Yen jumps broadly in Asian session today as Hong Kong stocks are accelerating its free fall. Dollar is following as the second strongest for now, and then Swiss Franc. Commodity currencies are naturally the weakest, as led by Australian Dollar, but Sterling is not too far away. Four central banks will meet this week. In particular, traders could be turning more cautious towards FOMC policy decision and economic projections. While an announcement of tapering is very unlikely, there is scope of some hawkish surprises.

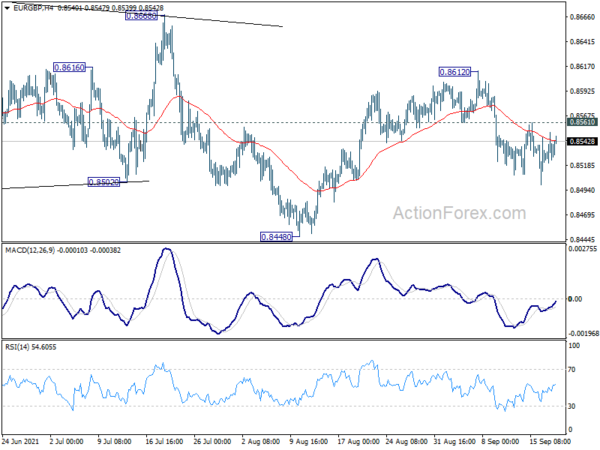

Technically, Sterling appears to be underperforming Euro today, but that’s mainly because Euro was the worse one last week. A development is note is whether the tide between Sterling and Euro is turning as risk sentiment turns sour. For now, deeper fall is in favor in EUR/GBP as long as 0.8561 minor resistance holds. But break of this resistance will bring stronger rise to 0.8612, and possibly resume the rebound from 0.8448 low.

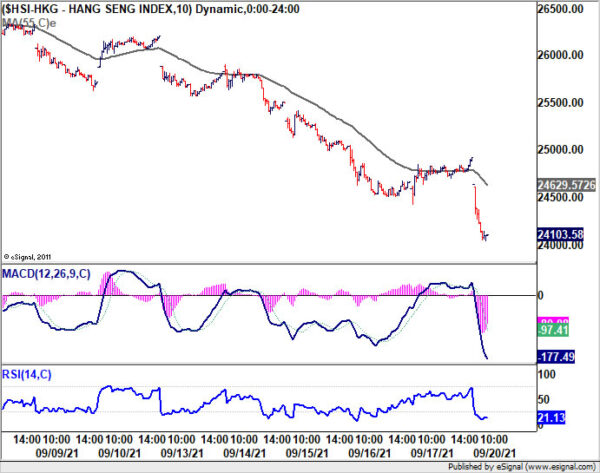

In Asia, Japan and China are on holiday. Hong Kong HSI is down -4.13%. Singapore Strait Times is down -0.33%.

Hong Kong HSI takes another beating as selloff in property stocks spreads

Asian markets are trading in risk-off mode, as Hong Kong stocks are taking another beating while Japan and China are on holiday. Selloff in shares of the troubled Chinese giant Evergrande Group is spreading to other property stocks. The group has just announced over the weekend to start repaying its wealth management products with real estates.

At the time of writing, Hong Kong HSI is down more than -4% or -1000 pts. As for the near term, 61.8% projection of 29394.68 to 24748.84 from 26560.03 at 23688.90 would be an important level to defend this week. Some support could be seen there to bring at least some consolidations first. However, any further downside acceleration could easy push HSI through the level to 100% projection at 21914.19. That’s a possible scenario considering the FOMC event risk this week.

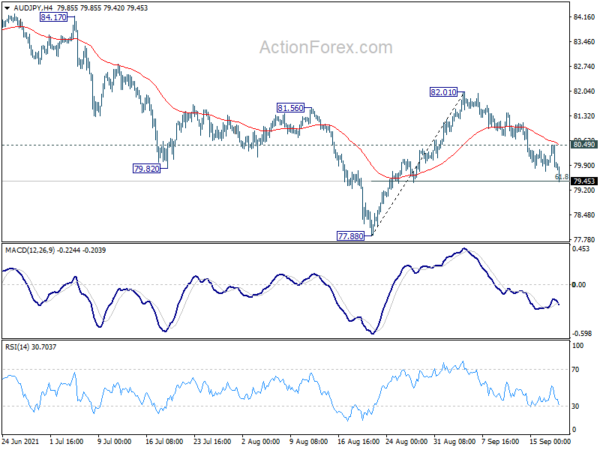

AUD/JPY extends decline on risk aversion, could target a test on 77.88 support first

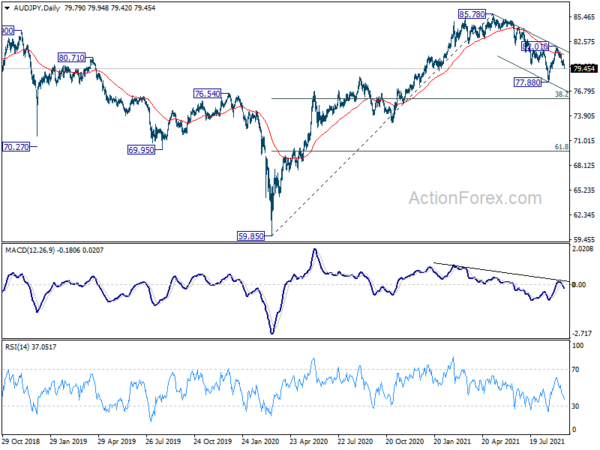

AUD/JPY’s fall from 82.01 resumes today on general risk-off sentiments in Asian markets. For now, further decline is expected as long as 80.49 minor resistance holds. Sustained trading below 61.8% retracement of 77.88 to 82.01 at 79.45 will raise the chance that it’s indeed ready to resume whole decline from 85.78 high. Retest of 77.88 low should be seen first.

