Following strong closes in US stocks, Asian markets ex-Japan are trading generally higher. The development helps lift commodity currencies generally higher. In particular, New Zealand Dollar is additionally lifted by much stronger than expected job data. Yen is paring some gains but weak treasury yields is keeping it afloat. On the other hand, Dollar continues to trade with an undertone and remains one of the weakest for the week.

Technically, as we’re entering into the second half of the week with job and services data, focuses will be on whether Dollar selling would take over again. In particular, break of 1.1907 resistance in EUR/USD and 1.3982 resistance in GBP/USD should seal the case in European-Dollar pairs. Meanwhile, Gold is holding on well to 4 hour 55 EMA so far, maintaining mild bullish favor. Break of 1833.91 resistance should resume the rebound from 1750.49 and double-confirm Dollar selloff.

In Asia, at the time of writing, Nikkei is down -0.20%. Hong Kong HSI is up 1.53%. China Shanghai SSE is up 0.56%. Singapore Strait Times is up 0.97%. Japan 10-year JGB yield is down -0.0024 at 0.007. Overnight, DOW rose 0.80%. S&P 500 rose 0.82%. NASDAQ rose 0.55%. 10-year yield rose 0.002 to 1.176.

New Zealand unemployment rate dropped to 4.0%

New Zealand employment rose 1.0% in Q2, above expectation of 0.7%. It’s also the lowest since Q4 2019. Employment rate rose 0.5% to 67.6%. Unemployment rate dropped from 4.6% to 4.0%, much better than expectation of 4.5%. Labor force participation rate rose 0.1% to 70.5%. Labor cost index rose 0.9% qoq, above expectation of 0.7% qoq.

“The fall in unemployment is largely in line with other labour market indicators, including declining numbers of benefit recipients and increased job vacancies, and recent media reports of labour shortages and skills mismatches,” work, wealth, and wellbeing statistics senior manager Sean Broughton said.

Australia AiG construction dropped to 48.7 on outbreaks and restrictions

Australia AiG Performance of Construction Index dropped -6.8 to 48.7 in July, recording the first contraction since September 2020. Looking at some details, activity dropped -14.4 to 40.4. Employment rose 2.5 to 60.8. New orders dropped -6.6 to 49.5. Supplier deliveries dropped -7.6 to 43.3. Input prices dropped -1.1 to 97.2. Selling prices dropped -4.0 to 81.2. Average wages rose 6.7 to 77.1.

Ai Group Head of Policy, Peter Burn, said: “With Australia’s two largest states affected by COVID-19 outbreaks and associated restrictions, the construction industry slipped into contraction in July after a robust nine-month expansion. The negative national result masked continued growth outside of NSW and Victoria and further expansions in both house building and commercial construction…

“The outlook over the next couple of months will depend heavily on the paths of the COVID-19 outbreaks and the extent of restrictions.”

Australia retail sales dropped -1.8% mom in Jun, led by Victoria and NSW

Australia retail sales dropped -1.8% mom in June, unchanged from preliminary reading. Over the June quarter, sales rose 0.8% qoq.

ABS said: “States under longer periods of restrictions for the month saw a larger fall in their June turnover. The largest falls were in Victoria (-4.0 per cent), New South Wales (-2.0 per cent), and Queensland (-0.9 per cent). Other states and territories that saw stay-at-home orders for a least one day of the month included Western Australia (0.1 per cent), and the Northern Territory (-1.8 per cent).”

China Caixin PMI services rose to 54.9, but still faces enormous downward pressure

China Caixin PMI Services rose from 50.3 to 54.9 in July, well above expectation of 54.9. PMI Composite rose from 50.6 to 53.1.

Wang Zhe, Senior Economist at Caixin Insight Group said: “As the July surveys of Caixin China PMIs were conducted after the epidemic in Guangdong province was brought under control, and before Covid-19 resurged in Jiangsu province, the services sector expanded rapidly, though the manufacturing sector was slightly weaker.

The resurgence of the epidemic in some parts of China at the end of July is expected to hurt August’s PMI readings. China’s official second-quarter economic figures were in line with expectations, but the Caixin China PMIs in July suggest that the economic recovery is not on sure footing. The economy still faces enormous downward pressure, and we need to ensure business owners remain confident.”

