Dollar continues to pare back some of this week’s losses in early US session, after slightly better than expected durable goods orders. But strength of recovery is so far relatively weak. Markets are also generally in mixed mode. Euro has litter reaction to worst than expected Germany business climate data, too. Overall, traders are turning cautious, awaiting Fed Chair Jerome Powell’s inspiration from his Jackson Hole speech.

Technically, Gold’s development is worth a note. Apparently, it lacks follow through buying to sustain above 1800 handle. Yet, retreat is held comfortably above 1774.14 support so far. We’d continue to monitor the next move. Sustained trading above 1800/32 resistance zone will suggest larger reversal, which could be accompanied by another round of selloff in Dollar. On the other hand, break of 1774.14 will indicate completion of rebound from 1682.60 and Dollar could rebound in tandem.

In Europe, at the time of writing, FTSE is up 0.34%. DAX is down -0.13%. CAC is up 0.24%. Germany 10-year yield is up 0.0337 at -0.440. Earlier in Asia, Nikkei closed down -0.03%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.74%. Singapore Strait Times dropped -0.0%. Japan 10-year JGB yield rose 0.0007 to 0.021.

US durable goods orders dropped -0.1% in Jul, ex-transport orders rose 0.7% mom

US durable goods orders dropped -0.1% mom to USD 257.2B in July, better than expectation of -0.2% mom. Ex-transport orders rose 0.7% mom, above expectation of 0.5% mom. Ex-defense orders dropped -1.2% mom. Transportation equipment, dropped -2.2% to USD 75.3B.

ECB Lane: There could be counterbalances in H2

ECB Chief Economist Philip lane said in an interview, Q2 GDP came in “well ahead of out June projections”, reflecting an “earlier opening up”, “strength of the world economy” and “progress in vaccinations”. It’s “still early days” regarding H2, and there could be “counterbalance” like bottlenecks, moderation in world economy, and the Delta variant. Overall, he said, “we’re broadly not too far away from what we expected in June for the full year.”

The Delta variant is now “part of the mix in the US and global economies”, while Europe “may not be among the regions hardest-hit thanks to high vaccination rates and prior lockdown measures. Also, the infrastructure and system for vaccination has “eliminated uncertainty about Europe’s ability to carry out vaccinations.”

On PEPP, Lane said “we’ll have to assess at the September meeting the appropriate calibration for the final quarter of the year”. He emphasized that “single philosophy” of maintaining favorable financing conditions regarding PEPP. “If favourable financing conditions require more purchases, we’ll conduct more purchases,” he said.

Germany Ifo business climate dropped to 99.4 in Aug, supply bottlenecks and rising inflections

Germany Ifo Business Climates dropped from 100.8 to 99.4 in August, below expectation of 100.4. Current Assessment index rose from 100.4 to 101.4, above expectation of 100.8. However, Expectations index dropped from 101.2 to 97.5, below expectation of 100.0.

Looking at some more details, manufacturing dropped from 27.4 to 24.1. Services dropped from 19.8 to 17.7. Trade dropped from 15.8 to 9.0. Construction rose from 6.0 to 7.8.

Ifo said: “This decline was due mainly to significantly less optimism in companies’ expectations. Concerns are growing in the hospitality and tourism sectors in particular. By contrast, companies assessed their current situation as somewhat better than in the previous month. Supply bottlenecks for intermediate products in manufacturing and worries about rising infection numbers are putting a strain on the economy.”

BoJ Nakamura warned of delayed spending, Japan expands state of emergency

BoJ board member Toyoaki Nakamura warned in a speech today that the economy is still in a “severe state” and outlook was “highly uncertain” with risks skewed to the downside. He added, “the resurgence in infections may have somewhat delayed the timing for when pent-up demand materializes.”

But he’s hopeful that economic activity would strengthen strongly as pandemic impact subsides. Inflation is likely to gradually accelerate as the economy recovers. Also, he expects exports to increase steadily on robust global demand and recovery in capital expenditure.

