The impact of slowing in US inflation was rather short-lived as major indexes turned red after initial rise. Sentiment is further weighed down by poor retail sales data from China. Yen notably overnight on mild risk-off sentiment while Dollar also regained some ground. On the other hand, Australian and New Zealand Dollar resumed recent near term decline. As for the week, Yen is currently the strongest one, followed by Canadian. Aussie and Kiwi are the worst performing. Focus will now turn to CPI from UK and Canada.

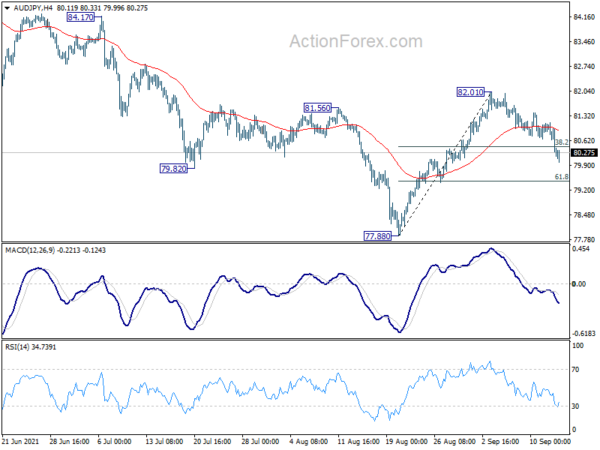

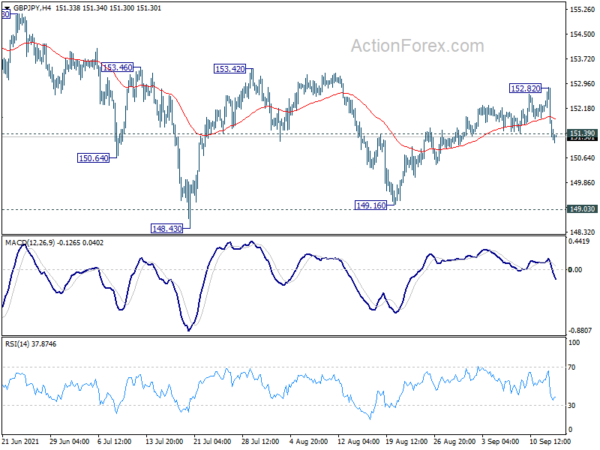

Technically, AUD/JPY is the biggest mover for the week for far. 38.2% retracement of 77.88 to 82.01 at 80.43 was taken out as fall from 82.01 extended. Deeper decline is now in favor as long as 4 hour 55 EMA holds. Further break of 61.8% retracement at 79.45 could pave the way to retest 77.88 low. In addition, EUR/JPY’s break of 129.57 support opens the way to retest 127.91 low. GBP/JPY’s break of 151.39 support could also bring retest of 149.16 low. A focus is on whether USD/JPY would also break out from near term range, to the downside.

In Asia, at the time of writing, Nikkei is down -0.38%. Hong Kong HSI is down -0.95%. China Shanghai SSE is up 0.31%. Singapore Strait Times is down -0.65%. Japan 10-year JGB yield dropped -0.0062 to 0.039. Overnight, DOW dropped -0.84%. S&P 500 dropped -0.57%. NASDAQ dropped -0.45%. 10-year yield dropped -0.047 to 1.277.

China retail sales grew only 2.8% yoy in Aug, way below expectation

China retail sales growth slowed sharply to 2.8% yoy in August , down from July’s 8.5% yoy, well below expectation of 7.1% yoy. China industrial production growth slowed further to 5.3% yoy, below expectation of 5.8% yoy. Fixed asset investment rose 8.9% ytd yoy, below expectation of 9.1%.

In a released, the National Bureau of Statistics said, “generally speaking, in August, the national economy maintained the trend of recovery. However, we must be aware that the international environment is still complicated and severe. At home, it has been felt that the sporadic outbreak of COVID-19 and natural disasters such as floods had caused impact on the economy, and the foundation for the economic recovery still needs to be consolidated”.

Australia Westpac consumer sentiment rose to 106.2, strong resilient despite lockdown

Australia Westpac-MI consumer sentiment rose 2.0% to 106.2 in September. The index remained comfortably above the levels five years prior to the pandemic. Confidence in New South Wales rose 5.3% while Victoria was steady at 104.1, despite extended lockdown in both states. Queensland jumped 8.4% to 111.6. Overall, the data indicates strong resilience of consumer sentiment and positives reactions to vaccination progresses.

Westpac added that given that RBA has already defer the next review of the asset purchase program to February, it’s highly unlikely that there will be any policy changes before that meeting. Nevertheless, it added, “with the US Federal Reserve likely to have begun its tapering program by then and the economy likely to be bouncing back as high vaccination levels see easing restrictions, we expect the Board to further taper its bond purchases in February.”

