Overall markets continue to trade in a mixed manner for now. Yen and Dollar are currently the weakest for the weak while commodity currencies are the strongest. But all major pairs and crosses are stuck inside prior week’s range. The situation in Afghanistan is unlikely to be a persistent worry for investors. Main focuses will remain on the comments from Fed officials regarding tapering.

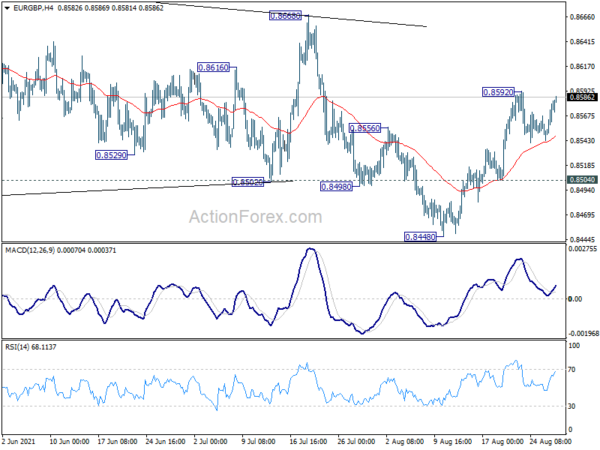

Technically, while focuses are on Dollar, Sterling appears to be turning slightly weaker. In particular, EUR/GBP drew some notable support from 4 hour 55 EMA and rebounded. Break of 0.8592 resistance will resume the rise from 0.8448 towards 0.8668 resistance. Meanwhile, GBP/JPY appears to be rejected by 151.38 minor resistance and it could be heading back to 149.16 support.

In Asia, at the time of writing, Nikkei is down -0.47%. Hong Kong HSI is up 0.51%. China Shanghai SSE is up 0.49%. Singapore Strait Times is down -0.81%. Japan 10-year JGB yield is up 0.0036 at 0.025. Overnight, DOW dropped -0.54%. S&P 500 dropped -0.58%. NASDAQ dropped -0.64%. 10-year yield closed flat at 1.342, after rising to 1.375.

NASDAQ closed lower after comments from Fed hawks

US stocks closed lower overnight as traders turned cautious, watching the development in Afghanistan and upcoming speech of Fed chair Jerome Powell at the Jackson Hole Symposium. A few Fed officials expressed their support for tapering asset purchases, somewhat talking down the impact of the spread of Delta. Yet, we’d note that those are known hawks already. Doves might come out today telling another story while Powell would likely sound non-committal. The overall Jackson Hole event would likely leave the market with nothing new on the net.

NASDAQ apparently faced some resistance from 61.8% projection of 10822.57 to 14175.11 from 13002.53 at 15074.39, and 15k psychological level. While it’s now in a retreat, there is no sign of reversal, at least before covering the gap made at weekly open. Nevertheless, it might still take some time to build the base to power through 15k at a later stage.

Fed Kaplan: It’s a lot healthier to wean economy off asset purchases

Dallas Fed President Robert Kaplan told CNBC that by and large, businesses are “weathering Delta at least as well as previous surges”. Businesses and consumers are learning to adapt well. There is no demand problem in the economy too.

He added that it would be “a lot healthier if Fed begins to wean economy off asset purchases”. Kaplan said he “would prefer to start taper soon but do it over plus or minus eight months, although I remain open-minded.” September meeting would remain his preference to announce tapering.

Fed Bullard: We don’t need the asset purchases at this point

St. Louis Federal Reserve president James Bullard repeated his call for tapering to end asset purchase by the early next year, as “we don’t need the asset purchases at this point.”

“I think a lot depends on whether inflation going to moderate in 2022 or not. I’m a little skeptical that it is. I think we’re going to get at least 2.5% inflation in 2022, maybe higher than that and there’s some risk to the upside on that,” Bullard said.

“We will be able to get to a good consensus on the committee and get to a good wind-down process. It does seem that we are coalescing around a plan,” Bullard said.

Australia retail sales dropped -2.7% mom in Jul, NSW down -8.9% on lockdown

Australia retail sales dropped -2.7% mom in July, slightly better than expectation of -2.9% mom. Comparing to a year ago, sales also dropped 3.1% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “Lockdowns and stay-at-home orders in many parts of Australia continued to impact retail trade in July, with many non-essential retail businesses closing their physical stores. In particular, the first full month of lockdown in New South Wales, following the Delta outbreak in June, saw retail turnover in the state fall 8.9 per cent. This was the largest fall of any state and territory since August 2020.”

