The overall markets continue to tread water in early US session. Two Fed officials expressed their support for tapering, but investors are probably still waiting for Chair Jerome Powell’s Jackson Hole speech to take action. There is also little reaction to stronger than expected PCE inflation data. Commodity currencies are still the strongest ones for the week while Yen, Swiss Franc and Dollar are the weakest. We’ll see if the positions change in the final hours.

Technically, we’ll keep an eye on Gold to double confirm Dollar’s next move. The retreat from 1809.35 was contained comfortably above 1744.14 minor support, maintaining mild near term bullishness. Break of 1809.35 will target 1832.47 resistance. Firm break there would be a strong sign of near term bullish reversal and target 1916.30 resistance that. That could affirm Dollar selloff if happens.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is down -0.06%. CAC is down -0.22%. Germany 10-year yield is down -0.0081 at -0.414, still not power through -0.4 handle. Earlier in Asia, Nikkei dropped -0.36%. Hong Kong HSI dropped -0.03%. China Shanghai SSE rose 0.59%. Singapore Strait Times dropped -0.92%.

Fed Bostic comfortable with Oct timeline for tapering

Boston Fed President Raphael Bostic he’s “comfortable with an October timeline” for starting tapering if August job growth could match the near 1m number as with the previous two months. Also, once the tapering starts, he was “definitely looking to get this done as quickly as possible”, and put a full end to the asset purchases “toward the end of Q1” of 2022.

He also said that the spread of the Delta variant had not changed his economic outlook in any fundamental way. “What I have seen is some suggestion that things are slowing down, but they are still just slowing from extremely high levels. I have not seen big changes in the underlying dynamic,” Bostic added.

Fed Harker still supportive of moving the taper along

Philadelphia Fed President Patrick Harker said he’s “still supportive of moving the taper along”, because he didn’t think asset purchase is “doing a whole lot right now”. He added that Fed should finish tapering before considering raising interest rates.

He said the Fed has achieved “substantial further progress on inflation” already. There is “some evidence that inflationary pressure “may not be so transitory”. Meanwhile, the job market is changing the people’s thinking about what a job is has changed too.

US PCE inflation accelerated to 4.2% yoy in Jul, core PCE unchanged at 3.6% yoy

US personal income rose 1.1% or USD 225.9B in July, well above expectation of 0.2%. Spending rose 0.3% or USD 42.2B, slightly below expectation of 0.4%.

Headline PCE accelerated to 4.2% yoy, up from 4.0% yoy, above expectation of 3.5% yoy. Core PCE was unchanged at 3.6% yoy, matched expectations. Energy increased 23.6% yoy while food prices rose 2.4% yoy.

Also released, goods trade deficit narrowed to USD -86.4B in Jul, below expectation of USD -90.8B.

Australia retail sales dropped -2.7% mom in Jul, NSW down -8.9% on lockdown

Australia retail sales dropped -2.7% mom in July, slightly better than expectation of -2.9% mom. Comparing to a year ago, sales also dropped 3.1% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “Lockdowns and stay-at-home orders in many parts of Australia continued to impact retail trade in July, with many non-essential retail businesses closing their physical stores. In particular, the first full month of lockdown in New South Wales, following the Delta outbreak in June, saw retail turnover in the state fall 8.9 per cent. This was the largest fall of any state and territory since August 2020.”

USD/JPY Mid-Day Outlook

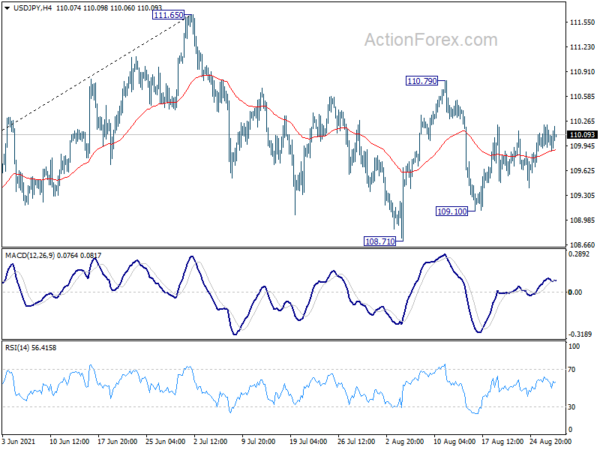

Daily Pivots: (S1) 109.93; (P) 110.08; (R1) 110.23; More…

Intraday bias in USD/JPY remains neutral at this point. It’s still bounded in sideway trading between 109.10/110.79. On the upside, break of 110.79 will resume the rebound from 108.71 to retest 111.65 high. On the downside, break of 109.10 will target 108.71 support first. Firm break there will resume the decline from 111.65 and target 38.2% retracement of 102.58 to 111.65 at 108.18 next.

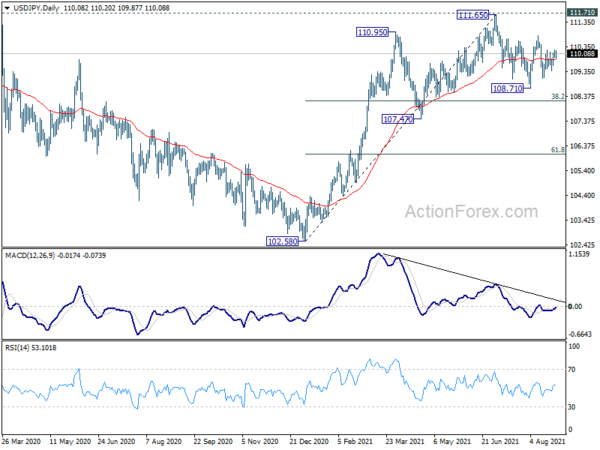

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 0.00% | -0.10% | 0.10% | |

| 01:30 | AUD | Retail Sales M/M Jul | -2.70% | -2.90% | -1.80% | |

| 12:30 | CAD | Industrial Product Price M/M Jul | -0.40% | 1.40% | 0.00% | |

| 12:30 | CAD | Raw Material Price Index M/M Jul | 2.20% | 2.70% | 3.90% | |

| 12:30 | USD | Personal Income Jul | 1.10% | 0.20% | 0.10% | 0.20% |

| 12:30 | USD | Personal Spending Jul | 0.30% | 1.10% | 1.00% | 1.10% |

| 12:30 | USD | PCE Price Index M/M Jul | 0.40% | 0.20% | 0.50% | |

| 12:30 | USD | PCE Price Index Y/Y Jul | 4.20% | 3.50% | 4.00% | |

| 12:30 | USD | Core PCE Price Index M/M Jul | 0.30% | 0.40% | 0.40% | 0.50% |

| 12:30 | USD | Core PCE Price Index Y/Y Jul | 3.60% | 3.60% | 3.50% | 3.60% |

| 12:30 | USD | Wholesale Inventories Jul P | 0.60% | 1.00% | 1.10% | 1.20% |

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -86.4B | -90.8B | -91.2B | -93.2B |

| 14:00 | USD | Michigan Consumer Sentiment Aug F | 71.5 | 70.2 |