Separately, Japan is set p expand a state of emergency to 8 more prefectures. That takes the total to 21 out of 47 total prefectures. Economy Minister Yasutoshi Nishimura emphasized, “the most important task is to beef up the medical system.”

New Zealand goods exports rose 15% yoy in Jul, imports rose 35% yoy

New Zealand goods exports rose 15% yoy to NZD 5.8B in July. Goods imports rose sharply by 35% yoy to NZD 6.2B. Monthly trade balance was a deficit of NZD -402m, versus expectation of NZD 100m surplus.

Exports to all trading partners were up (China +25% yoy, Australia 22% yoy, EU + 7.4% yoy, Japan +26% yoy), except the US (down -2.9% yoy. Imports from all top trading partners were up (China +22% yoy, EU + 38% yoy, Australia + 12% yoy, US + 14% yoy, Japan +71% yoy).

From Australia, construction work done rose 0.8% in Q2, below expectation of 2.8%.

USD/JPY Mid-Day Outlook

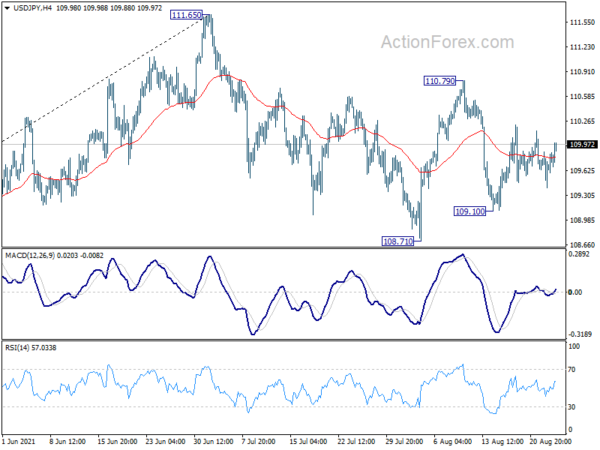

Daily Pivots: (S1) 109.45; (P) 109.66; (R1) 109.91; More…

USD/JPY recovers mildly today but stays in range of 109.10/110.79. Intraday bias remains neutral at this point. On the upside, break of 110.79 will resume the rebound from 108.71 to retest 111.65 high. On the downside, break of 109.10 will target 108.71 support first. Firm break there will resume the decline from 111.65 and target 38.2% retracement of 102.58 to 111.65 at 108.18 next.

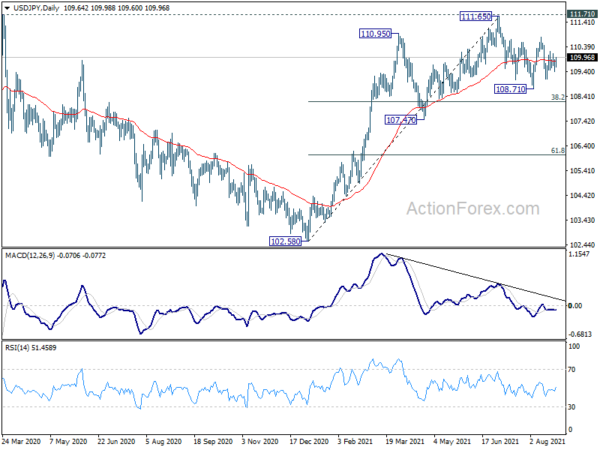

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jul | -402M | 100M | 261M | 245M |

| 01:30 | AUD | Construction Work Done Q2 | 0.80% | 2.80% | 2.40% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Aug | -7.8 | 42.8 | ||

| 08:00 | EUR | Germany IFO Business Climate Aug | 99.4 | 100.4 | 100.8 | |

| 08:00 | EUR | Germany IFO Current Assessment Aug | 101.4 | 100.8 | 100.4 | |

| 08:00 | EUR | Germany IFO Expectations Aug | 97.5 | 100 | 101.2 | |

| 12:30 | USD | Durable Goods Orders Jul | -0.10% | -0.20% | 0.90% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Jul | 0.70% | 0.50% | 0.50% | |

| 14:30 | USD | Crude Oil Inventories | -1.9M | -3.2M |