Looking ahead

Canada will release RMPI and IPPI in US session. US will release personal income and spending, with PCE inflation, goods trade balance.

GBP/USD Daily Outlook

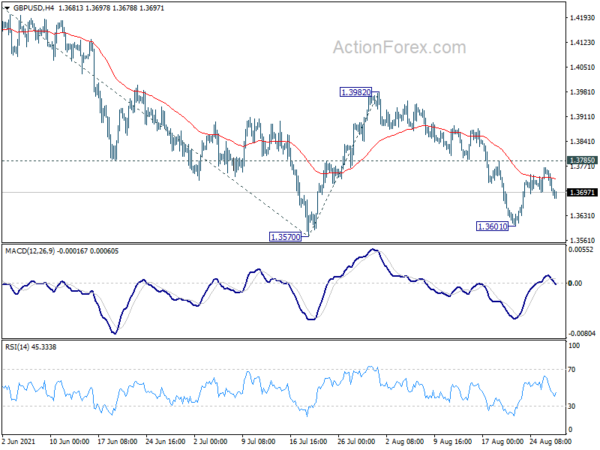

Daily Pivots: (S1) 1.3671; (P) 1.3720; (R1) 1.3749; More…

GBP/USD drops mildly after failing below 1.3785 resistance, but stays in range above 1.3601. Intraday bias remains neutral first. Another fall is in favor with 1.3785 minor resistance intact. On the downside, firm break of 1.3570 will resume larger fall from 1.4248 to 1.3482 resistance turned support next. Break there will target 100% projection of 1.4248 to 1.3570 from 1.3982 at 1.3304. However, on the upside, break of 1.3785 will turn bias back to the upside for 1.3982 resistance intact.

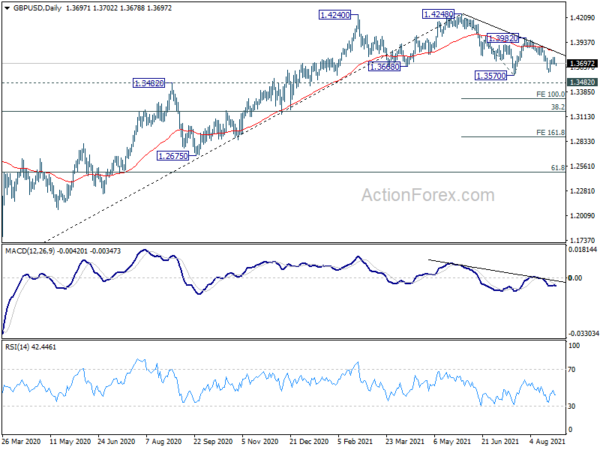

In the bigger picture, current development argues that rise from 1.1409 (2020 low) has completed at 1.4248, after failing 1.4376 resistance. Fall from there could either be correcting the rise form 1.1409, or starting another falling leg inside long term sideway pattern. In either case, sustained break of 1.3482 resistance turned support will target 38.2% retracement of 1.1409 to 1.4248 at 1.3164 first. Break there will pave the way to 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 0.00% | -0.10% | 0.10% | |

| 1:30 | AUD | Retail Sales M/M Jul | -2.70% | -2.90% | -1.80% | |

| 12:30 | CAD | Raw Material Price Index M/M Jul | 3.90% | |||

| 12:30 | CAD | Industrial Product Price M/M Jul | 0.00% | |||

| 12:30 | USD | Personal Income Jul | 0.20% | 0.10% | ||

| 12:30 | USD | Personal Spending Jul | 1.10% | 1.00% | ||

| 12:30 | USD | PCE Price Index M/M Jul | 0.50% | |||

| 12:30 | USD | PCE Price Index Y/Y Jul | 4.00% | |||

| 12:30 | USD | Core PCE Price Index M/M Jul | 0.40% | 0.40% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Jul | 3.60% | 3.50% | ||

| 12:30 | USD | Wholesale Inventories Jul P | 1.00% | 1.10% | ||

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -90.8B | -91.2B | ||

| 14:00 | USD | Michigan Consumer Sentiment Aug F | 71.5 | 70.2 |