Dollar’s recovered continued in Asian session today, partly supported by hawkish comments from a Fed official. Mixed sentiments in the stock markets also stabilized the greenback. Instead, commodity currencies continued to reverse some gains. Main focus today will turn to BoC policy decision but that would likely be a non-event. Based on current price actions, Canadian Dollar has the prospect to weaken slightly for the near term after clearing this risk.

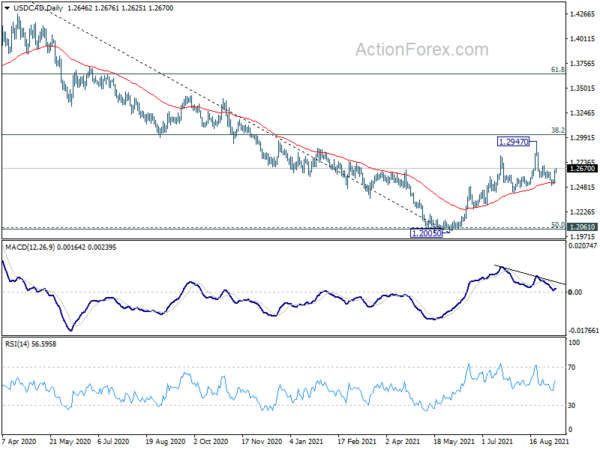

Technically, one focus is 1.2706 resistance in USD/CAD. Break there will suggests that pull back from 1.2947 has completed and bring stronger rebound to retest this high. At the same time, we’d look at 1.1792 support in EUR/USD and 1.3730 support in GBP/USD. Break of these levels will indicate more broad based rebound in Dollar, which could also be seen elsewhere.

In Asia, Nikkei closed up 0.89% at 30181.21, back above 30k handle. Hong Kong HSI, however, is down -0.23%. China Shanghai SSE is down -0.42%. Singapore Strait Times is down -1.11%. Japan 10-year JGB yield is up 0.0009 at 0.041. Overnight, DOW dropped -0.76%. S&P 500 dropped -0.34%. But NASDAQ rose 0.07%. 10-year yield jumped by 0.048 to 1.370.

Fed Bullard: Taper will get going this year

In an FT interview, St Louis Fed President James Bullard maintained the view that “the big picture is that the taper will get going this year and will end sometime by the first half of next year.”

The weak August NFP report didn’t alter his view on job market recovery. “There is plenty of demand for workers and there are more job openings than there are unemployed workers”, he said. “If we can get the workers matched up and bring the pandemic under better control, it certainly looks like we’ll have a very strong labour market going into next year.”

He also said there is “also a case” that inflation wont moderate into 2022, and may go higher, due to ” additional supply constraints coming from international sources now because of the Delta variant.”

Japan Q2 GDP growth upgrade to 0.5% qoq, 1.9% annualized

Japan GDP growth was finalized at 0.5% qoq, 1.9% annualized in Q2. It’s upgraded from initial estimate of 0.3% qoq, 1.3% annualized. Capital expenditure grew 2.3% qoq, upgraded from preliminary reading of 1.7% qoq. Private consumption grew 0.3% qoq, upgraded from 0.8% qoq.

Also released, bank lending rose 0.6% yoy in August, below expectation of 1.0% yoy. Eco watcher sentiment dropped from 48.4 to 34.7 in August. Current account surplus narrowed to JPY 1.41T in July.

BoC likely a non-event, EUR/CAD to continue sideway consolidation

BoC is generally expected to keep monetary policy unchanged today. In particular, the weekly asset purchases pace will be held at CAD 2B. Interest rate will be maintained at 0.25%. It’s clearly in a wait-and-see mode due to conflicting developments of disappointing economic activities and rising inflation, as well ass higher vaccination but worsening Delta infections. Additionally, a major risk event of federal election is less than two weeks away. The central bank should wait for new economic projections next month before making a move. Also, there is no press conference after the meeting today. Overall, it could be a non-event.

Some previews on BoC:

- BOC Preview – QE Tapering to Pause as Economy Contracted in 2Q21

- BoC to Keep Quiet as Canada’s Election Approaches

- Forward Guidance: BoC to Parse Weak GDP Reports, Persisting Virus Risks

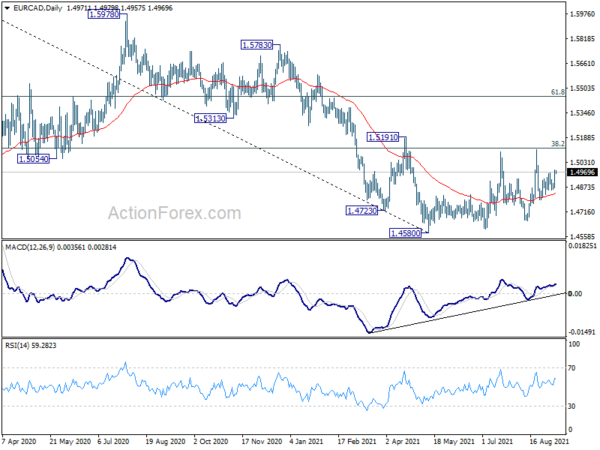

EUR/CAD is a pair to watch for the rest of the week with BoC and ECB meeting featured. Price actions from 1.4580 low are seen as a corrective pattern and hence, medium term outlook is staying bearish for now. While a downside breakout is slightly favored, we’d not seeing any indication of it yet. Hence, range trading will likely continue for a while. Medium term, any rally attempt could face strong resistance from 38.2% retracement of 1.5991 (2020 high) to 1.4580 (2021 low) at 1.5119.

Elsewhere

France will release trade balance in European session while Italy will release retail sales. Canada will also release Ivey PMI. Fed will publish Beige Book economic report.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2559; (P) 1.2608; (R1) 1.2695; More…

Intraday bias in USD/CAD stays neutral first. On the upside, break of 1.2706 resistance will indicate that pull back from 1.2947 has completed at 1.2492. That would also retain near term bullish after well defending 1.2421 support. Intraday bias will be back on the upside for retest 1.2947 high. Break there will resume larger rise from 1.2005. However, below 1.2492 will resume the fall from 1.2947 to 1.2421 key near term structural support next.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q2 F | 0.50% | 0.30% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | -1.10% | -0.70% | -0.70% | |

| 23:50 | JPY | Bank Lending Y/Y Aug | 0.60% | 1.00% | 1.00% | 0.90% |

| 23:50 | JPY | Current Account Jul (JPY) | 1.41T | 1.85T | 1.78T | |

| 5:00 | JPY | Eco Watchers Survey: Current Aug | 34.7 | 45.9 | 48.4 | |

| 6:45 | EUR | France Trade Balance (EUR) Jul | -5.8B | |||

| 8:00 | EUR | Italy Retail Sales M/M Jul | 0.30% | 0.70% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:00 | CAD | Ivey PMI Aug | 59.2 | 56.4 | ||

| 18:00 | USD | Fed’s Beige Book |