As the fall from 85.78 is now seen as a correction to up trend from 59.85, break of 77.88 would pave the way to 38.2% retracement of 59.85 to 85.78 at 75.87 next. Such development, if happens, could be a prelude in similar selloff in other Yen crosses.

Jam-packed week with BoJ, Fed, SNB and BoE

Four central banks will meet this week, BoJ, Fed, SNB and BoE. BoJ would be a non-event as there is no ground for scaling back stimulus given that the country was still in deflation. Upcoming leadership election of the ruling Liberal Democratic Party would be more crucial in determine how LDP would perform in the general election just two months away, and thus the impact on the markets. SNB will also stand pat and maintain that Franc remains high while negative rates and intervention are necessary. Meanwhile, BoE is also not expected to make any change in monetary policy and rhetorics, at least until November’s new economic forecasts.

September seems not the time for Fed to announce tapering yet, based on the disappointing August NFP numbers. Yet, recent upbeat data keep Fed on track for a decision later in the year. Chair Jerome Powell has this great opportunity to prepare the markets for a November announcement, and that’s what markets are eager to hear too. Additionally, Fed will release new economic projection, and eyes will be on whether policymakers would pull ahead the expected first hike from 2023 to 2022.

In addition to the above, RBA will release meeting minutes. ECB will publish the monthly economic bulletin. Focuses will also be on PMIs from Australia, UK, Eurozone, US and Japan, as well a German Ifo business climate. Overall a jam-packed week and here are some highlights:

- Monday: UK Rightmove house price; Germany PPI; US NAHB housing index.

- Tuesday: RBA minutes; Swiss trade balance; UK public sector net borrowing; Canada new housing price index; US building permits and housing starts, current account.

- Wednesday: BoJ rate decision SNB quarterly bulletin; Eurozone consumer confidence; FOMC rate decision, US existing home sales.

- Thursday: Australia PMIs; Eurozone PMIs, ECB monthly bulletin; SNB rate decision; BoE rate decision; UK PMIs; Canada retail sales; US jobless claims, PMIs, leading index.

- Friday: New Zealand trade balance; Japan CPI, PMI manufacturing; Germany import prices, Ifo business climate; US new home sales.

GBP/JPY Daily Outlook

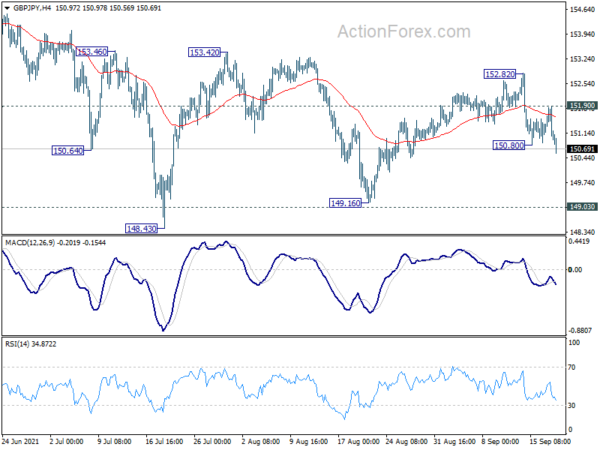

Daily Pivots: (S1) 150.65; (P) 151.29; (R1) 151.61; More…

GBP/JPY’s fall from 152.82 resumes today by breaking 150.80 temporary low. Intraday bias is back on the downside, and deeper fall would be seen to retest 148.43/149.16 key support zone. Decisive break there will carry larger bearish implications. On the upside, above 151.90 minor resistance will turn bias back to the upside for 152.82 resistance instead.

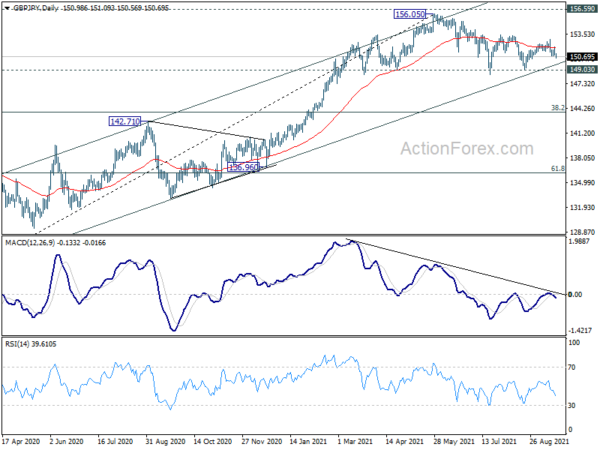

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). As long as 149.03 support holds, such rise would still resume at a later stage. However, sustained break of 149.03 support will indicate rejection by 156.59. Fall from 156.05 would be at least correcting the whole rise from 123.94. Deeper fall would be seen back 38.2% retracement of 123.94 to 156.05 at 143.78 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Sep | 0.30% | -0.30% | ||

| 06:00 | EUR | Germany PPI M/M Aug | 0.80% | 1.90% | ||

| 06:00 | EUR | Germany PPI Y/Y Aug | 9.20% | 10.40% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 75 | 75 |