Asian markets are staging a strong rebound today, despite poor economic data out of Japan and Australia. Investors are probably reassessing the timing of Fed’s tapering, which would be delayed by the current surge in Delta variant. Meanwhile, China reported zero case of local transmission of COVID-19 for the first time since July. Dollar, Yen and Swiss Franc are paring some of last week’s gains. Canadian Dollar leads commodity currencies higher.

Technically, we’ll pay some attention to the development in Gold today. It has been rather resilient last week despite the strong rise in Dollar. A break of 1795.42 will resume the rebound from 1682.60 and put 1800 handle to immediate focus. Sustained trading above 1800 would raise the change of bullish reversal. Further break of 1832.47 resistance could extend the rally to 1916.30 resistance. That, if happens, might signal a return to weakness in the greenback.

In Asia, at the time of writing, Nikkei is up 1.73%. Hong Kong HSI is up 2.09%. China Shanghai SSE is up 1.13%. Singapore Strait Times is up 0.09%. Japan 10-year JGB yield is up 0.010 at 0.022.

Japan PMI composite dropped to 45.9 in Aug, weaker demand and sustained supply chain pressures

Japan PMI Manufacturing dropped from 53.0 to 52.4 in August, below expectation of 53.4. PMI services dropped sharply from 47.4 to 43.5, worst in 15 months. PMI Composite dropped from 48.8 to 45.9, worst since August 2020.

Usamah Bhatti, Economist at IHS Markit, said: “The Japanese private sector economy saw business conditions deteriorate further midway through the third quarter of the year, with flash PMI data signalling a quicker decline in business activity in August. The latest contraction was the quickest recorded since August 2020, while incoming business was reduced at the sharpest pace for seven months. Survey respondents commonly attributed weaker demand to ongoing COVID-19 restrictions, coupled with sustained supply chain pressures.”

Australia PMI composite dropped to 15-month low, heavily impacted by restrictions

Australia PMI Manufacturing dropped from 56.9 to 51.7 in August, hitting a 14-month low. PMI Services dropped from 44.2 to 43.3, a 15-month low. PMI Composite dropped from 45.2 to 43.5, also a 15-month low.

Jingyi Pan, Economics Associate Director at IHS Markit, said: “Australia’s private sector remained stuck in decline in August… as activity remained heavily impacted by current mobility restrictions brought about by the spread of the COVID-19 Delta variant. Not only were demand and business activity hit, employment conditions also deteriorated, with private sector staffing levels falling for the first time since October 2020… The one bright spot had been an improvement in the outlook amongst Australian private sector firms in August, with hopes of an improvement in the COVID-19 situation expected to spark an eventual rebound for the Australian economy.”

Fed Chair Powell unlikely to deliver something substance at Jackson Hole

Fed Chair Jerome Powell’s speech in Jackson Hole symposium will be the highlight of the week. But he’s actually unlikely to deliver anything ground breaking. Instead, focuses would be on comments from other Fed officials, in particular the known hawks, regarding the timing of tapering. Some of them could follow Robert Kaplan’s step and turn more cautious.

Meanwhile, PMI data would be closely watched to gauge sentiments, together with Germany Ifo business climate. Other economic data like US durable goods orders, personal income and spending, PCE inflation will be featured. New Zealand retail sales and trade balance, and Australia retail sales could also trigger some volatility. Here are some highlights for the week:

- Monday: Australia PMIs; Japan PMI manufacturing; Eurozone PMIs; UK PMIs; US PMIs, existing home sales.

- Tuesday: New Zealand retail sales; Germany GDP final; US new home sales.

- Wednesday: New Zealand trade balance; Germany ifo business climate; Swiss Credit Suisse economic expectations; US durable goods orders.

- Thursday: Japan corporate services price index; Australia private capital expenditure; Germany Gfk consumer climate; Eurozone M3 money supply, ECB meeting accounts; US GDP, jobless claims.

- Friday: Japan Tokyo CPI, Australia retail sales; Germany import prices; Canada IPPI and RMPI; US goods trade balance, personal income and spending, wholesale sales.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2709; (P) 1.2770; (R1) 1.2890; More…

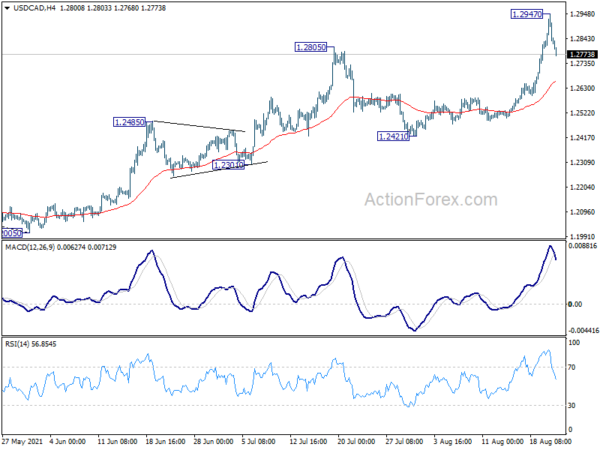

USD/CAD’s retreat from 1.2947 extends lower today but intraday bias remains neutral first. We’d expect downside to be contained by 4 hour 55 EMA (now at 1.2660) to bring rebound. Break of 1.2947 will resume the rise from 1.2005 to 1.3022 fibonacci level next. Nevertheless, sustained trading below 4 hour 55 EMA will bring deeper fall back to 1.2421 support.

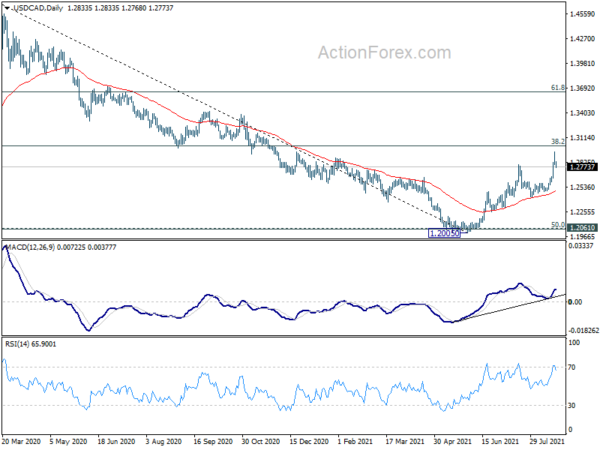

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Aug P | 51.7 | 56.9 | ||

| 23:00 | AUD | Services PMI Aug P | 43.3 | 44.2 | ||

| 00:30 | JPY | Manufacturing PMI Aug P | 52.4 | 53.4 | 53 | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 57.3 | 58 | ||

| 07:15 | EUR | France Services PMI Aug P | 57 | 56.8 | ||

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 65 | 65.9 | ||

| 07:30 | EUR | Germany Services PMI Aug P | 61 | 61.8 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 62 | 62.8 | ||

| 08:00 | EUR | Eurozone Services PMI Aug P | 59.8 | 59.8 | ||

| 08:30 | GBP | Manufacturing PMI Aug P | 59.5 | 60.4 | ||

| 08:30 | GBP | Services PMI Aug P | 59 | 59.6 | ||

| 13:45 | USD | Manufacturing PMI Aug P | 63 | 63.4 | ||

| 13:45 | USD | Services PMI Aug P | 59.9 | 59.9 | ||

| 14:00 | USD | Existing Home Sales Jul | 5.83M | 5.86M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -5 | -4 |