Commodity currencies are trading generally lower in Asia today, with pull back in Japanese stocks in the background. Canadian Dollar is also soft after BoC’s rate decision overnight. Dollar, Yen and Swiss Franc are trading mildly firmer, extending this week’s rebound. Euro is following closely, but momentum is starting to diminish, as focus turns to ECB today.

Technically, Euro will be a major focus today and we’ll pay attention to some minor support levels, including 1.1792 support in EUR/USD. 0.8561 support in EUR/GBP, and 1.0843 support in EUR/CHF. These levels need to be violated together to indicate a broad based selloff in Euro. Otherwise, even if EUR/USD would dip deeper, Euro would just be considered in mixed trading.

In Asia, at the time of writing, Nikkei is down -0.68%. Hong Kong HSI is down -1.83%. China Shanghai SSE is up 0.12%. Singapore Strait Times is up 0.19%. Japan 10-year JGB yield is down -0.0028 at 0.043. Overnight, DOW dropped -0.20%. S&P 500 dropped -0.13%. NASDAQ dropped -0.57%. 10-year yield dropped -0.036 to 1.344.

Fed Williams: It could be appropriate to start tapering this year

New York Fed President John Williams said, “assuming the economy continues to improve as I anticipate, it could be appropriate to start reducing the pace of asset purchases this year.” He added, “I will be carefully assessing the incoming data on the labor market and what it means for the economic outlook, as well as assessing risks such as the effects of the delta variant.”

“I think it’s clear that we have made substantial further progress on achieving our inflation goal,” Williams said. “There has also been very good progress toward maximum employment, but I will want to see more improvement before I am ready to declare the test of substantial further progress being met.”

Fed Beige Book: Economic growth downshifted slightly

In the Beige Book economic report, Fed said that “economic growth downshifted slightly to a moderate pace in early July through August”. The deceleration in activity was “largely attributable to a pullback in dining out, travel, and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions.” Other sectors were “constrained by supply disruptions and labor shortages, as opposed to softening demand”

All Districts continued to report “rising employment overall”. All Districts noted “extensive labor shortages that were constraining employment”. A number of Districts reported an “acceleration in wages”, with several noted “particularly brisk wage gains among lower-wage workers”. Inflation was “steady at a elevated pace”. Several Districts indicated that businesses anticipate “significant hikes in their selling prices in the months ahead”.

ECB to adjust PEPP and publishes new forecasts

ECB meeting will be a focus today and attention will mainly be on the PEPP purchase plan in Q4. The pace of purchases was significantly higher in Q2 and Q3. But with improvement in economic activities, as well as financing conditions, it’s time for the central bank to re-calibrate the program. Chief Economist Philip Lane sounded cautious as he indicated there could be a “local adjustment” of the program but not a “pure taper situation”. The plan for the emergency purchase program beyond the end date of March 2022 is probably still a bit “far away” for the council members.

New economic projections will be published and there were already some indications on upgrade in growth forecasts for this year. But that could also be offset by a slight downgrade for next year. So the overall impact could be muted. The key is indeed on how ECB views the inflation path. CPI was at a 10-year high of % in August and the projections would show how it will peak and then slow, to reflect how transitory inflation would be.

Here are some previews:

- ECB Preview – Time to Lower Asset Purchases?

- ECB Meeting: Tapering on the Menu, Sort of

- ECB Preview: Will the ECB Taper Bond Purchases?

- ECB Preview: Recalibrating, Not Tapering – But Hawks Will Squawk

Elsewhere

New Zealand manufacturing sales rose 3.9% in Q2. UK RICS housing price balance dropped to 73% in August. Japan M2 rose 4.7% yoy in August. China CPI slowed to 0.8% yoy in August but PPI accelerated to 9.5% yoy.

Looking ahead, Germany will release trade balance while US will release jobless claims.

EUR/USD Daily Outlook

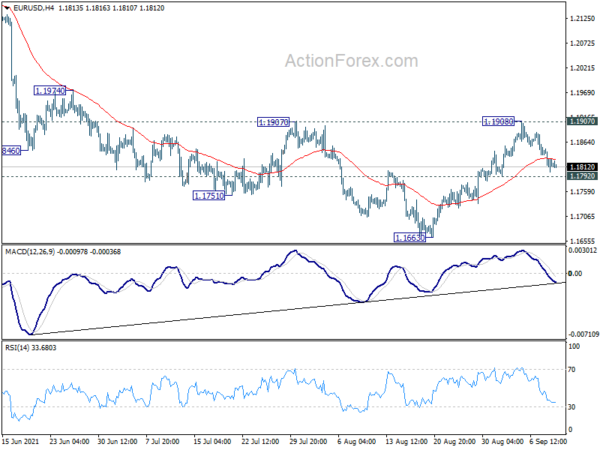

Daily Pivots: (S1) 1.1796; (P) 1.1824; (R1) 1.1845; More…

Intraday bias in EUR/USD remains neutral for the moment. On the downside, break of 1.1792 support will confirm rejection by 1.1907 resistance. Intraday bias will be turned back to the downside for retesting 1.1663 low first. On the upside, sustained break of 1.1907 should indicate that fall from 1.2265, as well as the consolidation pattern from 1.2348, have completed. Near term outlook will be turned bullish for 1.2265/2348 resistance zone.

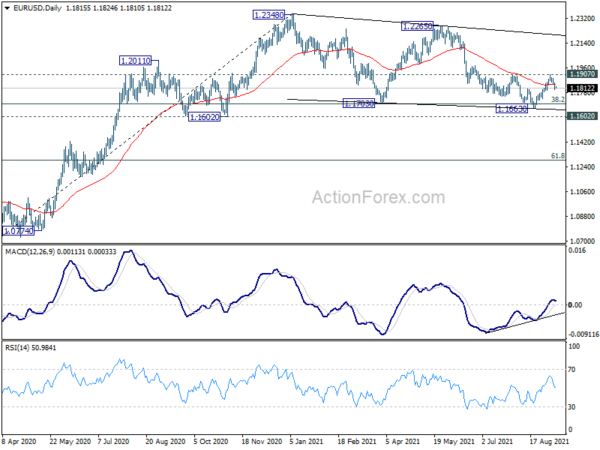

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q2 | 3.90% | 2.10% | 2.70% | |

| 23:01 | GBP | RICS Housing Price Balance Aug | 73% | 76% | 79% | 77% |

| 23:50 | JPY | Money Supply M2+CD Y/Y Aug | 4.70% | 4.70% | 5.20% | 5.30% |

| 1:30 | CNY | CPI Y/Y Aug | 0.80% | 1.00% | 1.00% | |

| 1:30 | CNY | PPI Y/Y Aug | 9.50% | 9.00% | 9.00% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Aug | 93.40% | |||

| 6:00 | EUR | Germany Trade Balance (EUR) Jul | 13.3B | 13.6B | ||

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Sep 3) | 340K | |||

| 14:30 | USD | Natural Gas Storage | 20B | |||

| 15:00 | USD | Crude Oil Inventories | -7.2M |