Dollar jumps sharply in early US session after stronger than expected non-farm payroll data. If job growth could sustain at current page in August, more FOMC members would be ready to call for tapering in Q4. Euro, Swiss Franc and Yen are the most responsive to Dollar buying so far. Sterling is staying resilient. Meanwhile, Canadian Dollar also drops slightly, along with Aussie, against the greenback.

Technically, gold’s break of 1789.42 support indicate that rebound from 1750.49 has completed already. Deeper fall would be seen back to retest this low, as Dollar strengthens in general. We’ll not look at when EUR/USD will break through 1.1751 low to resume recent decline. Also, USD/CHF and USD/JPY should also break through 0.9116 and 110.58 resistance respectively if Dollar buying is to sustain.

In Europe, at the time of writing, FTSE is up 0.09%. DAX is up 0.18%. CAC is up 0.45%. Germany 10-year yield is up 0.044 at -0.455. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI dropped -0.10%. China Shanghai SSE dropped -0.24%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield rose 0.0024 to 0.015.

US non-farm payroll grew 943k, unemployment rate dropped to 5.4%

US non-farm payroll employment grew 943k in July, above expectation of 900k. Prior month’s figure was also revised up from 850k to 938k. Notable job gains occurred in leisure and hospitality, in local government education, and in professional and business services. Total employment was still down -3.7% from its pre-pandemic level in February 2020.

Unemployment rate dropped sharply by -0.5% to 5.4%, versus expectation of 5.7%. Number of unemployed person fell by -782k to 8.7m. Labor force participation rate was little changed at 61.7%, within a narrow range of 61.4% to 61.7% since June 2020.

Canada employment grew 94k in July, unemployment rate dropped to 7.5%

Canada employment grew 0.5% mom or 94k in July, below expectation of 148.5k.gains were concentrated in full-time work (83; +0.5%). Unemployment rate dropped -0.3% to 7.5%, below expectation of 7.7%.

BoE Broadbent: Judgements on labor market frictions dissipating uncertain

Deputy Governor Ben Broadbent said BoE will pay attention to second-round effects of inflation on wages. He added, “the judgements about labour market frictions dissipating are probably more uncertain than those on the trade and goods side of things”.

At the same event, Governor Andrew Bailey also said labor shortages is the biggest topic in his discussions with businesses recently.

Released in European session, Italy industrial output rose 1.0% mom in June versus expectation of 0.8% mom. Swiss foreign currency reserves dropped to CHF 923B in July. France trade deficit narrowed to EUR -5.8B in June. Germany industrial production dropped -1.3% mom in June.

RBA Lowe: Fiscal support more appropriate response to temporary and localized hit to income

RBA Governor Philip Lowe said in a testimony that he didn’t rule out a recession due to restrictions, but still expecting a return to strong growth next year. “Any additional bond purchases would have their maximum effect at that time and only a very small effect right now when the extra support is needed most,” he added. For now, fiscal policy is “the more appropriate instrument for providing support in response to a temporary and localized hit to income.”

Regarding inflation, Lowe said much of this discussion has come out of the US, which was in a “substantially different position to the one we’re in.” In Australia, “the fact that wages growth is likely to remain below 3 per cent for the next couple of years means it’s very difficult for me to see us having an inflation problem.”

In the Statement on Monetary Policy, RBA downgraded 2021 year-average GDP growth forecast from 5.25% to 4.75%, but upgraded 2022 from 4% to 5%. GDP growth would then slow to 2.75% in 2023. Inflation is projected to be at 2.25% in December 2021 (upgraded from 1.75%), 1.75% in December 2022 (up from 1.50%), and then 2.25% in 2023 year-end. Unemployment rate is projected to be at 5% by 2021 year end, then gradually fall to 4% by 2023 year-end.

Australia AiG services dropped to 51.7, but employment holding up

Australia AiG Performance of Services dropped sharply by -6.1 pts to 51.7 in July. That’s the largest monthly decline since April 2020. Looking at some details, sales dropped -12.9 to 53.2. Employment dropped -3.2 to 51.0. New orders rose 0.1 to 56.7. Supplier deliveries dropped -9.6 to 45.3. Input prices rose 8.7 to 74.1. Selling prices rose 13.2 to 66.7. Average wages rose 2.0 to 68.0.

