items) dropped from -0.3% yoy to -0.4% yoy. CPI core-core (all items ex fresh food and energy) improved from -0.6% yoy to -0.5% yoy.

New Zealand: Record monthly trade deficit as imports surged

New Zealand goods exports dropped -0.9% yoy to NZD 4.4B in August. Goods imports rose 38.0% yoy to NZD 6.5B. Trade deficit came in at record NZD -2.1B, versus expectation of NZD 110m surplus.

Exports to top trading partners were mixed, up 12% to China and 5.9% to Japan, but down -9.1% to Australia, -11% to US and -12% to EU. Imports from all top trading partners were up, from China up 40%, from EU up 42%. from Australia up 19%, from USA up 15%, and from Japan up 83%.

“This is a larger deficit than normal because of higher values for imports, particularly vehicles, continuing the trend observed over the last few months. August is also the month when we typically see lower values for dairy exports,” international trade manager Alasdair Allen said.

UK Gfk consumer confidence dropped to -13 in Sep, consumers slamming on the brakes

UK Gfk consumer confidence dropped form -8 to -13 in September, with all measures down. In particular, general economic situation over the next 12 months dropped sharply from -6 to -16.

Joe Staton, Client Strategy Director GfK, comments: “On the back of concerns about rising prices for fuel and food, the growth in headline inflation, tax hikes, empty shelves and the end of the furlough scheme, September sees consumers slamming on the brakes as those already in economic hardship anticipate a potential cost of living crisis.

Looking ahead

Germany Ifo business climate is the main feature today while US will release new home sales. Attention will also be on Fed Chair Jerome Powell’s comment but he’s unlikely to deviate from what he said at the post FOMC press conference just two days ago.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.94; (P) 110.14; (R1) 110.54; More…

USD/JPY’s rebound from 109.11 extends higher today and focus is now immediately on 110.44 resistance. Firm break there will argue that consolidation pattern from 111.65 might have finally completed. Stronger rise would be seen through 110.79 to retest 111.65 high. On the downside, though, break of 109.10 will argue that larger fall from 111.65 is resuming. Deeper decline should then be seen to 108.71 support first, and then 38.2% retracement of 102.58 to 111.65 at 108.18 next.

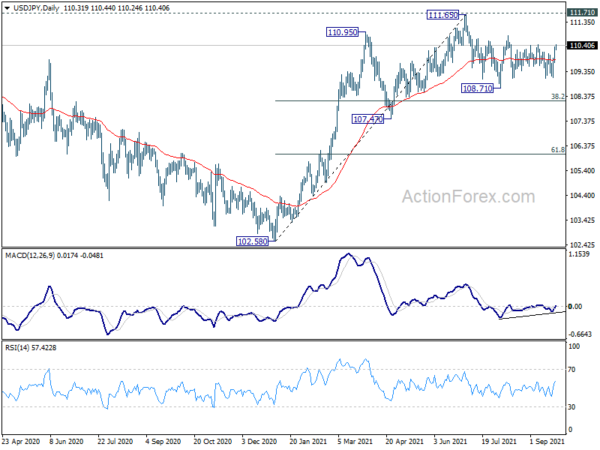

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Aug | -2144M | 110M | -402M | -397M |

| 23:01 | GBP | GfK Consumer Confidence Sep | -13 | -7 | -8 | |

| 23:30 | JPY | National CPI Core Y/Y Aug | 0.00% | 0.00% | -0.20% | |

| 00:30 | JPY | Manufacturing PMI Sep P | 51.2 | 52.5 | 52.7 | |

| 08:00 | EUR | Germany IFO Business Climate Sep | 100.4 | 99.4 | ||

| 08:00 | EUR | Germany IFO Current Assessment Sep | 100.8 | 101.4 | ||

| 08:00 | EUR | Germany IFO Expectations Sep | 100 | 97.5 | ||

| 14:00 | USD | New Home Sales Aug | 708K | 708K |