Dollar recovers mildly in Asian session today as selling lost some momentum. On the other hand commodity currencies are turning softer. Australian Dollar continues to be weighed down by surging coronavirus cases, as the State Premier also warned of “lots of pressures” on hospitals. But overall, traders are starting to turn cautious ahead of Jackson Hole Symposium and month end.

Technically, we’d reiterate that despite this week’s pull back in Dollar, near term support levels were not broken yet. The levels include 1.1804 resistance in EUR/USD, 1.3785 minor resistance in GBP/USD, 0.7288 support turned resistance in AUD/USD, 0.9098 support in USD/CHF, 109.10 support in USD/JPY. USD/CAD looks more committed with the break of 4 hour 55 EMA, but it’s still holding well above 1.2421 structural support. Near term outlook in Dollar is at least not bearish in general.

In Asia, at the time of writing, Nikkei is down -0.08%. Hong Kong HSI is down -0.36%. China Shanghai SSE is up 0.34%. Singapore Strait Times is up 0.06%. Japan 10-year JGB yield is flat at 0.020. Overnight, DOW rose 0.09%. S&P 500 rose 0.15%. NASDAQ rose 0.52%. 10-year yield rose 0.035 to 1.290.

BoJ Nakamura warned of delayed spending, Japan expands state of emergency

BoJ board member Toyoaki Nakamura warned in a speech today that the economy is still in a “severe state” and outlook was “highly uncertain” with risks skewed to the downside. He added, “the resurgence in infections may have somewhat delayed the timing for when pent-up demand materializes.”

But he’s hopeful that economic activity would strengthen strongly as pandemic impact subsides. Inflation is likely to gradually accelerate as the economy recovers. Also, he expects exports to increase steadily on robust global demand and recovery in capital expenditure.

Separately, Japan is set p expand a state of emergency to 8 more prefectures. That takes the total to 21 out of 47 total prefectures. Economy Minister Yasutoshi Nishimura emphasized, “the most important task is to beef up the medical system.”

New Zealand goods exports rose 15% yoy in Jul, imports rose 35% yoy

New Zealand goods exports rose 15% yoy to NZD 5.8B in July. Goods imports rose sharply by 35% yoy to NZD 6.2B. Monthly trade balance was a deficit of NZD -402m, versus expectation of NZD 100m surplus.

Exports to all trading partners were up (China +25% yoy, Australia 22% yoy, EU + 7.4% yoy, Japan +26% yoy), except the US (down -2.9% yoy. Imports from all top trading partners were up (China +22% yoy, EU + 38% yoy, Australia + 12% yoy, US + 14% yoy, Japan +71% yoy).

From Australia, construction work done rose 0.8% in Q2, below expectation of 2.8%.

Looking ahead

Germany Ifo business climate is a major focus in European session. Swiss will release Credit Suisse economic expectations. Later in the day, US will release durable goods orders.

AUD/USD Daily Report

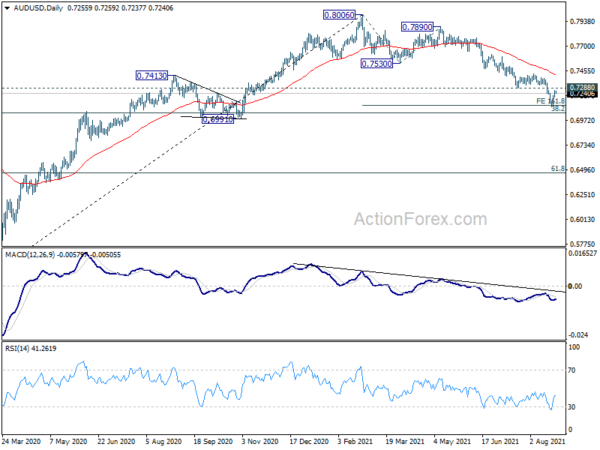

Daily Pivots: (S1) 0.7216; (P) 0.7243; (R1) 0.7286; More…

AUD/USD is staying in range of 0.7105/7288 and intraday bias remains neutral at this point. In case of another fall, through 0.7105, we’d continue to look for strong support from 0.6991/7051 support zone to bring rebound. On the upside, firm break of 0.7288 support turned resistance will indicate short term bottoming, and turn bias back to the upside for 0.7425 resistance next.

In the bigger picture, rise from 0.5506 medium term bottom could have completed at 0.8006, after failing 0.8135 key resistance. Correction from there could target 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051). We’d look for strong support from there to bring rebound. However, sustained break of this level would argue that the whole medium term trend has indeed reversed. Deeper decline would be seen to 61.8% retracement at 0.6461.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jul | -402M | 100M | 261M | 245M |

| 1:30 | AUD | Construction Work Done Q2 | 0.80% | 2.80% | 2.40% | |

| 8:00 | CHF | Credit Suisse Economic Expectations Aug | 42.8 | |||

| 8:00 | EUR | Germany IFO Business Climate Aug | 100.4 | 100.8 | ||

| 8:00 | EUR | Germany IFO Current Assessment Aug | 100.8 | 100.4 | ||

| 8:00 | EUR | Germany IFO Expectations Aug | 100 | 101.2 | ||

| 12:30 | USD | Durable Goods Orders Jul | -0.20% | 0.90% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Jul | 0.50% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | -3.2M |