Ai Group Chief Executive, Innes Willox, said: “The substantial easing in the performance of the Australian services sector in July was mainly driven by the COVID-19 outbreaks and associated restrictions…. There were some encouraging signs with employment and sales holding up and new orders coming in at a faster pace than in June. This provides some grounds to expect the services sector could bounce back quickly if restrictions were able to be lifted. However, with COVID-19 infections and restricted areas on the rise in the early days of August, the chances of an early rebound appear to be fading.”

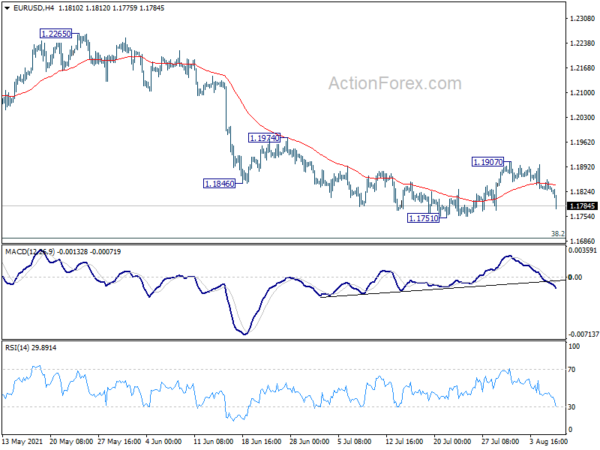

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1820; (P) 1.1839; (R1) 1.1849; More…

EUR/USD drops sharply in early US session and immediate focus is now on 1.1751 support. Break will resume the whole fall from 12265, as the third leg of the pattern from 1.2348, to 1.1703 support, or even further to 1.1602. On the upside, above 1.1907 will resume the rebound from 1.1751 to 1.1974 resistance.

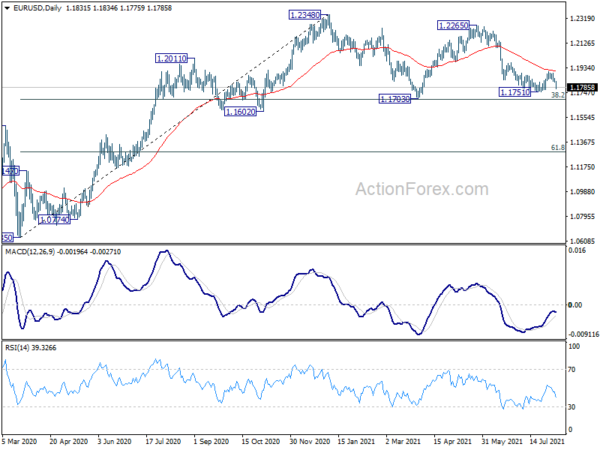

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Jul | 51.7 | 57.8 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jun | -0.10% | 1.20% | 1.90% | |

| 23:30 | JPY | Household Spending Y/Y Jun | -5.10% | 0.10% | 11.60% | |

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 05:00 | JPY | Leading Economic Index Jun P | 104.1 | 104.2 | 102.6 | |

| 06:00 | EUR | Germany Industrial Production M/M Jun | -1.30% | 0.50% | -0.30% | -0.80% |

| 06:45 | EUR | France Trade Balance (EUR) Jun | -5.8B | -6.1B | -6.8B | -6.6B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jul | 923B | 941B | ||

| 08:00 | EUR | Italy Industrial Output M/M Jun | 1.00% | 0.80% | -1.50% | -1.60% |

| 12:30 | USD | Nonfarm Payrolls Jul | 943K | 900K | 850K | 938K |

| 12:30 | USD | Unemployment Rate Jul | 5.40% | 5.70% | 5.90% | |

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.40% | 0.30% | 0.30% | |

| 12:30 | CAD | Net Change in Employment Jul | 94.0K | 148.5K | 230.7K | |

| 12:30 | CAD | Unemployment Rate Jul | 7.50% | 7.70% | 7.80% | |

| 14:00 | USD | Wholesale Inventories Jun F | 0.80% | 0.80% | ||

| 14:00 | CAD | Ivey PMI Jul | 67.3 | 71.9 |