Looking ahead

Looking ahead, Eurozone will release retail sales and PMI services final. UK will release PMI services final. Later in the day, Canada will release building permits. But focuses will be on US ADP employment and ISM services.

USD/JPY Daily Outlook

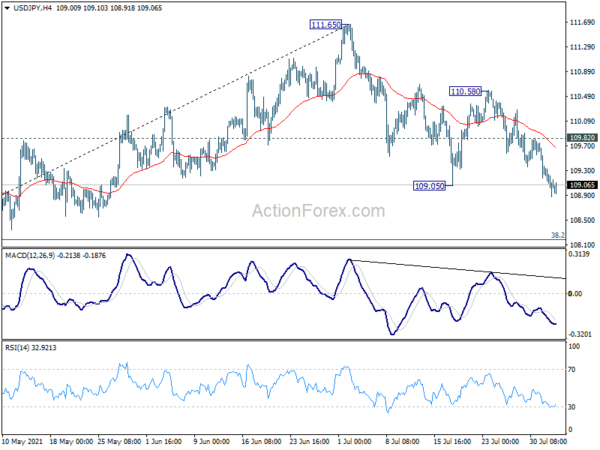

Daily Pivots: (S1) 108.83; (P) 109.08; (R1) 109.29; More…

Intraday bias in USD/JPY remains on the downside at this point. Fall from 111.65 is in progress for 38.2% retracement of 102.58 to 111.65 at 108.18. On the upside, above 109.82 minor resistance will turn bias back to the upside for 110.58 resistance instead.

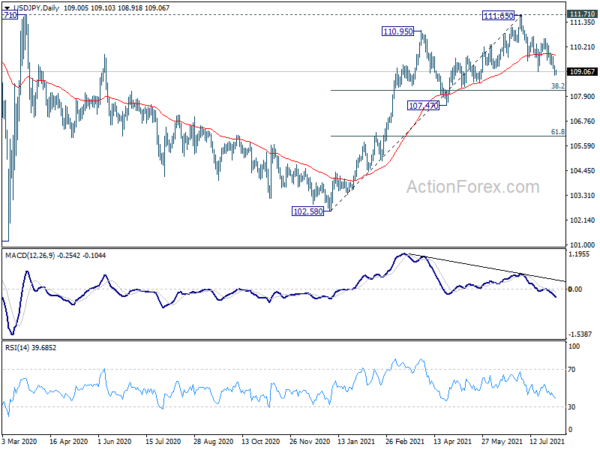

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 48.7 | 55.5 | ||

| 22:45 | NZD | Employment Change Q2 | 1.00% | 0.70% | 0.60% | |

| 22:45 | NZD | Unemployment Rate Q2 | 4.00% | 4.50% | 4.70% | 4.60% |

| 22:45 | NZD | Labour Cost Index Q/Q Q2 | 0.90% | 0.70% | 0.40% | |

| 1:30 | AUD | Retail Sales M/M Jun | -1.80% | -1.80% | -1.80% | |

| 1:45 | CNY | Caixin Services PMI Jul | 54.9 | 50.6 | 50.3 | |

| 7:45 | EUR | Italy Services PMI Jul | 58.2 | 56.7 | ||

| 7:50 | EUR | France Services PMI Jul F | 57 | 57 | ||

| 7:55 | EUR | Germany Services PMI Jul F | 62.2 | 62.2 | ||

| 8:00 | EUR | Eurozone Services PMI Jul F | 60.4 | 60.4 | ||

| 8:00 | EUR | Italy Retail Sales M/M Jun | 0.30% | 0.20% | ||

| 8:30 | GBP | Services PMI Jul F | 57.8 | 57.8 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Jun | 1.90% | 4.60% | ||

| 12:15 | USD | ADP Employment Change Jul | 680K | 692K | ||

| 12:30 | CAD | Building Permits M/M Jun | -0.30% | -14.80% | ||

| 13:45 | USD | Services PMI Jul F | 59.8 | 59.8 | ||

| 14:00 | USD | ISM Services PMI Jul | 60.4 | 60.1 | ||

| 14:00 | USD | ISM Services Employment Jul | 49.3 | |||

| 14:30 | USD | Crude Oil Inventories | -4.1M |