Dollar recovers mildly in early US session, following slight weakness in risk sentiments. Additionally, stronger than expected personal income and spending are providing some support too. Still, the greenback remains the worst performing one for the week. There is prospect of Yen, Aussie or Kiwi overtaking Dollar as biggest loser, but we’ll see. Meanwhile, Sterling is staying as the strongest one, followed by Swiss Franc.

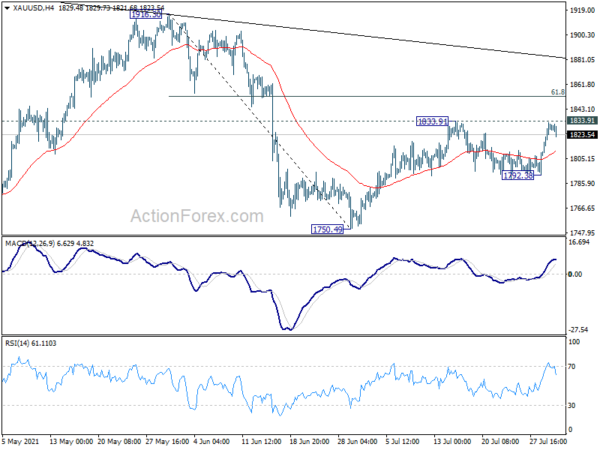

Technically, the rally is EUR/USD is a bit disappointing as it still couldn’t get rid of 1.1880 resistance cleanly. At the same time, Gold also appears to rejected by 1833.91 resistance too, as it fails to resume rise from 1750.49. The greenback sellers might retreat for now and wait for another chance next week.

In Europe, at the time of writing, FTSE is down -0.72%. DAX is down -0.68%. CAC is up 0.02%. Germany 10-year yield rose 0.0035 to -0.443. Earlier in Asia, Nikkei dropped -1.80%. Hong Kong HSI dropped -1.35%. China Shanghai SSE dropped -0.42%. Singapore Strait Times dropped -0.43%. Japan 10-year JGB yield dropped -0.0018 to 0.020.

US PCE price index unchanged at 4% yoy in Jun, core PCE rose to 3.5% yoy

US personal income rose 0.1%, or USD 26.1B in June, better than expectation of -0.4% contraction. Personal spending rose 1.0%, or USD 155.4B, above expectation of 0.7%.

Headline PCE price index was unchanged at 4.0% yoy. Core PCE price index accelerated to 3.5% yoy, up from 3.4% yoy, but missed expectation of 3.7% yoy.

Canada GDP contracted -0.3% mom in May, to recover 0.7% in Jun

Canada GDP contracted -0.3% mom in May, matched expectations. Total economic activity remained approximately -2% below prepandemic level in February 2020. Overall, 12 of 20 industrial sectors contracted, with services-producing down -0.2% and goods-producing down -0.4%. Preliminary information indices that GDP would grow 0.7% in June, and 0.6% in Q2.

Eurozone GDP grew 2.0% qoq in Q2, EU up 1.9% qoq

Eurozone GDP grew 2.0% qoq in Q2, well above expectation of 1.5% qoq. EU GDP grew 1.9% qoq. Among the Member States for which data are available for the second quarter 2021, Portugal (+4.9%) recorded the highest increase compared to the previous quarter, followed by Austria (+4.3%) and Latvia (+3.7%), while Lithuania (+0.4%) and Czechia (+0.6%) recorded the lowest increase. The year on year growth rates were positive for all countries.

Eurozone unemployment rate dropped to 7.7% in June, down from 8.0%, better than expectation of 7.9%. EU Unemployment rate dropped to 7.1%, down from 7.3%. Eurostat estimated that 14.916m people were unemployment in EU, of whole 12.517m in the Eurozone.

Eurozone CPI rose to 2.2% yoy in July, up from 1.9% yoy, above expectation of 2.0% yoy. Energy is expected to have the highest annual rate in July (14.1%, up from 12.6%), followed by food, alcohol & tobacco (1.6%, up from 0.5%), services (0.9%, up from 0.7%) and non-energy industrial goods (0.7%, down from 1.2%).

Germany GDP grew 1.5% qoq in Q2, France GDP grew 0.9% qoq

Germany GDP grew 1.5% qoq in Q2, below expectation of 2.0% qoq. Comparing to Q2 2020, GDP was up a price-adjusted 9.6% and a a price- and calendar-adjusted 9.2%. GDP was still -3.4% lower compared to Q2 2019, before the pandemic.

France GDP grew 0.9% qoq in Q2, slightly above expectation of 0.8% qoq. GDP still stood -3.3% below the level of Q4 2019, before the pandemic.

Swiss KOF economic barometer dropped to 129.8, economy still on a strong expansion path

Swiss KOF economic barometer dropped from 133.3 to 129.8 in July. But the indicate is still clearly above the long-term average. KOF added, “the economy is still on a strong expansion path, although the high pace of recent months may not to be sustained.”

“The outlook for manufacturing, foreign demand, construction, financial and insurance services as well as private consumption remains favourable but is not quite as positive as in the previous month. In contrast, the outlook for accommodation and food service activities and for other services is improving,” KOF said.

Japan industrial production rose 6.2% mom in Jun

Japan industrial production rose 6.2% mom in June, above expectation of 5.0% mom. Output also revised much of the -6.5% mom decline in May. Manufacturers expected production to fall -1.1% mom in July and then rise 1.7% in August.