OECD downgrades Australia growth forecast, urge broad RBA review

In the latest Economy Survey of Australia, OECD downgraded the country’s GDP growth to 4.0% in 2021 and 3.3% in 2022, from May’s forecast of 5.1% and 3.4% respectively. It said the upcoming post-restriction recovery may be “more gradual than in past episodes”, as it will “occur in an environment of higher virus transmission”. COVID-19 outbreaks in other states than New South Wales and Victoria, could deepen the economic shock. “Any ratcheting up of tensions with China could further weaken trade activity.”

OECD also pointed out that underlying inflation has undershot RBA’s target band for an extended period of time. It suggested that RBA should “conduct a monetary policy framework review that is broad in scope, transparent and involves consultation with a wide variety of relevant stakeholders.”

In response, Treasurer Josh Frydenberg said, “it’s something I will give consideration to in terms of looking at the RBA, looking at the monetary policy settings and learning from the experience through the pandemic. The RBA has performed very well through this crisis, its policy response has been in sync and coordinated with the government’s fiscal response.”

Looking ahead

UK CPI, RPI and PPI will be released in European session while Eurozone industrial production will be featured. Later in the day, Canada CPI will take center stage. US will release Empire State manufacturing, import price index and industrial production.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 150.90; (P) 151.88; (R1) 152.42; More…

GBP/JPY’s break of 151.39 minor support argues that rebound from 149.16 has completed at 152.82, well ahead of 153.42 resistance. Intraday bias is back on the downside for 148.43/149.16 support zone. Decisive break there will resume whole decline from 156.05 high, and carry larger bearish implications. On the upside, though, break of 152.82 will resume the rebound to 153.42 near term structural resistance.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). As long as 149.03 support holds, such rise would still resume at a later stage. However, sustained break of 149.03 support will indicate rejection by 156.59. Fall from 156.05 would be at least correcting the whole rise from 123.94. Deeper fall would be seen back 38.2% retracement of 123.94 to 156.05 at 143.78 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q2 | -1.40B | -2.15B | -2.90B | -3.19B |

| 23:50 | JPY | Machinery Orders M/M Jul | 0.90% | 3.10% | -1.50% | |

| 00:30 | AUD | Westpac Consumer Confidence Sep | 2.00% | -4.40% | ||

| 02:00 | CNY | Retail Sales Y/Y Aug | 2.50% | 7.10% | 8.50% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Aug | 8.90% | 9.10% | 10.30% | |

| 02:00 | CNY | Industrial Production Y/Y Aug | 5.30% | 5.80% | 6.40% | |

| 06:00 | GBP | CPI M/M Aug | 0.50% | 0.00% | ||

| 06:00 | GBP | CPI Y/Y Aug | 2.90% | 2.00% | ||

| 06:00 | GBP | Core CPI Y/Y Aug | 2.90% | 1.80% | ||

| 06:00 | GBP | RPI M/M Aug | 0.30% | 0.50% | ||

| 06:00 | GBP | RPI Y/Y Aug | 4.60% | 3.80% | ||

| 06:00 | GBP | PPI Input M/M Aug | 0.20% | 0.80% | ||

| 06:00 | GBP | PPI Input Y/Y Aug | 10.30% | 9.90% | ||

| 06:00 | GBP | PPI Output M/M Aug | 0.40% | 0.60% | ||

| 06:00 | GBP | PPI Output Y/Y Aug | 5.40% | 4.90% | ||

| 06:00 | GBP | PPI Core Output M/M Aug | 0.70% | |||

| 06:00 | GBP | PPI Core Output Y/Y Aug | 3.90% | |||

| 08:30 | GBP | DCLG House Price Index Y/Y Jul | 12.40% | 13.20% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | 0.50% | -0.30% | ||

| 12:30 | CAD | CPI M/M Aug | 0.10% | 0.60% | ||

| 12:30 | CAD | CPI Y/Y Aug | 3.20% | 3.70% | ||

| 12:30 | CAD | CPI Common Y/Y Aug | 1.70% | 1.70% | ||

| 12:30 | CAD | CPI Median Y/Y Aug | 2.60% | 2.60% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 3.10% | 3.10% | ||

| 12:30 | USD | NY Empire State Manufacturing Index Sep | 17.1 | 18.3 | ||

| 12:30 | USD | Import Price Index M/M Aug | 0.30% | 0.30% | ||

| 13:15 | USD | Industrial Production M/M Aug | 0.40% | 0.90% | ||

| 13:15 | USD | Capacity Utilization Aug | 76.30% | 76.10% | ||

| 14:30 | USD | Crude Oil Inventories | -3.6M | -1.5M |