Also released, unemployment rate ticked down to 2.9% in June, down from 3.0%. Retail sales rose 0.1% yoy in May, slightly below expectation of 0.2% yoy. Housing starts rose 7.3% yoy in June versus expectation of 7.2% yoy.

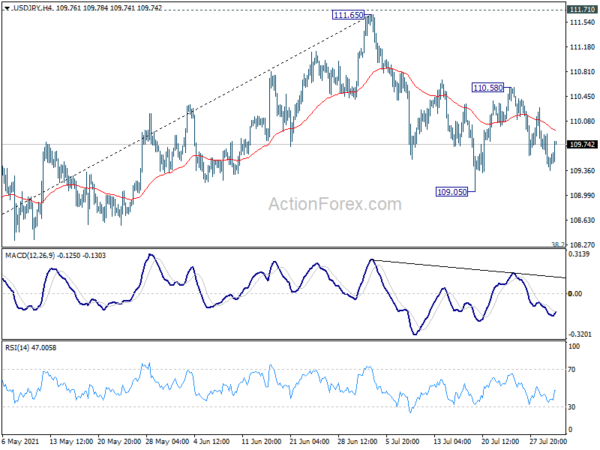

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.29; (P) 109.62; (R1) 109.82; More…

USD/JPY recovers mildly in early US session but stays well inside range of 109.05 and 110.58. Intraday bias remains neutral at this point. On the downside, break of 109.05 will resume the decline from 111.65. Next target is 38.2% retracement of 102.58 to 111.65 at 108.18. On the upside, break of 110.58 will resume the rebound from 109.05, for retesting 111.65 high.

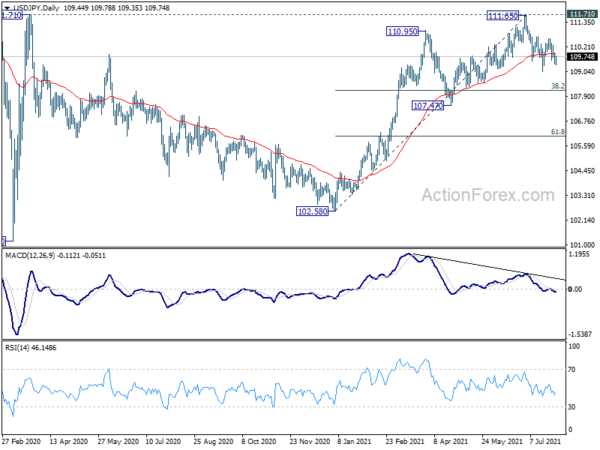

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | 3.80% | -2.80% | -2.40% | |

| 23:30 | JPY | Unemployment Rate Jun | 2.90% | 3.00% | 3.00% | |

| 23:50 | JPY | Industrial Production M/M Jun P | 6.20% | 5.00% | -6.50% | |

| 23:50 | JPY | Retail Trade Y/Y May | 0.10% | 0.20% | 8.30% | |

| 01:30 | AUD | Private Sector Credit M/M Jun | 0.90% | 0.40% | 0.40% | 0.50% |

| 01:30 | AUD | PPI Q/Q Q2 | 0.70% | 0.50% | 0.40% | |

| 01:30 | AUD | PPI Y/Y Q2 | 2.20% | 0.20% | ||

| 05:00 | JPY | Housing Starts Y/Y Jun | 7.30% | 7.20% | 9.90% | |

| 05:30 | EUR | France Consumer Spending M/M Jun | 0.30% | 1.80% | 10.40% | 10.60% |

| 05:30 | EUR | France GDP Q/Q Q2 P | 0.90% | 0.80% | -0.10% | |

| 07:00 | CHF | KOF Leading Indicator Jul | 129.8 | 133.4 | 133.3 | |

| 08:00 | EUR | Germany GDP Q/Q Q2 P | 1.50% | 2.00% | -1.80% | |

| 08:00 | EUR | Italy GDP Q/Q Q2 P | 2.70% | 1.40% | 0.10% | 0.20% |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 2.00% | 1.50% | -0.30% | |

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 7.70% | 7.90% | 7.90% | 8.00% |

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 2.20% | 2.00% | 1.90% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul P | 0.70% | 0.80% | 0.90% | |

| 12:30 | CAD | GDP M/M May | -0.30% | -0.30% | -0.30% | -0.50% |

| 12:30 | CAD | Industrial Product Price M/M Jun | 0.00% | -0.50% | 2.70% | |

| 12:30 | CAD | Raw Material Price Index Jun | 3.90% | 1.50% | 3.20% | |

| 12:30 | USD | Personal Income M/M Jun | 0.10% | -0.40% | -2.00% | -2.20% |

| 12:30 | USD | Personal Spending Jun | 1.00% | 0.70% | 0.00% | -0.10% |

| 12:30 | USD | PCE Price Index M/M Jun | 0.50% | 0.40% | 0.50% | |

| 12:30 | USD | PCE Price Index Y/Y Jun | 4.00% | 3.90% | 4.00% | |

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.40% | 0.60% | 0.50% | |

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 3.50% | 3.70% | 3.40% | |

| 12:30 | USD | Employment Cost Index Q2 | 0.70% | 1.00% | 0.90% | |

| 13:45 | USD | Chicago PMI Jul | 64 | 66.1 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul F | 80.5 | 80.8 |